How I Got My Start — And Where You Should Be Looking Next

I bought my first two homes for $10,000 at 18 years old, way back in 1992. That was my entry into real estate — not through some fancy seminar or six-figure syndication, but by getting my hands dirty, fixing what was broken, and creating value. If you’re looking to break into development or grow your investment portfolio, the fix-and-flip path is still one of the smartest ways to do it.

And right now, the opportunity is very real in certain states — if you know where to look.

Why Fixer-Uppers Matter Again

With home prices at historic highs and affordability at four-decade lows, many buyers and investors are looking at older, under-loved homes as a way in. You can often buy below market, renovate with a clear value-creation plan, and either resell at a profit or refinance into long-term rental debt.

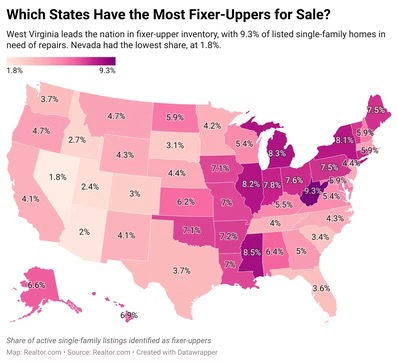

But not all states are created equal when it comes to fixer-upper supply. A new analysis of Realtor.com listing data shows where the best deals — and most opportunities — are hiding.

The Top States for Fixer-Uppers

At the top of the list: West Virginia, where over 9% of listings are fixer-uppers. If you’re looking for inventory, affordability, and older homes with good bones, this is your spot.

Here are the top 5 states with the highest share of fix-and-flip inventory:

West Virginia

Mississippi

Michigan

Illinois

New York

Yes, New York may surprise you — but the state has the oldest housing stock in the country, with a median home age of 62 years. That means untapped opportunities for those who know how to assess and reposition properties. These are places where you can still buy low and add real value through renovation.

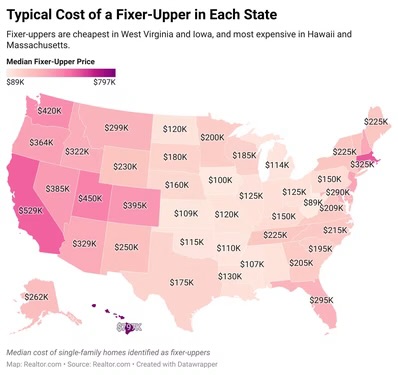

Where Fixer-Uppers Are Cheapest

If you’re looking at cost of entry, here’s where fixer-uppers are most affordable:

West Virginia: Median price of just $89,250 Iowa, Mississippi, and Kansas also offer project homes under $110,000

Even more telling is the “fixer-upper discount” — the markdown compared to median-priced homes in each state. Here, North Dakota leads with a 66% discount, followed by West Virginia, Kansas, and Iowa.

Where You Won’t Find Many Opportunities

On the flip side, states like Nevada, Arizona, Colorado, Utah, and Idaho have the fewest fixer-uppers. Why? Their housing stock is newer, thanks to construction booms in recent decades. In Nevada, the average home is only 23 years old.

That means less aged inventory, and fewer homes in need of significant rehab. If you’re a value-add investor or flipper, your time and money may be better spent elsewhere.

Final Thoughts — And Free Advice

Look, you don’t need to max out your credit card on some flashy seminar to figure this stuff out. I’m here to give away every tip and insight I’ve learned from decades in this business — for free.

If you’re just getting started, fixer-uppers are still the most accessible way to build sweat equity and get in the game. If you’re an experienced developer, these markets offer solid returns for those who can execute on a reposition strategy.

Follow me here, reach out anytime, and let’s talk real estate — no strings attached.

Leave a comment