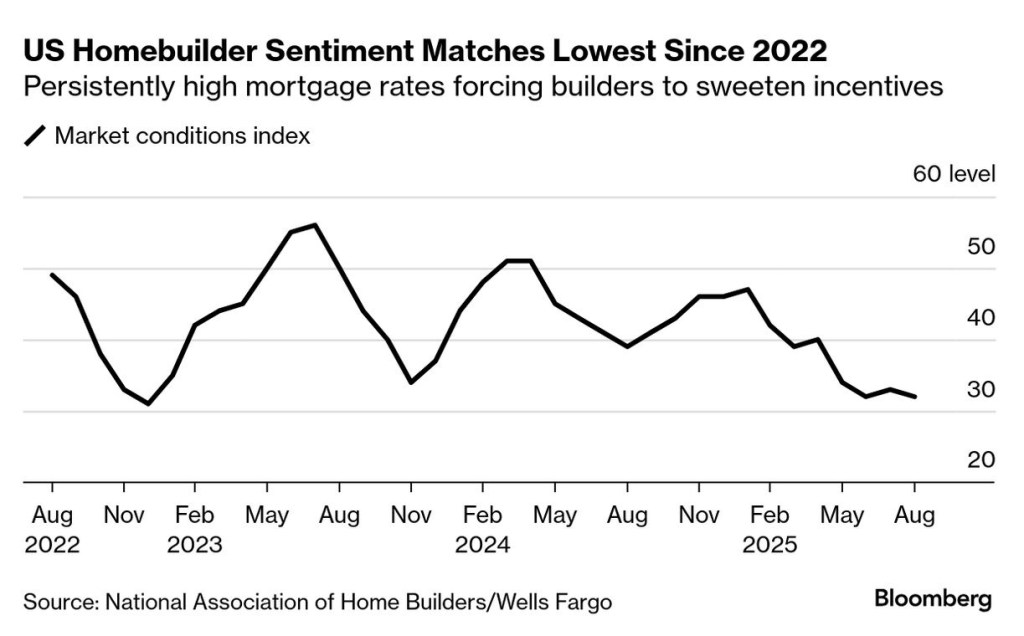

US homebuilder confidence has slipped again, falling to match the lowest level since 2022. The National Association of Home Builders/Wells Fargo Housing Market Index dipped one point to 32 in August, missing economists’ expectations of a slight uptick.

On the ground, that decline isn’t just a number—it reflects the reality that many builders are struggling to keep momentum. Incentives, long a tool of last resort, are becoming the norm: 66% of builders now report using sales incentives, the highest share since the pandemic. At the same time, 37% are cutting prices to keep absorption rates moving.

As a developer, I see this dynamic every day. Incentives are powerful in the short term, but they also signal pressure. When builders are forced into price cuts or giveaways, it underscores how weak buyer confidence has become. High mortgage rates remain the primary drag, keeping affordability at crisis levels and sidelining a wide swath of would-be buyers.

The Foreign Buyer Factor

While domestic demand is showing strain, there’s a countercurrent worth noting: foreign buyers are back.

For the first time in eight years, sales of US real estate to non-US citizens increased. According to the National Association of Realtors, foreign buyers purchased $56 billion in existing homes in the year through March, up 33% year-over-year.

This shift is no accident. Elevated mortgage rates and steep home prices have created barriers for American buyers, leaving space in the market for international capital. Many of these buyers transact in cash and are less sensitive to borrowing costs, giving them an edge in today’s environment.

While foreign purchases only represent 2.5% of total existing home sales, the effect is more pronounced than the number suggests. In certain markets—think Florida, California, New York, and parts of Texas—this demand competes directly with local buyers already stretched to their limits.

My Take

We’re at a critical inflection point. Builders are leaning heavily on incentives to move product, signaling real pain on the supply side. At the same time, foreign buyers are re-entering the market, drawn by relative value and opportunity in US real estate compared to global alternatives.

