Tag: venture capital

-

A Rollercoaster Week for Wall Street: The Fed’s Strategy Put to the Test

Wall Street’s high-stakes game of anticipation against the Federal Reserve’s moves has reached a fever pitch this week. Investors, who had been retreating from credit, cryptocurrency, and equities amid persistent inflation concerns, witnessed a turn of events that seemed to vindicate the central bank’s tactics. As the week wrapped up, the market’s pessimists felt the…

-

Capital Currents: The Forces Shaping CRE in 2024

As we navigate through 2024, it’s crucial to understand the economic undercurrents molding the commercial real estate (CRE) landscape. Amidst a market seeking equilibrium, we delve into the potential trough and the ongoing dislocation affecting CRE. The past three years have been a rollercoaster for the global economy. Injecting trillions into a functioning economy, while…

-

What we are working on right now

We are buying land for residential development in the following markets: Myrtle Beach-North Myrtle Beach, SCConway, FLCape Coral-Fort Myers, FLDeltona-Daytona Beach-Ormond Beach, FLNorth Port-Bradenton-Sarasota, FLCharleston-North Charleston-Summerville, SCLakeland-Winter Haven, FLCharlotte-Gastonia-Concord, NC-SCJacksonville, FLPort St. Lucie, FLTampa-St. Petersburg-Clearwater, FLFayetteville-Springdale-Rogers, AR-MOKnoxville, TNPalm Bay-Melbourne-Titusville, FLRaleigh-Cary, NCChattanooga, TNNashville-Davidson–Murfreesboro–Franklin, TNHuntsville, ALOklahoma City, OKWinston-Salem, NCPensacola-Ferry Pass-Brent, FLIndianapolis-Carmel, INLas Vegas-Paradise, NVBoise City-Nampa, IDReno-Sparks, NV…

-

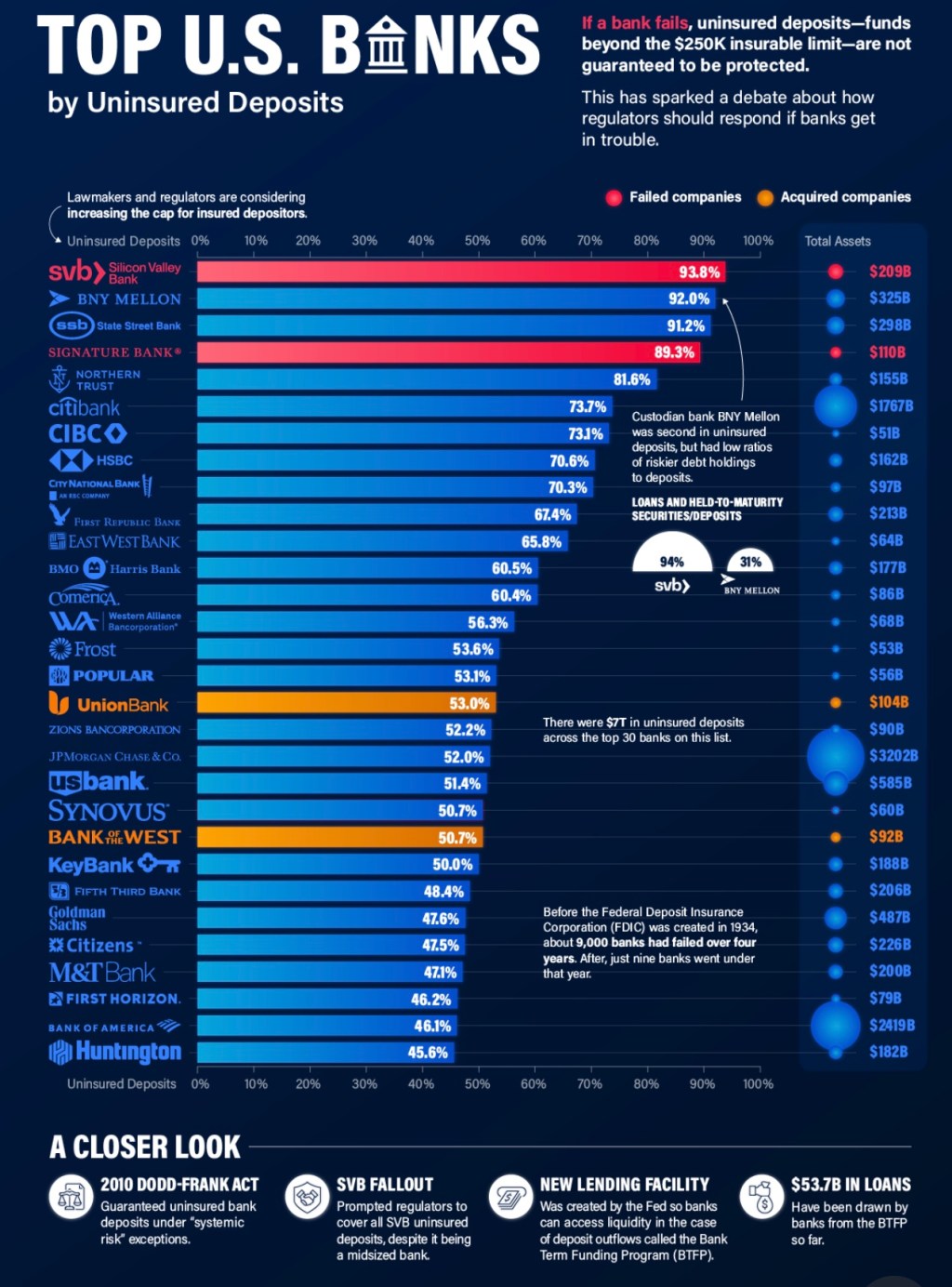

The U.S. Banks With the Most Uninsured Deposits

Today, there is at least $7 trillion in uninsured bank deposits in America. This dollar value is roughly three times that of Apple’s market capitalization, or about equal to 30% of U.S. GDP. Uninsured deposits are ones that exceed the $250,000 limit insured by the Federal Deposit Insurance Corporation (FDIC), which was actually increased from $100,000 after…

-

The Search for Clarity: Multifamily and Commercial Real Estate Investing in 2023

For the last fifteen years, multifamily and commercial real estate investors surfed a rising wave of increasing property valuations buoyed by abundant and cheap capital. But in 2022 the ebb currents gained the upper hand and liquidity washed away. The culprit? The return to higher interest rates powered by the Fed’s wrestling match with inflation.…

-

Why I’m betting big on San Francisco

I’m investing $400 million toward reimagining the Transamerica Pyramid and its surrounding neighborhood. It’s because I believe in this city and what it stands for. https://www.sfchronicle.com/opinion/openforum/article/san-francisco-transamerica-neighborhood-17650989.php

-

Tech’s Bust Delivers Bruising Blow to Hollowed-Out San Francisco

Job cuts and remote work are colliding to reshape the center of American innovation. San Francisco’s Salesforce Tower opened almost five years ago as a monument to the region’s tech-driven economy, piercing the skyline as the tallest office building on the US West Coast. It symbolized a boom for the city’s downtown, alongside a new futuristic…