Let’s cut to the chase: the Florida real estate market—and the broader economy—is in raw, undeniable distress. While emotion rules the roost among brokers and marketers—pumping fear, hype, and wishful thinking—the real numbers are grim. And yet, it’s this very downturn that’s laying the groundwork for game-changing opportunities.

Foreclosure Hotspot: Florida Ranks Second Worst Nationwide

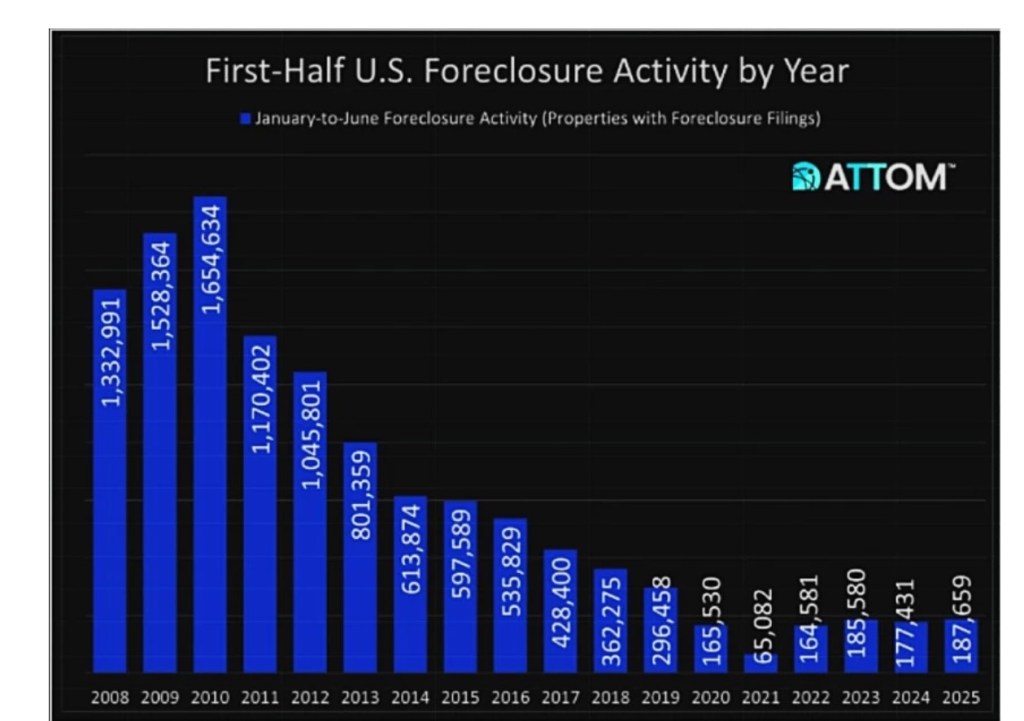

According to ATTOM Data Solutions, Florida’s foreclosure rate is the second highest in the nation, with one in every 2,420 homes entering foreclosure in July 2025—surpassed only by Nevada. Nationwide, the average is 1 in 3,939 homes.

These aren’t isolated blips. The surge is palpable, especially along South Florida’s coastal belt. Mid-Florida, for now, is faring slightly better.

Sales Are Slumping, Market Is Cooling

The Orlando area may be defying the foreclosure trend—distressed sales like short and foreclosures are actually down 51% from two years ago. But that doesn’t paint a rosy picture—it’s thanks to high home equity buffering homeowners better from financial shock.

Still, Orlando is hardly snowed under with activity. Home sales have crashed—down 63% compared to two years ago. Listings are languishing for more than six months, and 1.5% month-over-month sales uptick isn’t enough to call it a rebound.

Across Florida, we’re seeing a spike in failed closings. Nearly 15% of pending sales in June and July were canceled—highest since at least 2017—and in hot metros like Fort Lauderdale, Jacksonville, and Orlando, cancellation rates hover at or above 20%.

Cape Coral Is Where The Crash Is Hitting Hardest

Cape Coral, once emblematic of Florida’s housing boom, is now ground zero for the state’s real estate freefall. Home prices have dropped 11% over two years, and over 50% of listings have cut prices. Nearly 8% of homeowners are underwater on their mortgages.

Broader Market Pressures: Insurance, Migration, Affordability

Florida’s challenges aren’t limited to housing data:

The average home insurance premium in Florida skyrocketed from roughly $2,380 (2021) to around $6,000 in 2023—triple the U.S. average. That’s putting unchecked upward pressure on carrying costs . Market sentiment is shifting. A Business Insider report called Florida’s post-pandemic boom a “cautionary tale,” noting a drop in net migration, falling prices (about 3% down from the spring 2024 peak), and buyers fleeing for more affordable markets like Georgia and Tennessee . Homes are being delisted because sellers expect previous highs—not realistic buyers (Miami saw ~27 delistings per 100 new listings; national average is 13.6) . Listings are staying on the market longer across Orlando, Miami, Nashville, and more, reflecting lower demand and increased buyer leverage. Cape Coral isn’t alone. Flood risks, climate change, and insurance meltdown are turning large chunks of Florida’s coastal real estate into potentially stranded assets. Experts warn some properties could fall 20–40% in value over the next 5–6 years.

Why This Downturn Is Your Opportunity (Yes, Seriously)

Here’s the good news—as grim as the situation is, downturns like this are the catalyst for smart investors and developers to gain real advantage:

Inventory Flood (But Savvy Buyers Win): Listings are rising—giving buyers the upper hand. Price cuts are slipping through everywhere . Capitalize on Distress: Foreclosure rates and failed closings are flushing opportunity. On-the-ground, these are transactional openings. Climate Risk Repricing: Coastal risk is reshaping demand. The inland and resilient markets will stand out. Play with foresight. Rethink Insurance Dependency: With insurance costs crushing affordability, repositioning—or holding until policy reforms—can unlock value. Early Entrants Get Rewarded: Markets like Orlando will “recalibrate”—not crash. Homes sitting today could become undervalued gems in 18–24 months.

Final Word

Lots of emotional noise is swirling around Florida’s real estate right now. Brokers and marketers cling to narratives of “resilience” or “bounce-back.” But you don’t keep winning by ignoring data. By doubling down on markets, metrics, and mechanisms, you can outrun the hype—and build real value from this mess.

Want to go deeper with city-by-city breakdowns, investment strategies, or how this plays out through 2026? Just say the word.

Remember: in real estate—like pretty much everything else—staying honest with the data is the competitive edge.

Leave a comment