What started as another Washington standoff has now turned into something far more dangerous for housing markets. As the federal government shutdown enters its fifth week, the effects are no longer theoretical — they’re hitting the multifamily sector head-on.

The Pressure Builds

November 1 is shaping up to be the next major inflection point. That’s when SNAP funding for more than 40 million Americans is projected to lapse. If the shutdown extends beyond that, Section 8 vouchers could be next, putting millions of low-income renters — and the landlords who rely on those payments — at risk.

Nicole Upano from the National Apartment Association has already warned of “real risks to both tenants and landlords” as critical support systems begin to erode.

HUD on Pause

With only 25% of HUD staff still working, the machinery of federal housing has essentially ground to a halt. Loan processing, inspections, and new project-based vouchers are frozen. The shutdown has also sidelined the CDFI Fund, which supports affordable and workforce housing projects nationwide — especially in rural and low-income markets.

Entire development pipelines are suddenly stuck in limbo.

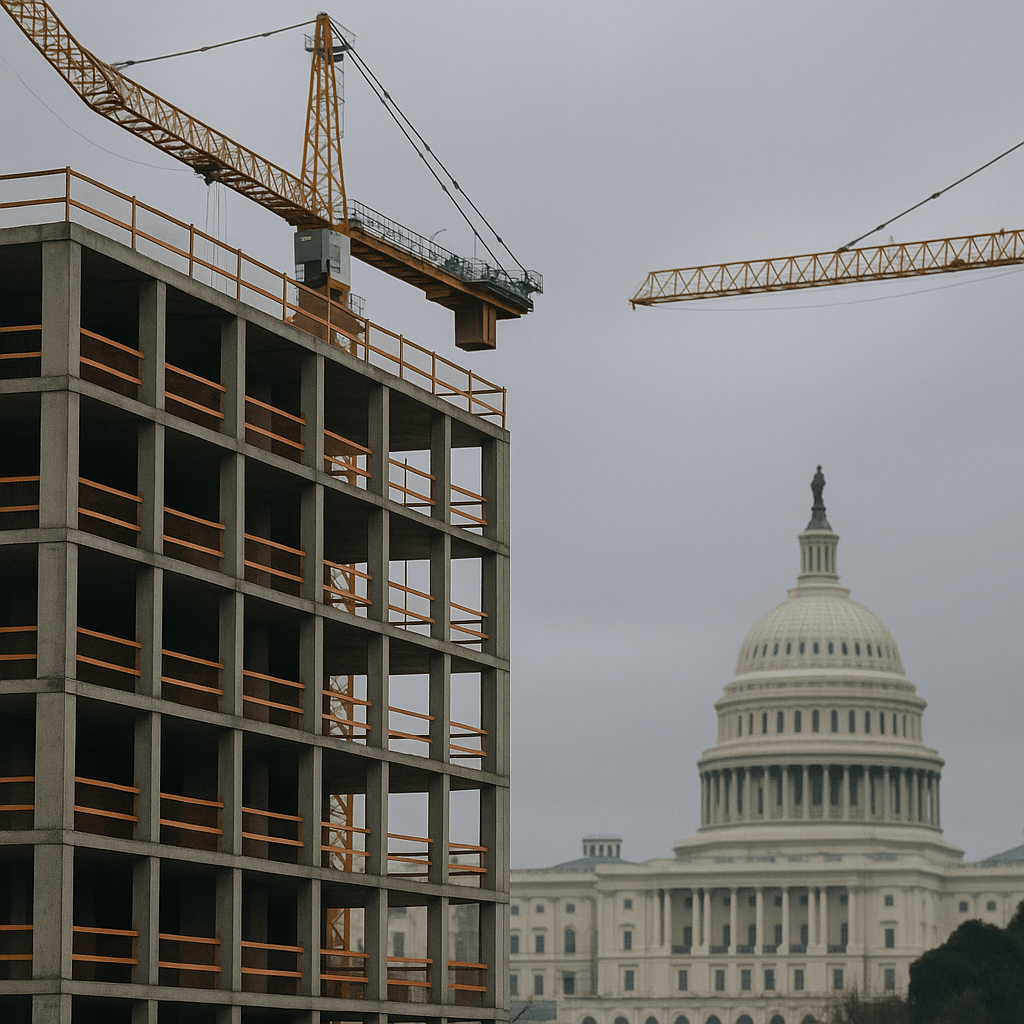

Development Timelines Blown Apart

For active developers, this isn’t an abstract issue — it’s a direct hit to project timelines and capital confidence. FAA approvals, site inspections, and environmental reviews are being delayed or canceled outright.

In South Florida, developer Lissette Calderon summed it up bluntly: “Markets just don’t like uncertainty.” That uncertainty is already showing up in delayed closings, strained lender relationships, and project pro formas that no longer pencil.

Closings and Capital at Risk

The year-end closing window for LIHTC and HUD deals was already tight before the shutdown. Now, attorneys and housing advocates warn of a “chilling effect” across the pipeline. If this continues, thousands of affordable units could lose funding or miss tax credit deadlines, putting both developers and tenants in an impossible position.

Safety Nets Are Fraying

Even outside the development sphere, the impact is spreading. Continuum of Care funds are being redirected from permanent housing to emergency shelters. Missed payments from tenants who rely on food assistance or housing vouchers could trigger a wave of rent delinquencies and evictions, particularly for small landlords with tight margins.

The Takeaway: What Was a Nuisance Is Now a Systemic Threat

The multifamily sector is entering a danger zone. What started as a bureaucratic slowdown is evolving into a full-blown structural crisis — one that threatens both housing stability and private capital flows.

If the shutdown drags on much longer, we’re not just talking about delayed projects — we’re looking at potential displacement, capital flight, and the collapse of key affordable housing pipelines across the country.

This isn’t a political issue anymore. It’s an economic one — and the clock is ticking.

Leave a comment