When we talk about real estate growth markets, the conversation often drifts toward the usual suspects—Texas metros, the Carolinas, or the outskirts of fast-growing Western cities. But in 2025, the data points us somewhere less obvious: Northwest Arkansas.

According to the latest report from Realtor.com’s economic research team, the Fayetteville, AR metro area—home to Walmart’s corporate headquarters in nearby Bentonville—is now the number one market in the nation for new-home construction.

Why Fayetteville Leads the Pack

What makes this market stand out isn’t just raw growth—it’s the convergence of affordability, supply, and economic drivers. More than 40% of active listings in the Fayetteville metro are new builds, a share that far exceeds most markets nationwide. Even more compelling, these new homes are priced below the area’s existing housing stock:

Median new home price: $399,717 Median resale home price: $418,375

That pricing inversion is rare, and it’s creating a competitive advantage for builders while giving buyers access to move-in ready homes at a relative discount.

The University of Arkansas provides a stable anchor institution, but Walmart’s gravitational pull is the real story here. The retail giant’s headquarters and its ecosystem of suppliers continue to fuel population growth, job creation, and infrastructure investment. It’s the kind of environment that gives developers confidence to bring large volumes of inventory to market.

How the Rankings Were Built

Realtor.com’s new-home construction index looked at the 100 largest U.S. metros, ranking them on four key factors:

Share of listings that are new construction Price differential between new and existing homes Relative climate risk Buyer demand for new construction

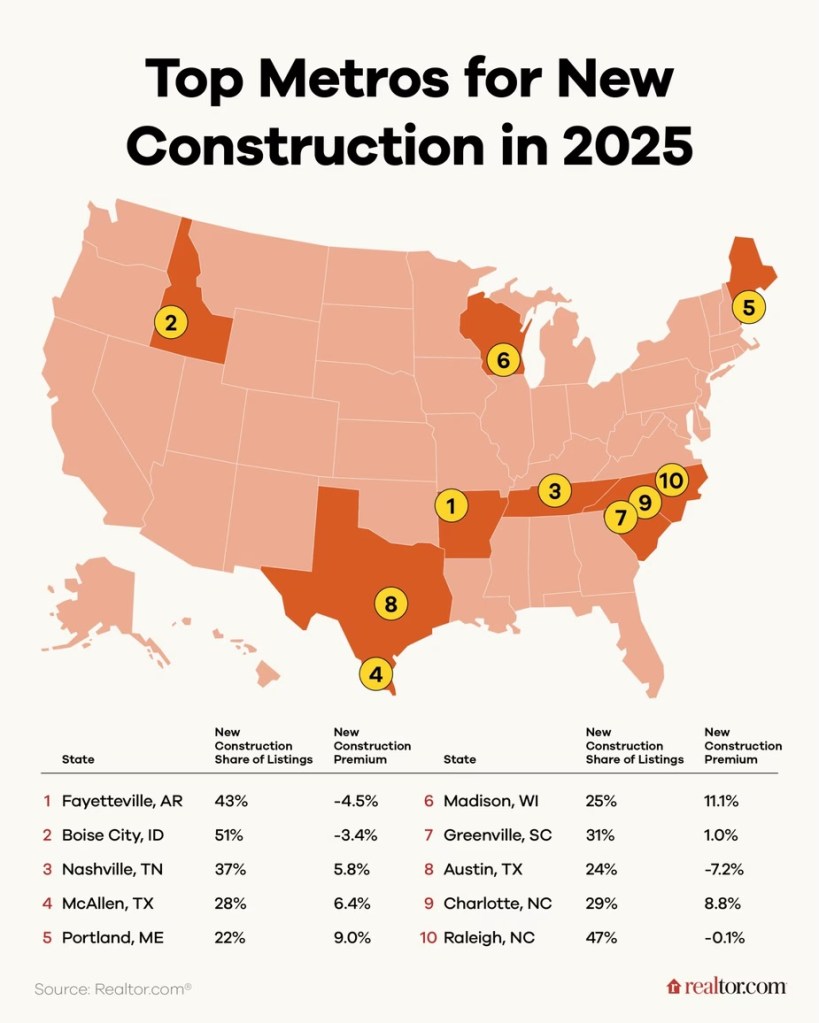

The top 10 metros illustrate a clear trend: seven are in the South, and more than half are college towns. Following Fayetteville are Boise (ID), Nashville (TN), McAllen (TX), Portland (ME), Madison (WI), Greenville (SC), Austin (TX), Charlotte (NC), and Raleigh (NC).

What It Means for Developers and Investors

For those of us in development and investment, the lesson here is clear: new construction is no longer the premium-priced option in many markets. Elevated mortgage rates and a lock-in effect among existing homeowners have tightened resale supply, making new builds the only real source of fresh inventory. Nationally, supply metrics underscore the imbalance:

New homes for sale: 9.8 months of supply Existing homes for sale: 4.7 months of supply

On a per-square-foot basis, the advantage is even more striking: new homes list for $218.66 per square foot nationally, compared with $226.56 for resales. That’s a structural shift in the way we think about new construction versus existing housing.

Modern Features and Lower Risk

Beyond pricing, new homes are delivering what buyers demand: modern layouts, energy efficiency, and resilience. In several of the top metros, new construction also carries a lower relative risk profile for natural hazards like wildfire, flooding, and extreme heat.

Realtor.com’s senior economist Joel Berner captured it well: when local governments reduce zoning barriers and builders invest at scale, “it’s a win for affordability, livability, and long-term resilience.” These communities are setting the blueprint for how housing markets can close the supply gap while maintaining quality of life.

Final Takeaway

As developers and investors, we should be watching these markets closely—not only for potential opportunities but also for the policy frameworks that enable this kind of supply response. The Fayetteville story is a reminder that strong job markets, affordability, and forward-looking planning can align to produce real, scalable housing solutions.

In a national housing landscape defined by scarcity, markets where new construction is affordable, abundant, and aligned with economic growth will lead the way. Northwest Arkansas just happens to be setting the pace in 2025.

Leave a comment