For developers and investors, this presents a paradox. On one hand, weakening domestic demand means slower absorption and tighter margins. On the other hand, international demand provides a buffer—particularly in gateway markets and high-profile metros where foreign capital tends to concentrate.

The real question is whether these trends converge or diverge. If foreign demand continues to rise, it could further constrain affordability for US buyers. If builder sentiment remains in the doldrums, it will limit new supply. Together, these forces risk deepening the affordability crisis rather than relieving it.

Where Opportunity Lies

For investors, there are opportunities hiding within the turbulence:

Target markets where foreign demand is increasing, as these are likely to see more resilient pricing. Pay close attention to builders under margin pressure. Projects facing sluggish sales today may create acquisition opportunities tomorrow. Expect more creative deal structures, as incentives expand beyond traditional discounts to include rate buy-downs, closing cost coverage, and even partnership equity.

The US housing market remains one of the most complex and contradictory investment landscapes in the world. Understanding both the domestic headwinds and the global capital flows is essential. As always, success lies in navigating between distress and demand, and positioning ahead of the next shift.

Perfect — here’s the expanded closing section of your blog post with additional paragraphs on specific markets most affected, where developers/investors can lean in, and where caution is warranted:

Where Opportunity Lies

For investors, there are opportunities hiding within the turbulence:

Target markets where foreign demand is increasing, as these are likely to see more resilient pricing. Pay close attention to builders under margin pressure. Projects facing sluggish sales today may create acquisition opportunities tomorrow. Expect more creative deal structures, as incentives expand beyond traditional discounts to include rate buy-downs, closing cost coverage, and even partnership equity.

Markets Most Affected

The regions feeling this push and pull most acutely are the gateway metros and high-demand Sunbelt markets.

Florida continues to be the epicenter of foreign capital inflows, particularly from Latin America and Europe. Miami, Orlando, and Tampa have all seen increased competition from cash buyers, putting added strain on local affordability. California remains a magnet for Asian buyers, especially in Los Angeles and the Bay Area, where international investors often focus on trophy properties or second homes. Developers in these markets face the double challenge of weak domestic affordability and resilient global demand. New York City has also benefited from the rebound of foreign purchasing, especially in Manhattan condos and Brooklyn brownstones. While sales velocity has slowed overall, foreign capital has helped stabilize the higher-end market. Texas metros like Houston and Dallas are attracting global capital due to their relative value compared to the coasts, alongside strong long-term fundamentals.

Where Developers and Investors Can Capitalize

Secondary Sunbelt Markets. Cities like Charlotte, Raleigh, Nashville, and Phoenix still offer room to run. While domestic affordability is stretched, these markets are magnets for migration and job growth, making them better long-term bets even with short-term softness. Select Midwest Markets. Chicago, Indianapolis, and Columbus remain overlooked but are drawing increasing interest from institutional investors. Lower barriers to entry and stable rental demand create attractive conditions for patient capital. Build-to-Rent (BTR). With homebuyers sidelined, demand for rental housing is surging. Developers able to pivot projects to BTR formats—or partner with single-family rental operators—will find more resilient exit strategies.

Where to Steer Clear

Overbuilt Condo Markets. Parts of Miami, Austin, and Las Vegas have seen aggressive pipeline expansion, and foreign demand isn’t enough to backstop absorption in the near term. Ultra-High-End Luxury Spec Homes. With domestic buyers retrenching and foreign capital still selective, the appetite for $10M+ speculative product has thinned. Carrying costs in this segment are punishing if absorption slows. Markets With Weak Job Growth. Cities without strong employment anchors—especially in the Rust Belt—will be hardest hit as affordability deteriorates and foreign capital largely bypasses them.

The US housing market is diverging. On one side, builders are bending under the weight of affordability constraints. On the other, international buyers are stepping back into the picture, adding fuel to already overheated markets.

For developers and investors, the path forward isn’t about chasing national trends—it’s about understanding where capital is flowing, where supply pipelines are constrained, and where the risks of oversupply are highest. The winners will be those who lean into resilient migration markets, adapt product strategies to rental demand, and stay disciplined in overbuilt segments.

Leave a comment