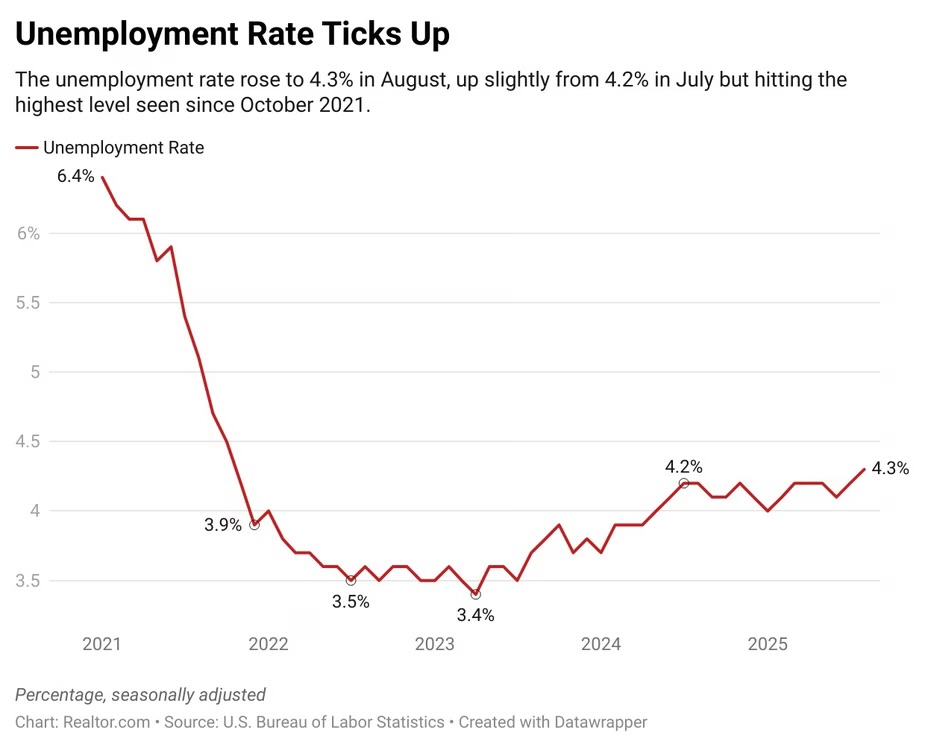

The Federal Reserve is now staring down one of the clearest signals yet that rate cuts are coming — and soon. The August jobs report was a gut punch to those betting on a strong labor market, showing that unemployment ticked up to 4.3%, its highest level since October 2021.

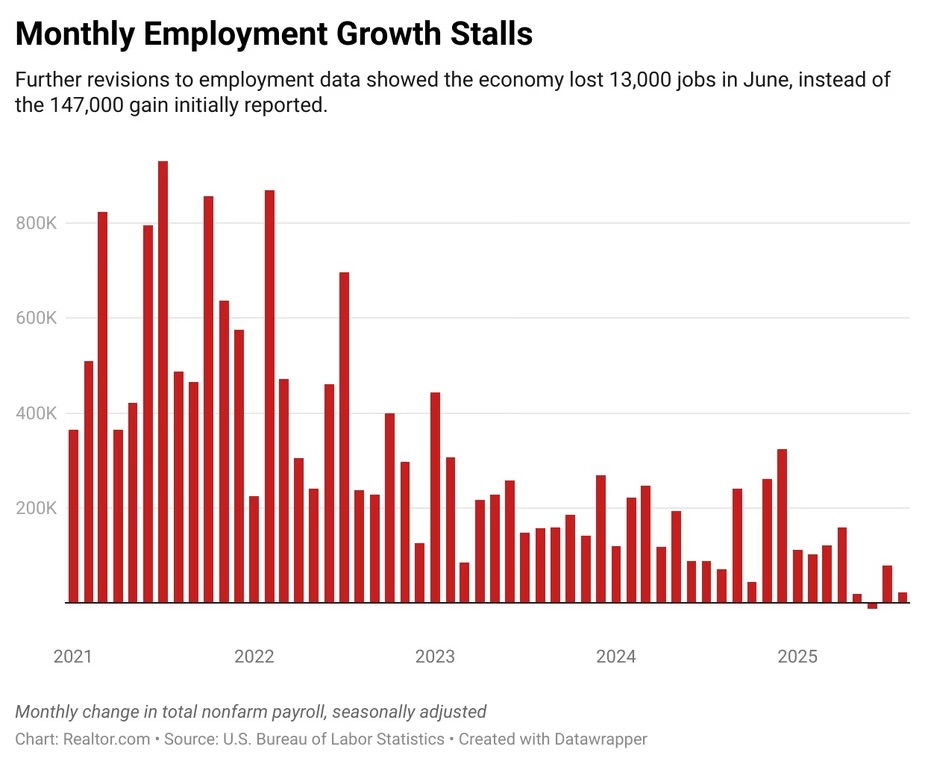

The U.S. economy added just 22,000 jobs in August, far below expectations, and that number comes on the heels of massive downward revisions from earlier months. In other words, the slowdown is real, and the Fed has a green light to move aggressively on rates this fall.

