Tag: banking

-

Is the U.S. Housing Market on the Brink of Another Bubble?

The U.S. housing market is currently experiencing a peculiar trend that echoes the prelude to the financial crisis of 2008. With home prices escalating rapidly, experts are debating whether this signals the inflation of another bubble. Despite the dampening effect that high mortgage rates typically have on home buying, prices continue to soar. A recent…

-

A Rollercoaster Week for Wall Street: The Fed’s Strategy Put to the Test

Wall Street’s high-stakes game of anticipation against the Federal Reserve’s moves has reached a fever pitch this week. Investors, who had been retreating from credit, cryptocurrency, and equities amid persistent inflation concerns, witnessed a turn of events that seemed to vindicate the central bank’s tactics. As the week wrapped up, the market’s pessimists felt the…

-

Revitalizing Urban Landscapes: The Rise of Residential Havens from Commercial Foundations

The urban housing landscape is undergoing a remarkable metamorphosis. Amidst a pressing inventory crunch, a wave of ingenuity is sweeping the real estate sector, offering a beacon of hope for home seekers. The latest trend? The transformation of commercial strongholds into cozy residential retreats. In an exclusive feature by Yahoo Finance’s ‘Real Estate: The New…

-

Navigating the Tides: Florida’s Housing Market Amidst Rising Mortgage Rates

Introduction:The Sunshine State, known for its vibrant property market, is now facing a new challenge. As mortgage rates soar past the 7% mark, the first time in 2024, the once-booming housing market is showing signs of strain. This article delves into the current state of Florida’s real estate, examining the factors contributing to its vulnerability…

-

A Fresh Perspective on Real Estate in 2024: What Lies Ahead

While the S&P 500 has experienced some turbulence recently, it remains in positive territory for the year, boasting a 6% increase. However, the real estate sector is not sharing in this upward trend and is instead experiencing significant challenges. With the looming possibility of enduring high interest rates, the real estate market is under pressure,…

-

Capital Currents: The Forces Shaping CRE in 2024

As we navigate through 2024, it’s crucial to understand the economic undercurrents molding the commercial real estate (CRE) landscape. Amidst a market seeking equilibrium, we delve into the potential trough and the ongoing dislocation affecting CRE. The past three years have been a rollercoaster for the global economy. Injecting trillions into a functioning economy, while…

-

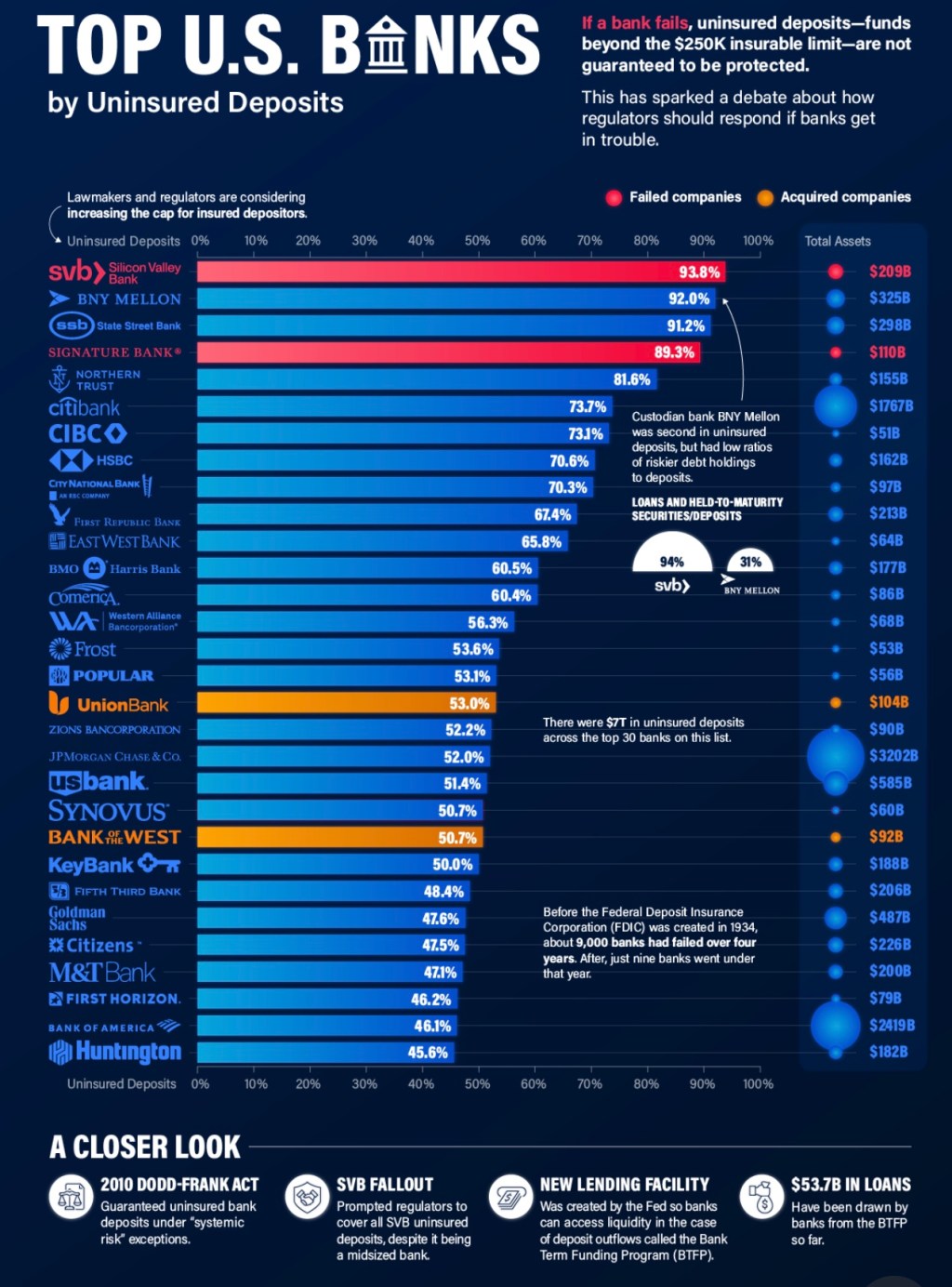

The U.S. Banks With the Most Uninsured Deposits

Today, there is at least $7 trillion in uninsured bank deposits in America. This dollar value is roughly three times that of Apple’s market capitalization, or about equal to 30% of U.S. GDP. Uninsured deposits are ones that exceed the $250,000 limit insured by the Federal Deposit Insurance Corporation (FDIC), which was actually increased from $100,000 after…