By Daniel Kaufman

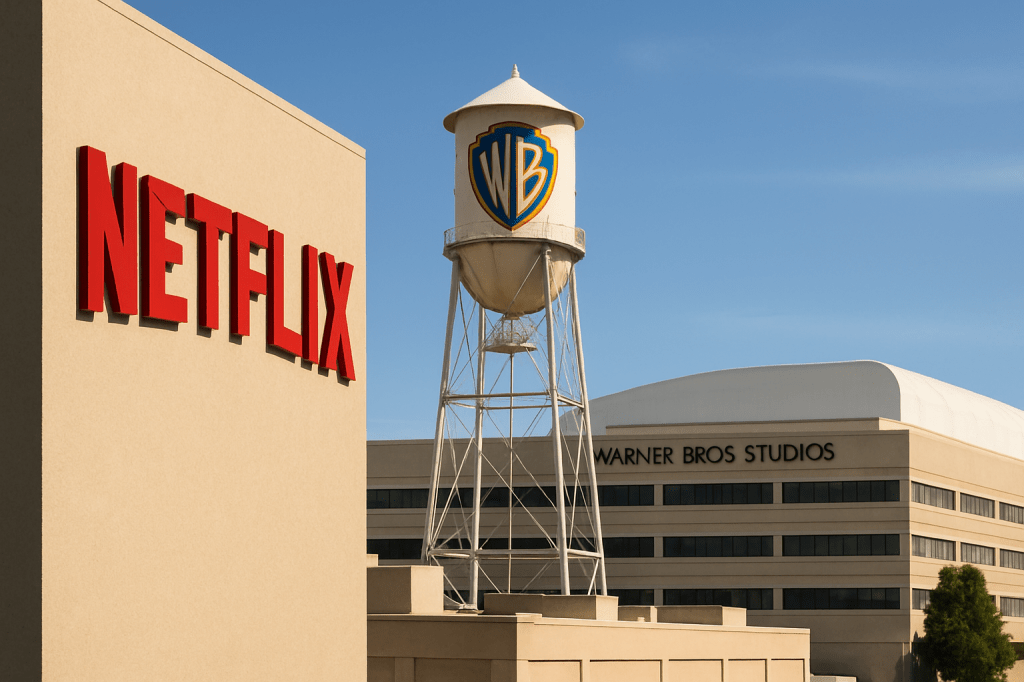

Hollywood is on the verge of a structural shift that goes far beyond streaming dominance or content libraries. Netflix’s proposed $72 billion acquisition of Warner Bros. is being framed as a media story, but the more consequential impact may be in real estate. If approved, Netflix would instantly become one of the largest owners of entertainment property in the world, controlling over 100 million square feet of production, office, and studio assets across the U.S. and Europe.

This is more than a merger. It is a decisive land play.

A New Era: From Renter to Global Studio Landlord

For years, Netflix built its operational model around flexibility, leasing the majority of its 5.2 million square feet of global space. That approach kept capital light, but it also left the company dependent on a small group of major landlords—most notably Hackman Capital and Hudson Pacific, who own many of the flagship soundstages Netflix relies on.

Acquiring Warner Bros. flips that equation.

Ownership gives Netflix full control of legendary assets such as:

Warner Bros. Studios in Burbank Leavesden Studios in the U.K. A global studio portfolio that is effectively irreplaceable

With ownership comes stability, cost efficiency, and negotiating leverage. Analysts already project the combined entity could eliminate or roll back certain leases, producing $3 billion in annual savings.

This is not a consolidation of content. It’s a consolidation of infrastructure.

A Softening Studio Market Faces a New Power Dynamic

The timing of this shift is striking. Los Angeles’ production ecosystem has been under pressure for years:

Soundstage occupancy has fallen to 63%, down from 90% pre-pandemic Production volumes remain muted, even with enhanced California film tax incentives Independent studio landlords are facing the toughest leasing environment in a decade

If Netflix becomes both the anchor tenant and the dominant owner, the market recalibrates overnight. Fewer leases, more owner-operated facilities, and less reliance on third-party stages could reshape the economics of studio real estate from Burbank to Culver City.

Independent operators—many of whom expanded aggressively between 2018 and 2022—now face a future where the biggest customer is increasingly self-sufficient.

The Competitive Advantage of Infrastructure Control

Owning the ground beneath its productions allows Netflix to do what every major studio in Hollywood’s golden age understood: control the full ecosystem.

This isn’t a new strategy for Netflix. It has been moving in this direction for years:

A $1 billion, 12-soundstage campus rising in New Jersey Acquisition and restoration of the historic Egyptian Theatre Targeted global studio purchases to support international production

The Warner Bros. portfolio accelerates that plan by several decades.

Real estate is becoming a competitive moat. In an industry defined by volatility—from strikes, to tax credit cycles, to shifting consumer behavior—owning the physical assets that enable production is a stabilizing force.

The Takeaway: Hollywood’s Next Great Real Estate Story

If the deal clears regulatory review, Netflix won’t just reshape the streaming landscape. It will redefine the power structure of Hollywood’s built environment.

A company once known for disrupting distribution could soon become one of the most influential studio landlords in the world. For Los Angeles, for independent studio owners, and for entertainment real estate more broadly, this marks the beginning of a new era—one where the true battle for content may be fought not just on screens, but on the land beneath them.

Leave a comment