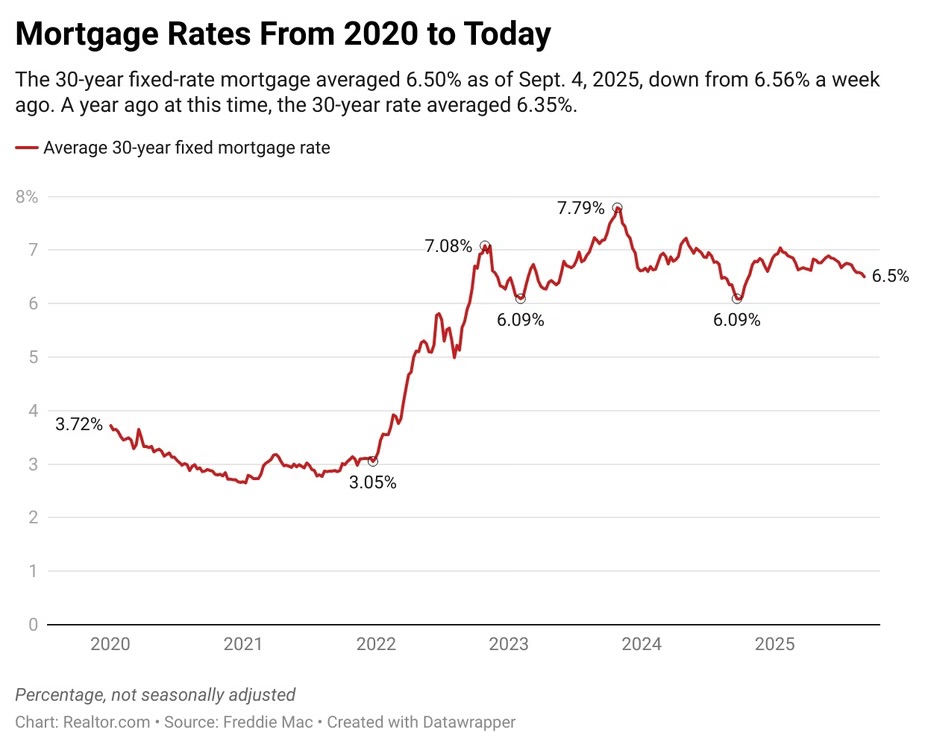

For those of us in real estate, this is a moment to pay attention. The macroeconomic data is troubling, but for homebuyers and sellers it means a window of opportunity is opening. Mortgage rates, already sliding to an 11-month low of 6.5%, are poised to fall further as the bond market prices in a weaker economy and multiple rate cuts.

Mortgage Rates Respond to Bonds, Not Just the Fed

As I’ve said before, mortgage rates follow the 10-year Treasury yield more closely than they do the Fed funds rate. Friday’s report sent those yields to their lowest level since April, when President Trump’s Liberation Day tariff announcement rattled markets. The connection is straightforward: weaker jobs data → lower bond yields → lower mortgage rates.

So while headlines will focus on what the Fed does on September 17, the real action is in the bond market. The CME FedWatch tool now puts the odds of three rate cuts before year-end at 67%, with speculation rising about a possible half-point cut this month instead of a quarter-point move.

For buyers with job security and sellers willing to price realistically, this environment could be the most favorable in over a year.

Inflation Remains the Wild Card

Of course, the Fed can’t ignore inflation. The August CPI print is due next week, and if headline inflation holds at 2.7% or ticks higher, the central bank will have a tougher job balancing economic weakness with price stability.

Still, the labor market deterioration is clear: revisions show that June hiring was overstated by 27,000 jobs, turning an initially reported gain of 14,000 into a loss of 13,000. July hiring was slightly revised up, but combined, employment in June and July was 21,000 lower than previously reported.

The July jobs report had already shocked markets with a 258,000-job downward revision for May and June. Now August adds to that picture of a rapidly slowing economy.

What This Means for Real Estate

We’re watching a sharp shift in momentum. The Fed is likely to cut rates not just once, but multiple times this year, creating breathing room in mortgage markets. If you’re an investor, this is the moment to:

Lock in cheaper debt as rates fall Revisit acquisition targets that were shelved when rates spiked Evaluate refinance opportunities for stabilized assets Prepare for a buyer’s market if economic weakness pushes prices lower in some regions

This is a reminder that the best opportunities often appear when headlines are bleak. Smart capital moves now could position buyers and developers to ride the next cycle higher.

Leave a comment