South Florida has been one of the hottest multifamily markets in the country for the better part of a decade. The post-pandemic boom sent rents and property values into the stratosphere, attracting capital from every corner of the globe.

But today, the tide has turned.

As a developer and investor who’s watched market cycles play out across the U.S., I can tell you that Florida is going through one of its fastest real estate sentiment shifts in recent memory. What we’re seeing now is a big readjustment — call it a correction, call it a buyers’ market, call it distress. Whatever the name, it’s here.

The Numbers Don’t Lie

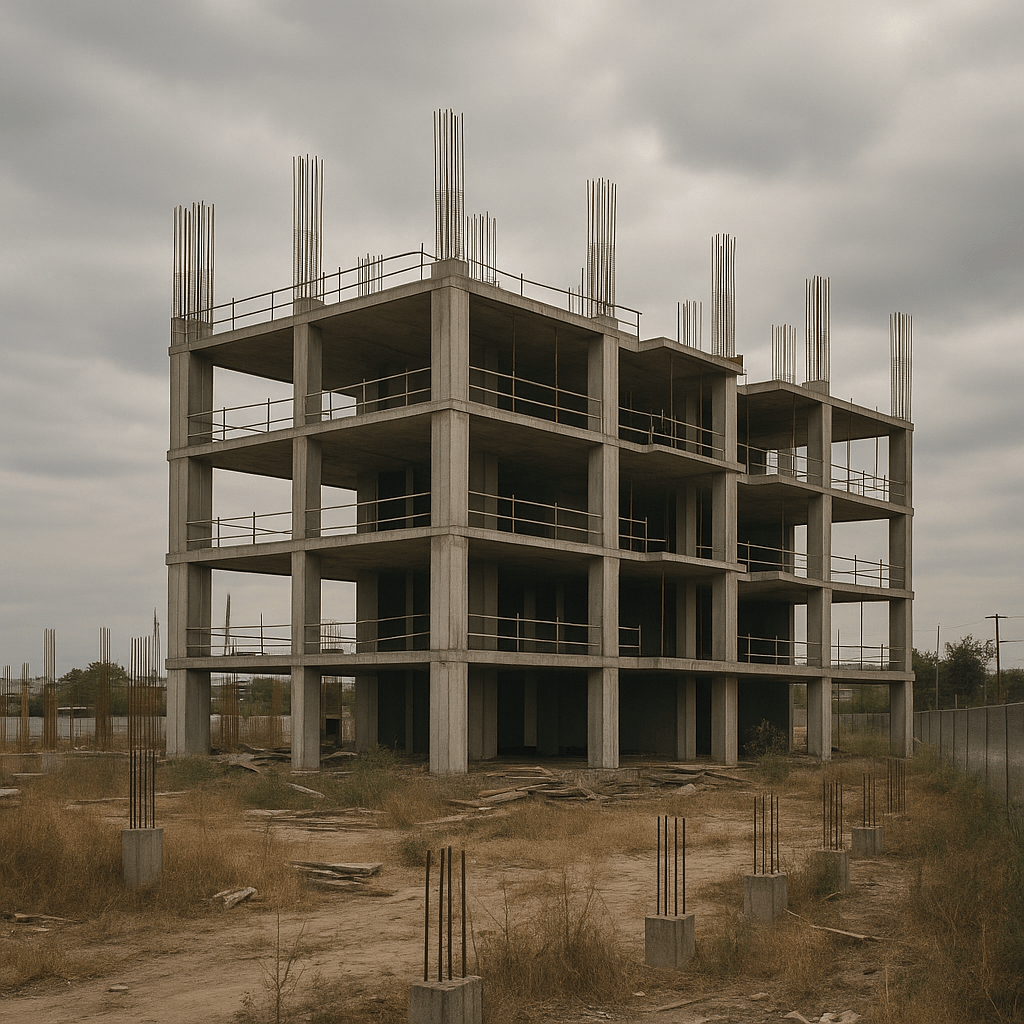

Developers in Miami-Dade, Broward, and Palm Beach counties are listing multifamily sites instead of breaking ground. That’s not speculation — that’s a wave of for-sale signs going up on shovel-ready projects that, just a year ago, were being fast-tracked to construction.

Here’s why:

High interest rates have blown up pro formas. Construction costs remain stubbornly elevated despite softening in some trades. Rent growth has stalled in key markets — in some cases, rents are falling.

The oversupply in Wynwood is a prime example. The area’s trendy one-bedroom apartments are now leasing for an average of $3,049, down 7% year-over-year. And that’s before factoring in rising property taxes and looming loan maturities.

From Boom to Pause

In 2024, South Florida delivered 18,600 new apartments. Demand absorbed only 15,000 net new leases. That gap is all it takes to tip a market from red-hot to room-temperature.

The result? Projects that secured approvals in the last 12 months — some just months ago — are suddenly hitting the market.

Notable Listings Signaling the Shift

Clara Wynwood – Approved 147-unit tower site asking $10.9M. Developer pivoting to larger projects. Evolve Companies – Two Wynwood Norte sites totaling 240 units asking $26M combined. K2 Capital Group – Goulds site for 206 units asking $6.3M, testing buyer interest.

Strategic Moves or Distress?

Some brokers call this a distress sale wave. Others see it as a natural cycle reset. In my experience, both can be true.

Developers are:

Leveraging the Live Local Act to boost entitlements before selling. Converting planned rentals to condos for faster capital recycling. Partnering up instead of going solo.

The Next 12 Months

Banks are cautiously lending again. Certain material costs are trending down. And with potential Fed rate cuts on the horizon, the market’s mood could shift again.

But right now? Everyone is a net seller.

This is what happens when oversupply meets expensive debt and cooling demand. In South Florida, it doesn’t take long for the narrative to flip.

Opportunity for the Bold

Here’s where the doom-and-gloom turns into strategy:

For well-capitalized investors, this is the moment to buy quality dirt at a discount. Entitled land, approved projects, and prime locations are coming to market from sellers who, six months ago, wouldn’t have taken your call.

Cycles create opportunities. The window is open — but in markets like South Florida, it rarely stays that way for long.

Leave a comment