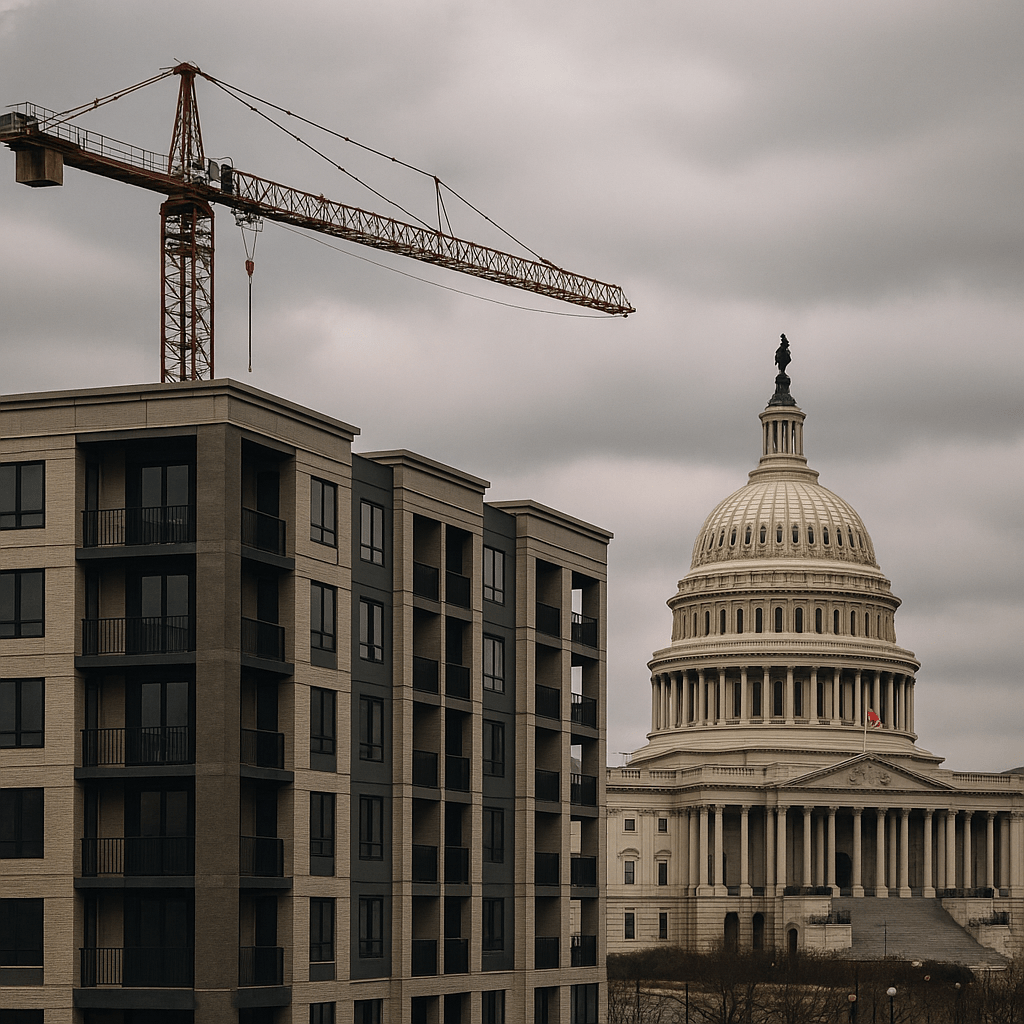

The federal shutdown has now stretched into its 36th day — the longest in U.S. history — and real estate is feeling the strain. What began as a political standoff in Washington has rippled across leasing, development, and hospitality, freezing deal flow and shaking confidence at a time when the industry was finally regaining its footing.

A Historic Stall in Momentum

When Washington stops, so does a large part of the economy. Federal-heavy markets like D.C. are taking the hardest hits as HUD, GSA, and other agencies operate on skeletal staff. Global investors are watching closely.

“When Washington stalls, it weakens the U.S. brand as a reliable, stable market,” said Peachtree Group CEO Greg Friedman.

That sentiment captures a broader reality: real estate depends on confidence — and right now, that confidence is eroding.

HUD Paralysis Freezes Housing Development

The Department of Housing and Urban Development plays a critical role in housing finance and development, particularly through its loan programs, guarantees, and subsidies that underpin multifamily and affordable housing projects nationwide.

With the shutdown now entering its second month, HUD funding has ground to a halt. No new applications are being reviewed, and projects awaiting approvals are stuck in limbo. Developers relying on HUD-insured financing or programs such as 221(d)(4) and 223(f) are unable to close loans or move forward with construction.

“Deals are harder to close. Certainty has disappeared — and that’s critical in real estate,” said Brad West, policy director at the Supportive Housing Alliance.

HUD’s freeze has also slowed critical backend functions such as inspections, environmental reviews, and mortgage insurance processing — creating cascading delays across the capital stack. For developers, lenders, and investors, this isn’t just an inconvenience; it’s a liquidity issue. The absence of HUD funding has created a funding vacuum in markets already strained by higher interest rates and tighter credit.

Hospitality Takes a Direct Hit

Air traffic controllers and TSA agents working without pay have led to flight delays, cancellations, and reduced schedules. The FAA has even begun limiting inbound flights at some airports.

The U.S. Travel Association estimates $5 billion in lost travel spending since the shutdown began. Washington, D.C. hotels have seen revenue per available room fall 20% year-over-year.

“Hotels that rely on government business are under pressure,” said Driftwood Capital CEO Carlos Rodriguez Sr.

Hilton has already baked shutdown-related losses into its Q4 guidance — an early signal of how deep the impact could run if this drags on.

GSA Leasing Grinds to a Halt

The General Services Administration manages over 173 million square feet of office space across the country — a quarter of it in the D.C. area. Nearly all leasing activity is now paused.

“Lease awards require certified funding,” said FD Stonewater Principal Norman Dong, a former GSA official. “If the government isn’t funded, that certification can’t happen.”

Even where rent is being paid through carryover funds, renewals and new leases are frozen, and staff furloughs have crippled the pre-leasing pipeline.

The Bigger Picture for Real Estate

The shutdown hit just as data was turning positive. MSCI Real Assets recently reported a 19% year-over-year rise in transaction volume, signaling early signs of a rebound. But that momentum is already fading.

The Fed’s October rate cut came without the usual supporting economic data, creating more uncertainty. Risk spreads are widening, borrowers are pulling back, and capital is once again sidelined.

Still, not everyone sees this as a reason to panic.

“Periods like this often reveal the best entry points,” Friedman noted. “Disciplined, liquid capital can move when confidence returns.”

That may prove true — but for now, liquidity and patience are the only safe bets.

What Comes Next

The Congressional Budget Office estimates the shutdown could shave 1%–2% off Q4 GDP, potentially costing the economy $14 billion if it extends beyond mid-November.

Developers, lenders, and investors are largely in wait-and-see mode, holding their breath for a budget deal that shows no sign of materializing. The result is paralysis at nearly every level — a pause that underscores how deeply intertwined the federal government is with the real estate market nationwide.

Until Washington moves, real estate stands still.

Leave a comment