Mortgage rates have been steadily trending lower over the last month, and the expectation is that they’ll hover in the low-6% range through the end of 2025. For buyers who have been sitting on the sidelines, that shift is meaningful. Lower rates open the door to more affordability, more options, and in some markets, a real chance to finally move.

But the impact won’t be the same everywhere. Some metros are poised to benefit far more than others, depending on how many households are actually carrying mortgages.

Why Mortgage Usage Matters

The Federal Reserve’s recent quarter-point rate cut pushed the average 30-year fixed mortgage down to 6.26%. With two more cuts likely before year-end, economists expect the “lock-in effect” — where homeowners hesitate to sell because their current mortgage rate is lower than what they’d get in today’s market — to start loosening.

Right now, about 81% of U.S. mortgages are locked at 6% or below. That means millions of owners have been staying put rather than trade up, downsize, or relocate. As rates creep closer to that 6% threshold, more owners may finally be willing to list — especially in markets with high concentrations of mortgage holders.

As Realtor.com economist Jiayi Xu explains, markets where most owners rely on mortgages are more rate-sensitive. A half-point swing in financing costs can be the difference between staying frozen and unlocking a new wave of listings. By contrast, metros where large shares of homeowners own free and clear will feel far less impact from rate moves.

The Metros Most Impacted by Falling Rates

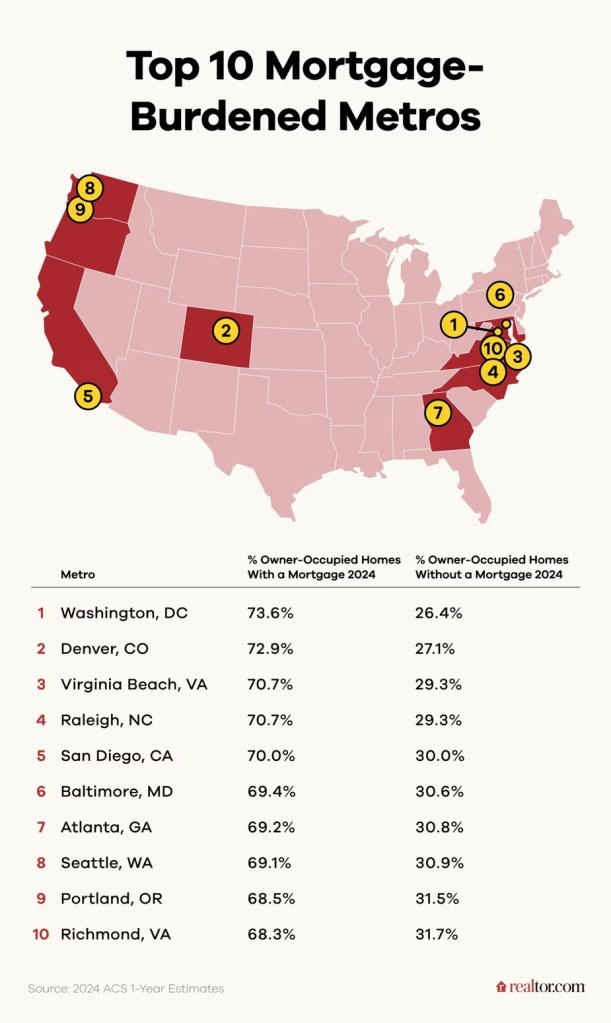

According to recent Census and Realtor.com data, just under 60% of U.S. homeowners still carry a mortgage, while about 40% own outright. In markets where financing is the norm, falling rates could be a game-changer.

Washington, DC tops the list with nearly 74% of homeowners holding a mortgage — the highest share in the country. Denver isn’t far behind at 72.9%, followed by Virginia Beach and Raleigh at 70.7%, and San Diego at 70%.

Other metros with heavy mortgage reliance include:

Baltimore (69.4%)

Atlanta (69.2%)

Seattle (69.1%)

Portland, OR (68.5%)

Richmond, VA (68.3%)

Regionally, the South and West dominate the list, reflecting both younger household demographics and newer housing stock. These are the markets where affordability is most tied to financing costs — and where falling rates can directly boost transaction volume.

What This Means for Buyers and Sellers

For buyers, a lower mortgage rate doesn’t just improve monthly affordability — it broadens the set of homes they can realistically pursue. Families who were priced out in 2022 and 2023 are reentering the conversation, particularly in higher-cost markets like Orange County, CA, where affordability has been strained for years.

For sellers, the psychology shifts too. A homeowner sitting on a 3% or 4% mortgage isn’t eager to trade up if new financing means 7% rates. But at 6% — or below — the calculus changes. That opens the door to more listings, which can help ease inventory shortages in markets where supply has been the main constraint.

The Bottom Line

The headline is simple: falling mortgage rates won’t lift all markets equally. The metros most dependent on financing are where the biggest unlock will occur, as homeowners finally break out of the lock-in effect and new buyers take advantage of improved affordability.

For investors and developers, these are the markets worth watching. Lower rates mean not just more transactions, but also more household mobility, which feeds into demand for both for-sale housing and rentals. If the Fed continues on its projected path, the housing market could see meaningful activity in late 2025 — with the South and West leading the charge.

Leave a comment