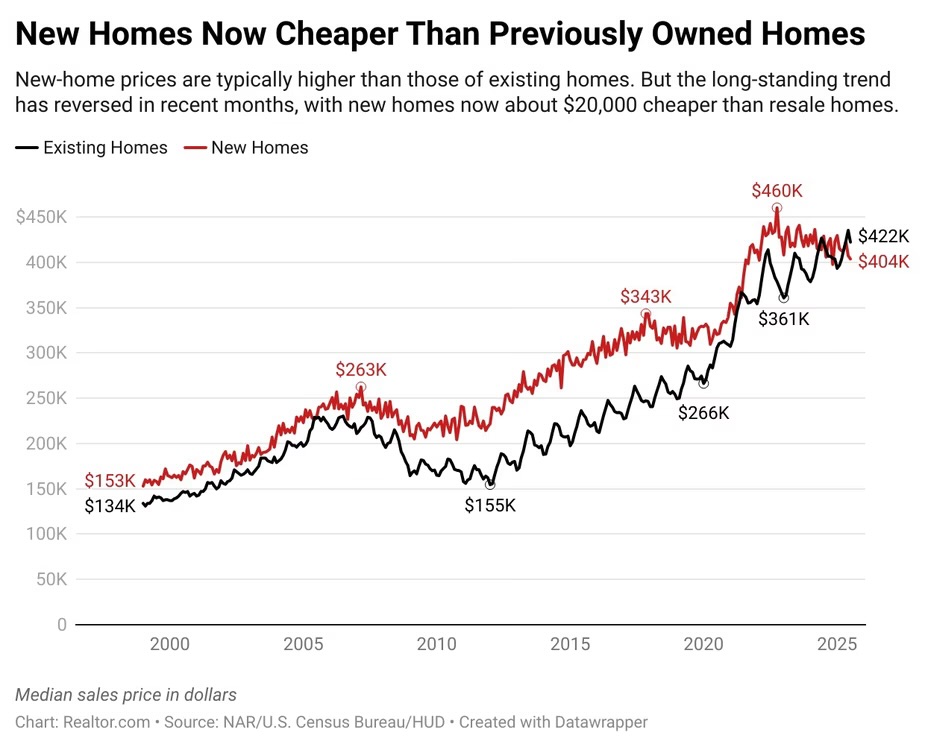

For as long as anyone can remember, newly built homes have carried a premium over existing ones. It made sense—brand-new appliances, modern layouts, customizable finishes, and the peace of mind that you won’t be dealing with a leaking roof or a furnace from 1992.

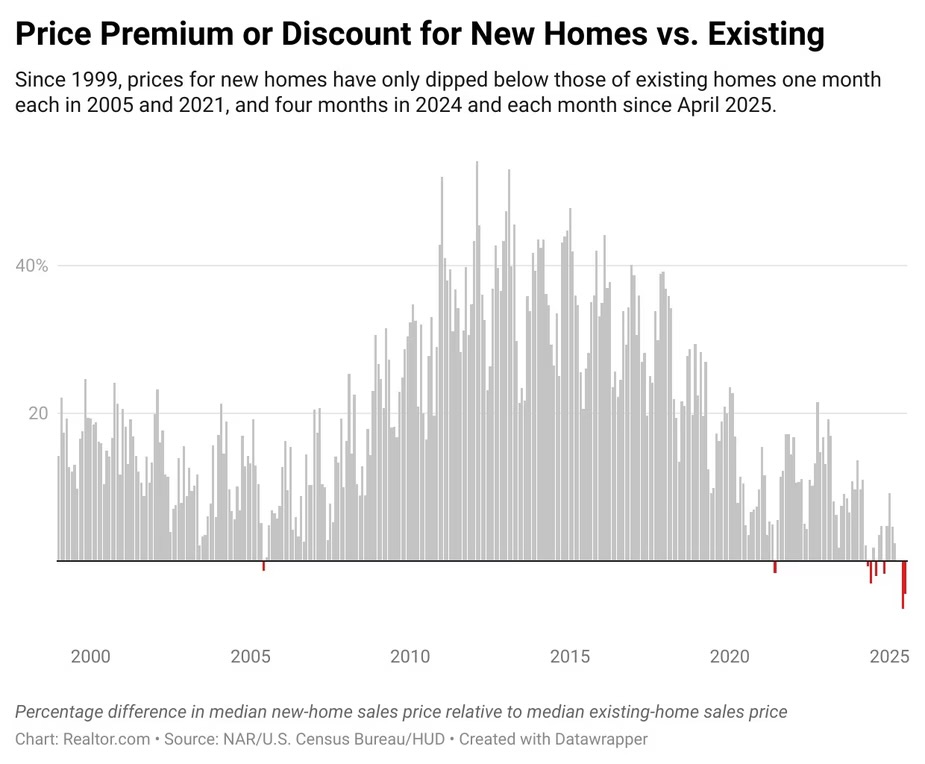

But in 2025, we’ve flipped the script. For the first time on record, new construction is consistently selling at a discount to resale homes. And it’s not a small blip—it’s a multi-month, meaningful inversion that has real implications for developers, investors, and brokers.

In June, the median new home sold for $407,200—about $28,000 less than the median resale. That gap has narrowed slightly, but July still saw nearly a $19,000 spread. More importantly, this marks the longest stretch of new-construction discounts we’ve ever tracked.

Why This Matters

This isn’t just a statistical quirk. Builders are actively repositioning to move product. They’ve been cutting prices, offering incentives (rate buydowns, cash at closing, upgrades), and, in many cases, designing smaller floor plans to meet affordability thresholds. On a per-square-foot basis, new homes are still coming in cheaper—$218 versus $226 for resale, per Realtor.com’s latest data.

Meanwhile, resale pricing remains stubborn. Sellers don’t want to admit that the market has shifted. Many would rather delist than take a haircut, betting that lower rates will bail them out down the road. Builders don’t have that luxury—they’re sitting on hundreds of homes and balance sheets that demand velocity.

The result: new home prices move with the market, resale prices stay sticky. That stickiness raises questions about whether resale prices are truly reflecting market reality or just seller psychology.

The Regional Factor

Yes, geography plays a role. Roughly 60% of new home sales are in the South, where overall housing costs skew lower, compared with 46% for resale. But this isn’t new—it doesn’t explain why we’re suddenly seeing price inversions in 2024 and 2025.

What has changed is supply. New construction has over nine months of inventory at the current sales pace. Resale? Less than five months. Builders are oversupplied and motivated. Homeowners are under no pressure—unless life forces their hand.

What Happens Next?

Two paths are possible:

Resale sellers blink. If buyer demand stays soft, resale pricing eventually has to come down to meet the market. Think of it as a slow correction—just as we’ve seen with new construction prices drifting about 5% off peak since late 2022. Sellers wait it out. If mortgage rates come down and incomes catch up, resale sellers may hold firm long enough to reset affordability dynamics in their favor.

Either way, the opportunity right now is clear: buyers have leverage in new construction. Builders are motivated, the discounts are real, and the incentives make the effective pricing gap even wider than the data shows.

Takeaway for Professionals

For developers: expect continued pressure to right-size product and sweeten deals. For investors: watch this inversion closely—if resale pricing cracks, it will ripple across appraisals, comps, and land valuations. For brokers: educate your buyers. The resale market may still feel tight, but the value play is in new construction, at least in the near term.

This moment is rare—new homes selling cheaper than resale. The only question is how long it lasts.

Leave a comment