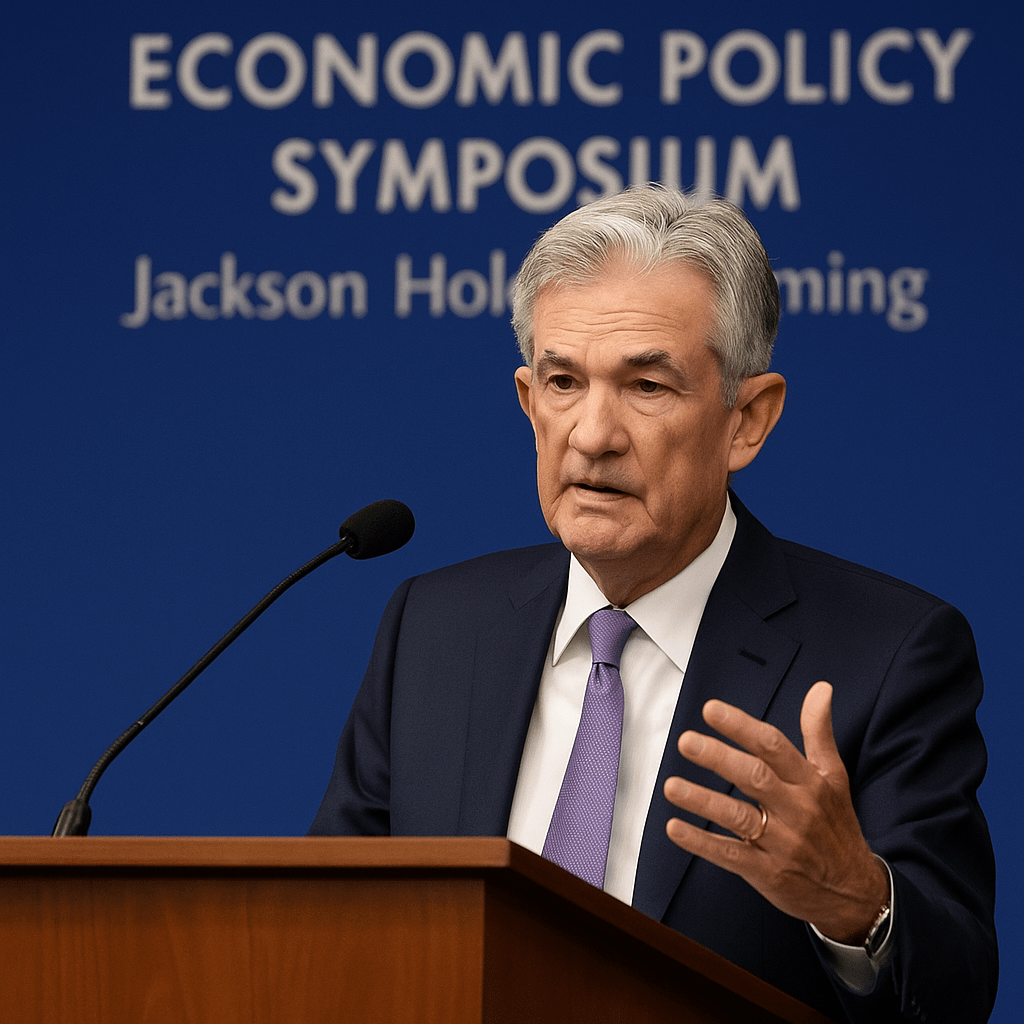

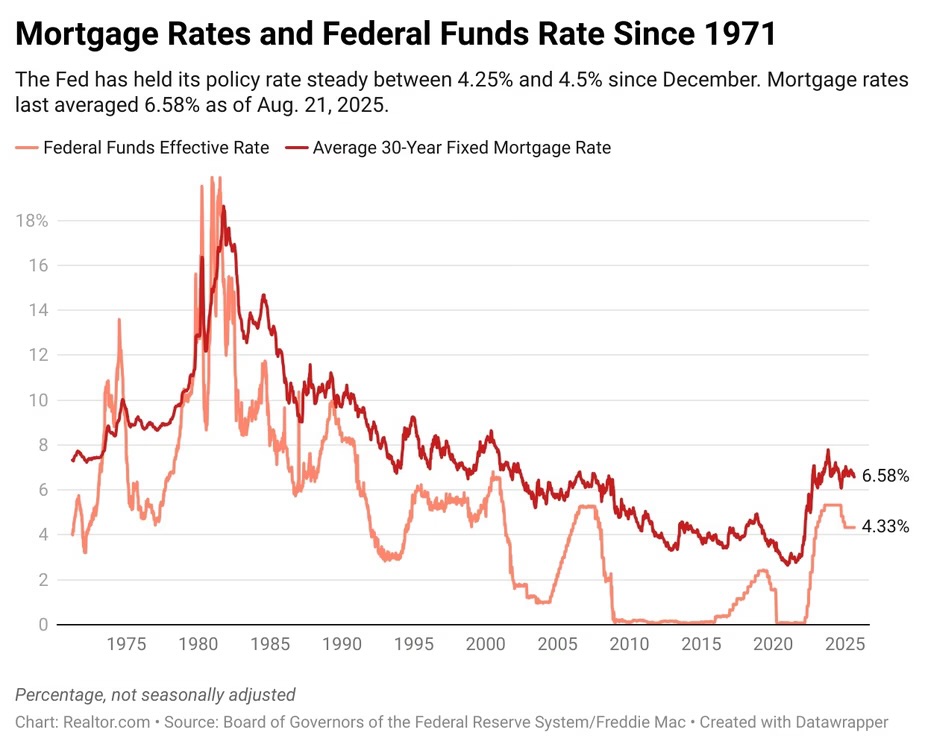

Federal Reserve Chair Jerome Powell’s speech in Jackson Hole is sending a clear signal: the balance of risks is moving away from inflation and toward the labor market, opening the door for a September rate cut. Markets reacted instantly—bond yields dropped, equities jumped, and mortgage rates touched a 10-month low of 6.58%.

For those of us actively building and investing in real estate, this isn’t just financial theater—it has real consequences on our deals, pro formas, and capital stacks.

Mortgage Rates and Housing Affordability

While the Fed doesn’t directly set mortgage rates, expectations about policy shape them. Developers and homebuilders have been battling affordability challenges for years, with buyers squeezed by borrowing costs. Even modest rate relief helps unlock demand on the for-sale side, and potentially revives stalled absorption in both single-family and multifamily projects.

But let’s be realistic—rates dipping into the mid-6s are a relief, not a game-changer. Unless the economy weakens sharply, I don’t see mortgages breaking below 6% this year. That means homebuilders still face constrained buyers, and investors like us must underwrite deals with caution.

Builder Confidence and Construction Costs

Public builders like Lennar, DR Horton, and Toll Brothers popped more than 5% on Powell’s comments. That reflects how sensitive construction economics are to financing costs. In my own pipeline, I see the same: every quarter-point shift in rates impacts not just buyers but also our construction loans, bridge facilities, and ultimately investor returns.

Single-family starts remain down year-over-year, and the double hit of high material costs and elevated financing continues to weigh on new development. Lower rates would help, but don’t erase systemic cost inflation in land, labor, and materials.

Politics and Policy Risk

Trump’s pressure campaign on the Fed underscores something we, as developers, must constantly factor in: political interference in monetary policy. Markets crave predictability, but election-year politics will inject volatility into rates, lending, and investor sentiment. I’ve seen firsthand how quickly lender appetite can shift when politics cloud Fed independence.

The Bigger Picture

Powell also announced the Fed will pivot back to a more traditional inflation-targeting framework, giving more room to prioritize employment stability. That matters for us—because a weakening labor market could dampen household formation and rental demand just as much as it could bring down rates.

For developers and investors, the playbook is clear:

Underwrite conservatively—don’t bank on sub-6% mortgages this cycle. Stay flexible in capital structure—bridge lenders and equity partners are watching every Fed headline. Lean into demand resilience—projects near job hubs, schools, and infrastructure will outperform in a slower economy.

In short, Powell may have opened the door to cheaper capital, but the road ahead is anything but certain. As always in real estate, risk management and execution will separate winners from those caught flat-footed.

Leave a comment