By Daniel Kaufman

Kaufman Development | Kaufman Real Estate

http://www.DanielKaufmanRealEstate.com

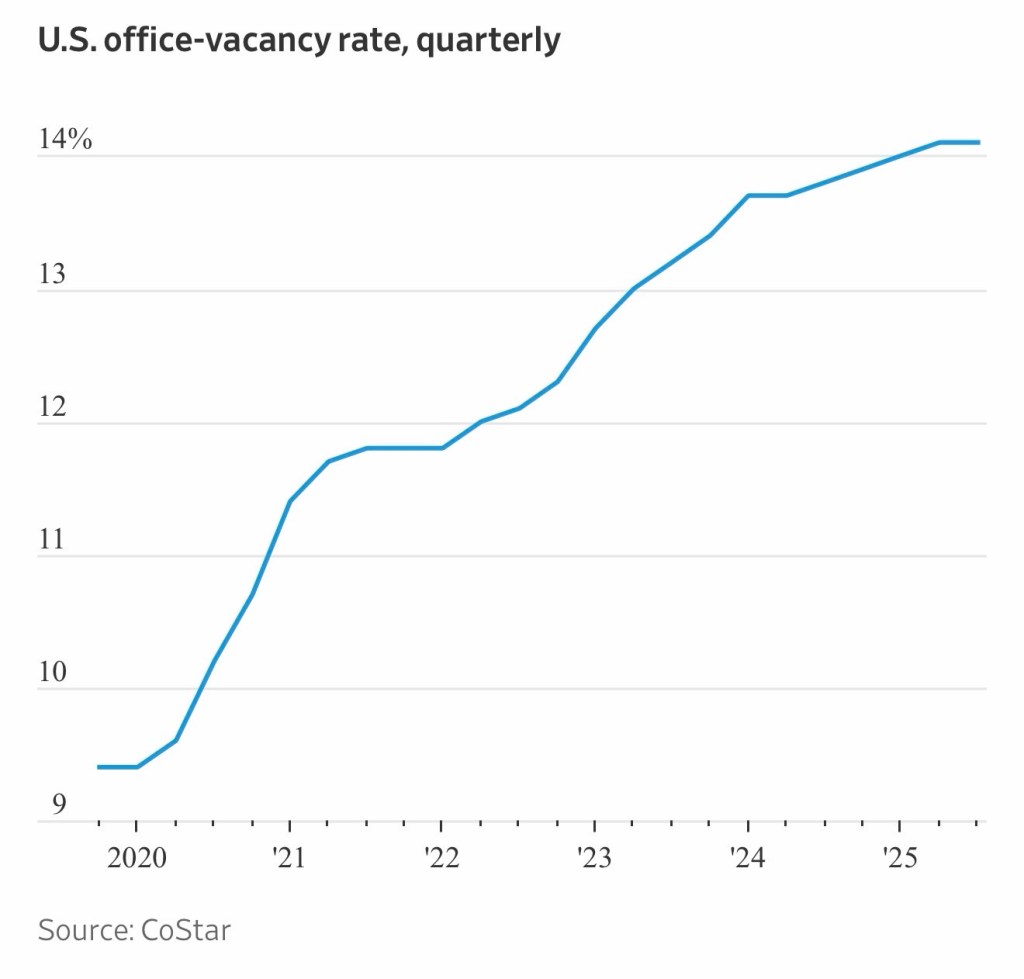

The U.S. office market is showing early signs of recovery, but only in select places. According to recent reporting from The Wall Street Journal, national vacancy rates are still near historic highs, and delinquency rates on office-backed loans have surged. Yet in a handful of prime submarkets, demand is firming and tenants are willing to pay a premium for high-quality space.

This is not a typical cyclical downturn. Remote and hybrid work have permanently changed how tenants use space, which means the old assumptions about office demand no longer apply. The market is undergoing a structural reset, and as developers and investors, we must adjust our strategies to match the new reality.

A Market Splitting in Two

The gap between the strongest and weakest office assets is widening. We are seeing a clear split:

