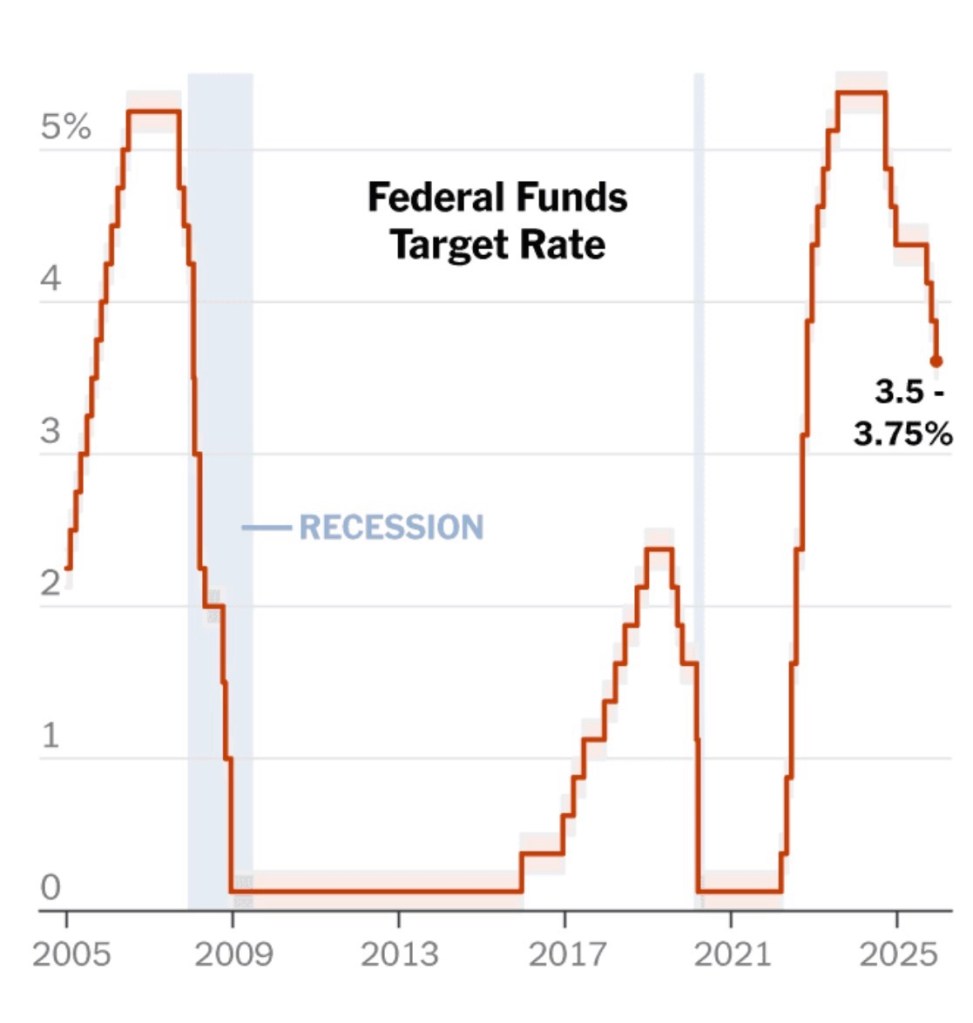

When the Federal Reserve lowered its benchmark rate again — and signaled a likely pause — the ripple effects will not be uniform across the U.S. Instead, the impact will vary significantly by market type and geography. For our platform (spanning everything from Los Angeles and Dallas to Detroit, emerging Sunbelt metros, and more rural or secondary markets), the signal matters in distinct ways.

Debt Costs & Financing Relief — Nationwide, but Benefits Vary

A modest rate cut eases financing costs broadly: for development loans, refinancings, and acquisitions across all markets.

In high-growth Sunbelt metros and emerging markets (e.g., Phoenix, Charlotte, Salt Lake City, Cincinnati), slightly cheaper financing can revive development momentum — especially for build-to-rent, mixed-use, and multifamily deals where underwriting was marginal. In coastal or high-cost metros (like Los Angeles), relief helps reduce pressure on cap rates and improves the economics of affordable-housing or mixed-use developments. In industrial or infrastructure-oriented markets (e.g., Detroit for data-center / AI-infrastructure investments), lower capital costs improve the returns on long-term projects, which often depend heavily on financing.

Cap-Rate Stabilization & Value-Add Opportunity — Not a Boom, But a Reset

Because the Fed signaled a pause, markets should see stabilization rather than a surge. That’s beneficial for value-add or repositioning plays across geographies:

In emerging/secondary markets, this creates opportunity to acquire undervalued assets or reposition dated office / industrial / mixed-use properties before price appreciation returns. In metros with oversupply or structural headwinds (legacy office, older suburbs, small cities), opportunity exists to acquire assets at discount, then redevelop or reposition them into uses that match current demand (residential, industrial, or mixed-use).

Diversified Portfolio Advantage — Our Spread Pays Off

Because we operate across a diverse portfolio of markets — from primary metros to secondary and tertiary ones, and from residential to industrial/AI-infrastructure — we’re positioned to weather market bifurcation. For example:

Slower but stable markets (like certain emerging Sunbelt metros or smaller cities) may deliver strong rental yields even if appreciation is modest. Growth-heavy markets (LA, Dallas) may see rebound in demand once financing conditions stabilize, especially for mixed-use or workforce-housing. Industrial / infrastructure-focused markets (like Detroit) may benefit from secular demand — especially in edge-compute / AI-infrastructure — whose economics improve with lower financing costs.

But Equity, Execution, and Discipline Matter More Than Ever

Lower rates help, but they don’t erase underlying risk:

Rising construction costs, zoning/entitlement delays, supply-chain bottlenecks — these remain across all geographies. Markets with weak fundamentals (population decline, job losses, poor demand) will still struggle — even if financing is cheaper. Over-leveraged deals (common when investors expected continually falling rates) remain risky, especially in volatile or transitional markets.

What This Means for Our Strategy — Across All Markets

We’ll prioritize deals with strong underwriting across financing, demand, and operating assumptions — not just rate assumptions. We’ll seek value in secondary and tertiary markets where we have flexibility — especially for adaptive-reuse, build-to-rent, and infrastructure-type assets. We’ll continue investing in growth metros (LA, Dallas, Sunbelt) — but remain conservative on valuation compression expectations. We’ll lean on our diversified national footprint to manage risk and capture opportunity wherever it appears, from high-growth Sunbelt cities to legacy-industrial locales, to smaller or non-urban markets like Maine.

Final Thought

The Fed’s move should be seen not as a catalyst for a nationwide real-estate boom, but as a reset — a recalibration. For firms like ours, with a diversified geographic footprint and a multi-strategy platform (residential, mixed-use, industrial, infrastructure), this could be exactly the right environment.

Opportunity won’t come from chasing rate-driven appreciation — but from disciplined execution, smart underwriting, and flexible deployment across markets.

Leave a comment