Hey everyone,

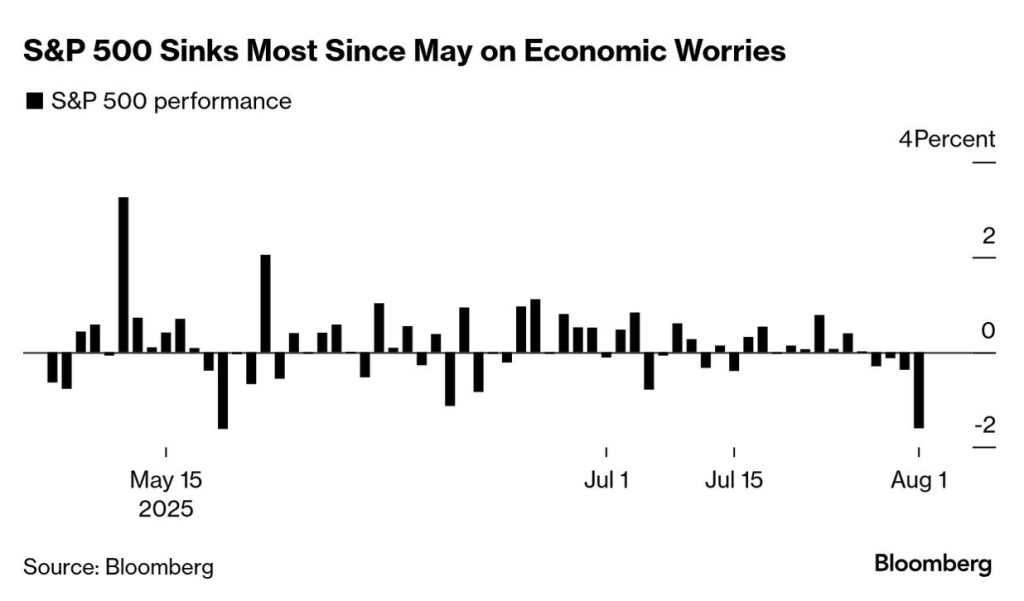

If you’ve been following the markets, you probably felt the tremors this past week—even if you weren’t glued to the financial news. What started as another round of tariff threats from Trump quickly spiraled into something bigger: a clear sign that things aren’t just volatile, they’re vulnerable.

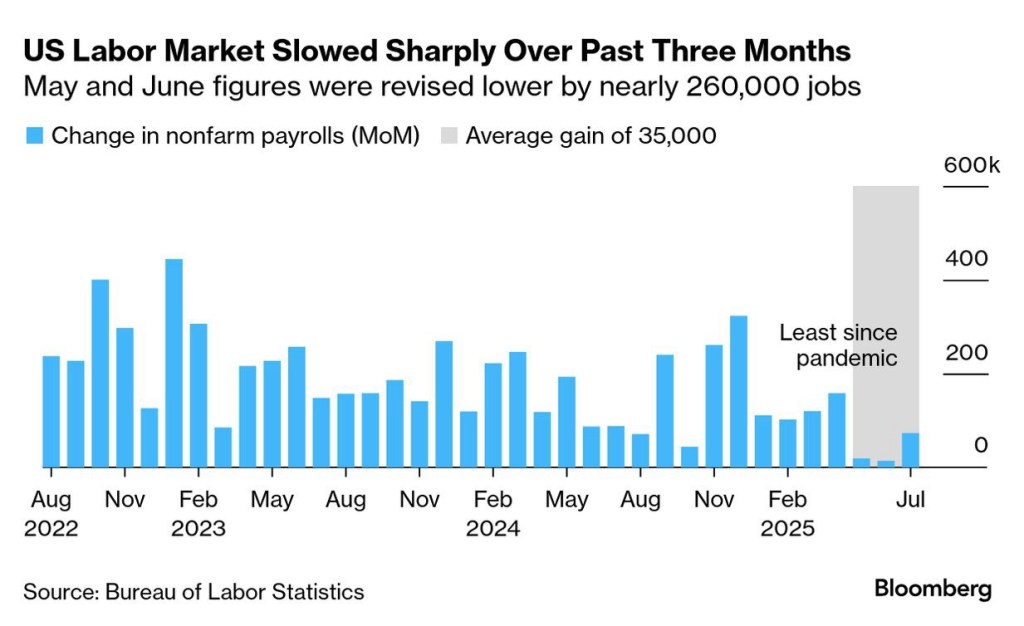

Let’s start with the numbers. The job market, which has been holding up surprisingly well, suddenly showed its cracks. The latest report from the Bureau of Labor Statistics came in light—just 73,000 new jobs last month. Worse, they quietly revised the previous two months down by 258,000. That’s not a typo. And it’s not just July that looks weak—this revision drops the three-month average from 150,000 to just 35,000 new jobs. That’s a cliff.

So what does Trump do? He lashes out. He’s reportedly told aides to fire the BLS commissioner—Erika McEntarfer—for the “bad numbers.” The role has traditionally been nonpartisan and independent, but with recent Supreme Court rulings making it easier for presidents to remove agency heads, this move might stick. That’s scary. If you can’t trust the data, how do you build—or invest—with confidence?

And then there’s the Fed. Trump is back to attacking Chair Jerome Powell, saying he should be “put out to pasture.” As a developer and investor, this kind of political pressure on the Fed is alarming. Rates are the lifeblood of real estate. If the Fed bends to political will, it makes long-term planning and financing decisions harder for all of us.

But the instability doesn’t stop there. Trump also got into a public flame war with Dmitry Medvedev, a close Putin ally, over Ukraine. It escalated into nuclear threats. And while that was happening, reports surfaced that the administration quietly moved Ghislaine Maxwell to a minimum-security prison in Texas. The bigger story? She’s been cooperating with officials over the Epstein files—files that, according to sources, have been redacted to remove Trump’s name (and others).

That’s not a conspiracy theory—that’s from the FOIA team reviewing the Epstein documents. It’s not hard to see why people are losing trust in institutions. When political influence seeps into data, justice, and economic policy, it has ripple effects in every sector—including real estate.

Meanwhile, the Supreme Court is preparing to hear a major case that could reshape how voting districts are drawn. They’re considering whether the Voting Rights Act still justifies creating majority-Black or Hispanic districts. This has massive implications not just for politics, but for how cities and suburbs are shaped—and where capital flows.

On the global side, hedge funds are betting hard on oil. With more Trump threats against Russia, supply fears are back on the table. That’s pushed oil bullishness up at the fastest pace in over a month. If you’re building anything that relies on transport or materials (i.e., every real estate project ever), you’re watching this closely.

And finally, some corporate clarity: Apple had a rare all-hands meeting after their earnings call. Tim Cook is going all-in on AI—finally. Apple was late to the game, but Cook reminded his team that being second (or third or fourth) has worked for them before. Think about it: the iPod wasn’t the first MP3 player. The iPhone wasn’t the first smartphone. But they won anyway by getting the details right.

That hits close to home. In development, timing matters—but execution matters more. Sometimes it pays to be patient, to listen, to learn—and then strike when it’s time. Whether you’re building housing in a ski town, negotiating with a school district, or putting together a public-private deal (like I am), that’s the edge.

Stay sharp out there. The world is noisy. The data is messy. But the fundamentals still matter. Watch the numbers, ignore the distractions, and build what matters.

—Daniel

Leave a comment