Sun Belt Vacancies Are Rising, and the Multifamily Market Is Quietly Rebalancing

At the national level, the multifamily market looks deceptively calm. Vacancy rates are relatively stable, rents have not collapsed, and transaction volume is beginning to thaw. But when you move past the headline numbers, the story becomes far more fragmented, and far more important for investors underwriting deals in 2025 and beyond.

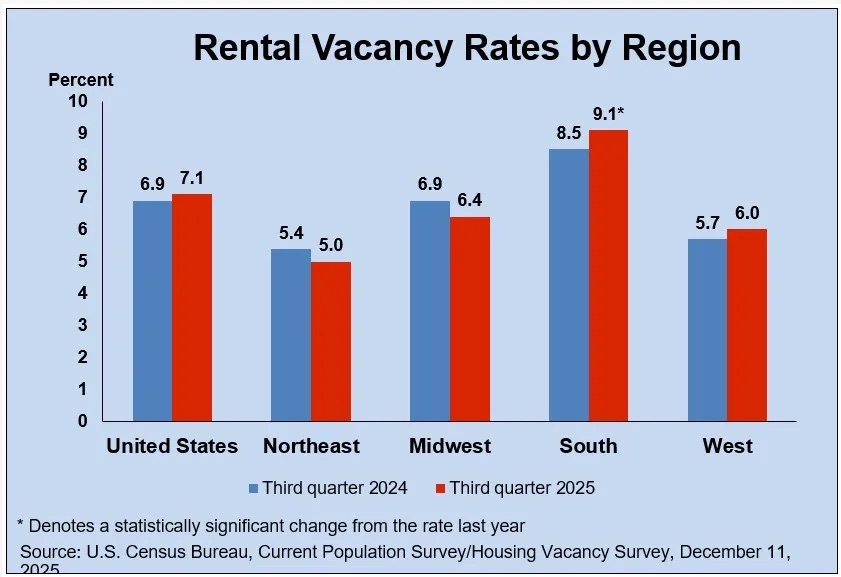

The U.S. rental vacancy rate ticked up to 7.0% in Q2, from 6.6% a year earlier, according to Census data. That is not a shock. It suggests gradual normalization after years of undersupply and rent acceleration. What matters more is where those vacancies are showing up, and where they are not.

The Sun Belt Is Feeling the Weight of Its Own Success

The most notable pressure is in the South, where vacancy has climbed to 9.0 percent, the highest of any region in the country. This is not a demand collapse. It is a supply story.

For more than a decade, capital flooded into Sun Belt markets on the back of population growth, job migration, and favorable tax and regulatory environments. Developers, myself included, followed the fundamentals. But in many metros, supply has now outpaced absorption. Lease-ups are taking longer, concessions are back, and rent growth has cooled meaningfully, particularly in Class A product delivered over the last 24 to 36 months.

This does not mean the Sun Belt is “over.” It does mean the easy money phase is gone. Underwriting that assumes quick stabilization and aggressive rent growth is increasingly disconnected from reality.

Urban Markets Are Absorbing the Brunt of New Supply

Vacancy in principal cities rose to 7.6%, outpacing suburbs at 6.7% and non-metro areas at 5.8%. Again, this is not surprising. Urban cores absorbed a disproportionate share of new Class A development, and those assets are now competing heavily on price and incentives.

By contrast, suburban and workforce-oriented properties, particularly garden-style and mid-rise assets, are holding up better. Renters are still prioritizing affordability, space, and livability. That trend has not reversed.

From an operator’s standpoint, this is where asset selection matters. Not all urban markets are weak, and not all suburban markets are strong. But the dispersion between asset types is widening.

The Midwest Continues to Play Defense, Quietly and Consistently

The Midwest posted a 6.6% vacancy rate, below the national average and well below the Sun Belt. This reinforces something we have been saying for years, stability matters, especially late in the cycle.

Midwestern markets tend to be undersupplied, less volatile, and more income-driven. Rent growth may be slower, but so are corrections. The Northeast (5.2%) and West (5.7%) remain tight as well, though those markets come with higher costs, regulatory friction, and political risk that must be underwritten honestly.

This is where capital is beginning to rebalance. Investors are no longer chasing growth at any cost. They are looking for durability.

The Takeaway: National Averages Are Lying to You

The biggest risk right now is relying on national metrics to make local decisions. The multifamily market is no longer moving in one direction. It is splitting by region, by submarket, and by asset type.

The Sun Belt’s “can’t-miss” narrative is fading, replaced by a more nuanced, barbell-style strategy. On one end, selective growth markets with real demand and constrained supply. On the other, stable, defensive markets that continue to perform through cycles.

Going forward, hyperlocal analysis is not optional. It is the difference between surviving this phase of the cycle and underwriting yesterday’s story.

As developers and investors, this is the moment to slow down, sharpen assumptions, and let data, not momentum, drive decisions.

Leave a comment