Potential Long-Term Winners

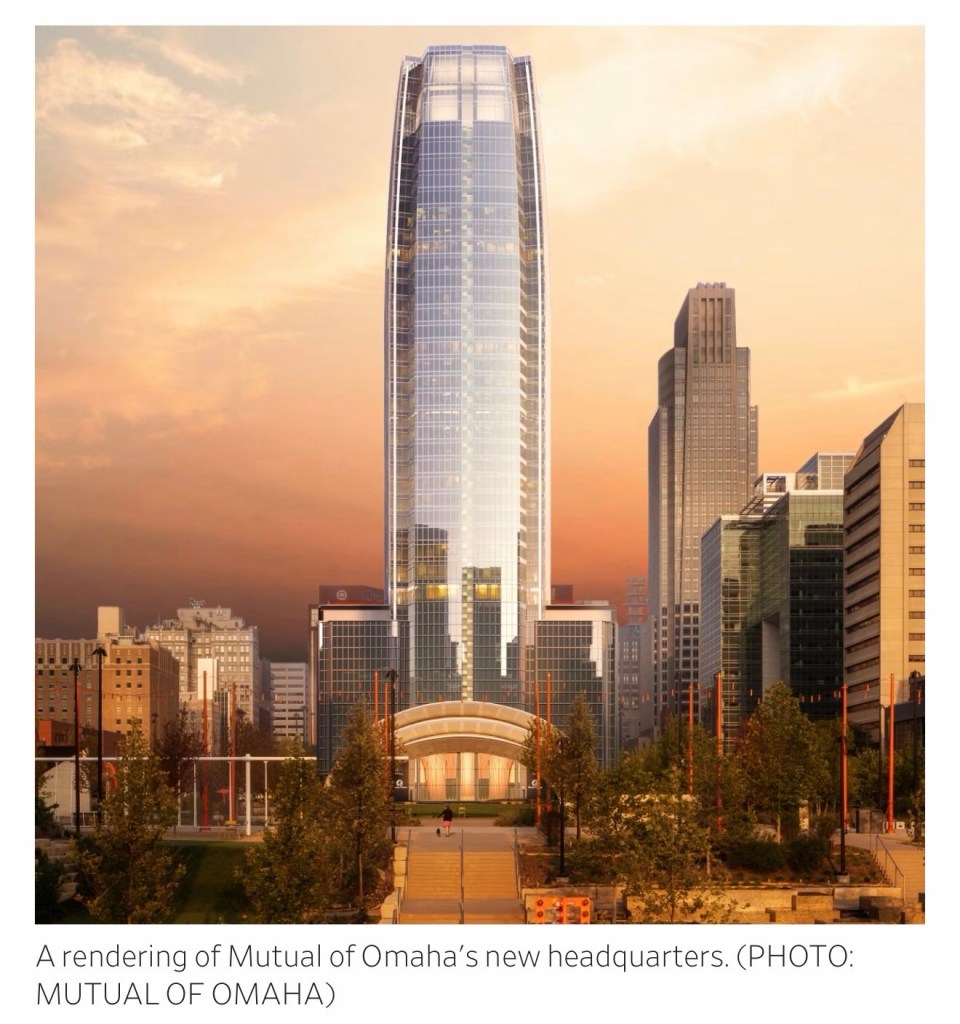

Trophy and top-quartile office buildings Amenitized, wellness-focused, flexible workspace Mixed-use environments that integrate office with residential and retail Prime coastal and knowledge-economy markets

Long-Term At-Risk Assets

Outdated Class-B and Class-C office buildings Older towers in central business districts without conversion potential Single-tenant legacy buildings with expensive retrofit needs Municipalities dependent on shrinking office tax revenue

For many office properties, the question is no longer how long it will take to lease the space, but whether the building should remain office at all.

Where Kaufman Development Sees Opportunity

Over the past 18 months, our strategy at Kaufman Development and Kaufman Real Estate has evolved around the areas where we believe the strongest returns will emerge.

1. Trophy and Prime-Amenity Office Assets

Tenants reducing square footage are also spending more per square foot on space that supports recruitment, brand, collaboration, and client experience. We are evaluating selective acquisition and joint-venture opportunities in markets where premium office remains fundamentally strong but pricing is temporarily depressed due to broader market sentiment.

2. Adaptive Re-Use and Office-to-Residential Conversion

Many struggling office assets are better suited for conversion than continued office use. Ideal candidates include buildings with:

Narrow floor plates that allow natural light Walkable infill locations with strong housing demand Parking and infrastructure compatible with residential codes Municipalities that support adaptive reuse, zoning adjustments, or incentives

We are actively underwriting conversion opportunities in mid-sized cities where replacement cost far exceeds current asset pricing.

3. Converting Office to Specialized Workspaces

Some uses are less remote-friendly and remain healthy drivers of space demand. These include:

Medical and clinical office Creative and production studios Innovation, design, and engineering workspaces Small-business and entrepreneurial flex campuses

Vacant offices in the right locations can be repositioned into ecosystem-driven commercial properties that serve this tenant base.

4. Distressed Debt and Recapitalization

With more owners facing refinancing challenges and loan maturities, there is growing opportunity in:

Acquiring notes at a discount Partnering with lenders on workouts Recapitalizing viable buildings with new business plans Pursuing REO and special-servicer pipelines

This phase of the cycle has historically been one of the best times to capture value in office real estate.

Policy and Downtown Revitalization Tailwinds

As office valuations decline, city budgets feel the impact. We expect to see more:

Adaptive-reuse and tax incentive programs Reduced parking minimums Faster entitlement pathways Public-private partnerships focused on mixed-use redevelopment

We are positioning to support municipalities that choose revitalization over decline, particularly in downtown cores transitioning toward more balanced live-work districts.

How We Are Positioning Kaufman Development

Our platform is taking the following steps to remain ahead of this cycle:

Auditing all existing office exposure across holdings and pipeline Targeting acquisitions and JV partnerships for conversion-viable buildings Prioritizing mixed-use planning where office is a component, not the anchor Focusing on infill markets with resilient economic and population fundamentals Preparing capital relationships for opportunistic and distressed investment

Final Thoughts

The U.S. doesn’t simply have too much office space. It has too much of the wrong type of office space.

The assets that will define the next decade are not the ones that dominated the last cycle. They will be more flexible, more experiential, more integrated with housing and hospitality, and more aligned with how people actually work today.

The next 12 to 24 months may offer some of the most attractive opportunities we have seen in office real estate in more than a decade, but only for those willing to rethink, reposition, and rebuild.

If you are an investor, family office, municipality, or development partner interested in exploring a joint venture or strategic acquisition, I welcome the conversation.

— Daniel Kaufman

Kaufman Development | Kaufman Real Estate

Leave a comment