After several years of resilience, the multifamily housing market is showing its first real signs of cooling. While national occupancy remains strong, subtle shifts in rent growth and regional performance are signaling that this is no longer a one-size-fits-all story. Investors, developers, and property managers need to understand that apartment market trends in 2025 are increasingly local, with performance diverging sharply across U.S. cities.

National Trends: Subtle Shifts, Big Implications

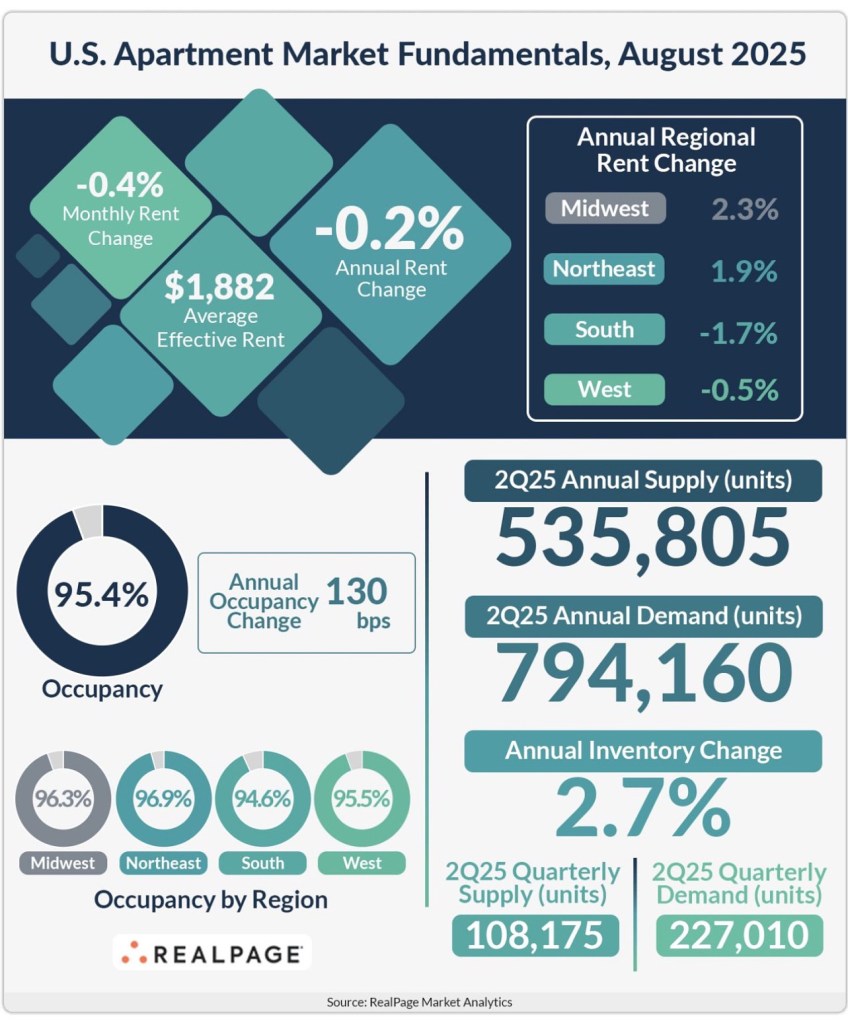

August occupancy averaged 95.4%, down slightly from July but still well within the five-year range. That number alone might not raise alarms—but the 0.2% year-over-year decline in effective asking rents is the first national rent cut since March 2021.

The culprit? Oversupply in historically high-growth Sun Belt markets like Texas, Arizona, and North Carolina, where new deliveries have outpaced demand. These regions, which dominated multifamily development during the pandemic migration boom, are now facing increased vacancy pressure and softening rent growth.

Regional Performance: Winners and Losers

Sun Belt Oversupply: Austin, Dallas, Denver, Phoenix, and Charlotte are at the center of the supply surge. Apartment developers in these markets are offering concessions to attract tenants, and investors are facing flat or negative rent growth. Tourism Hubs Cooling Off: Orlando and Las Vegas are softening—an early sign that consumer spending may be tightening. These markets often act as a bellwether for broader economic sentiment. Tech Hubs Outperforming: San Francisco, San Jose, and New York remain bright spots, with rent growth between 3% and 7% year-over-year. These cities benefit from high barriers to entry and job growth in tech, finance, and biotech. Midwest Steadiness: Chicago, Pittsburgh, and Minneapolis are proving that diversified job bases and slower development pipelines can create stability, even in uncertain cycles.

Key Takeaways for Real Estate Investors and Developers

The U.S. apartment market has entered a market-by-market era. National metrics are no longer enough to guide investment strategies. For developers, this means tighter underwriting and selective site acquisition. For investors, success lies in identifying cities where fundamentals are still strong—think supply-constrained coastal hubs or secondary markets with high occupancy and minimal pipeline growth.

Markets once considered safe bets, like Dallas or Phoenix, now demand a far more cautious approach, while Chicago and San Francisco are offering resilience that may surprise many.

Bottom Line

The multifamily housing sector is evolving. Oversupply continues to weigh heavily on the Sun Belt, while coastal metros and select Midwest markets are defying national trends and demonstrating long-term strength. In 2025, real estate investing success will hinge on hyper-local insights, market-by-market data, and disciplined strategies.

Now is the time to reevaluate assumptions, diversify portfolios, and focus on fundamentals rather than headlines.

Leave a comment