For years, Florida’s real estate market seemed almost immune to gravity. Fueled by migration, remote work, and post-pandemic stimulus, prices surged across the state. But in 2025, the momentum has clearly shifted.

According to the latest data, Florida’s median home price fell to $412,734 in April—marking one of the sharpest year-over-year declines in over a decade. May brought a slight rebound, with prices sitting at $439,999 statewide, but the year-over-year decline remained at -2.2%. Zoom out, and the picture is clear: the tide is receding.

Brad O’Connor, Chief Economist at Florida Realtors®, called it the most significant percentage drop since October 2011. That’s not a footnote—that’s a flashing signal.

What’s driving this? Inventory is up statewide—active listings rose 34% over the past year—giving buyers more leverage. But new listings are actually flat or down, which suggests that the boost in supply isn’t from fresh product. Instead, it’s existing inventory sitting longer, or homeowners finally putting their properties on the market after watching prices peak.

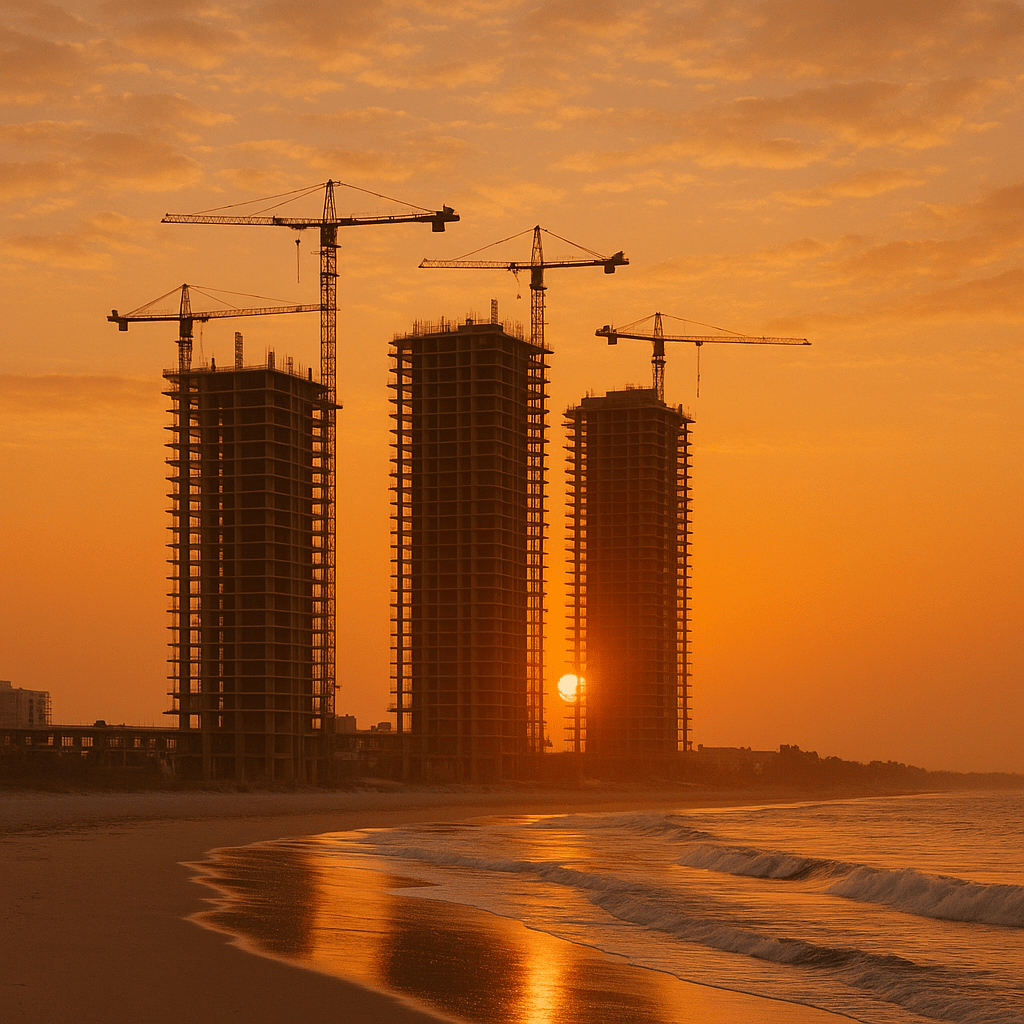

And it’s not just resale homes that sellers are competing with. Builders, facing slower absorption, are deploying every trick in the book—rate buydowns, closing cost credits, and price reductions—to move inventory. The pressure is mounting.

In this environment, some Florida metros are feeling the pain more acutely than others. Below are the five markets showing the steepest home price declines—and why it matters.

🔻 Cape Coral–Fort Myers

Median List Price: $429,900 YOY Price Decline: -6.7% Inventory Increase: 36.1%

Cape Coral leads the pack in price drops, and inventory here is surging. Homes are sitting longer, with days on market up 22% year over year. This is a textbook cooling cycle—rising inventory, falling prices, and softening demand.

🔻 Naples–Marco Island

Median List Price: $749,000 YOY Price Decline: -6.3% Inventory Increase: 33.9%

Even Florida’s luxury enclaves aren’t immune. Inventory is climbing despite a sharp drop in new listings. That suggests homes are lingering—buyers are hesitant, and affordability (or lack thereof) remains a barrier.

🔻 Miami–Fort Lauderdale–West Palm Beach

Median List Price: $510,000 YOY Price Decline: -5.5% Inventory Increase: 38.7%

South Florida remains desirable, but pricing is adjusting fast. Nearly 20% of listings have seen reductions. For buyers waiting on the sidelines, this may be the early innings of a correction.

🔻 Punta Gorda

Median List Price: $389,900 YOY Price Decline: -5.6% Inventory Increase: 25%

Punta Gorda is now the most affordable metro in this group, and it’s seeing clear signs of supply growth. Lower price points are no longer insulated as cost-conscious buyers become more selective.

🔻 Panama City–Panama City Beach

Median List Price: $425,000 YOY Price Decline: -5.4% Inventory Increase: 18.5%

This market is holding up slightly better in terms of days on market, but the price trend is unmistakable. Even here, sellers are adjusting expectations and moving off pandemic-era highs.

👀 Markets to Watch: Orlando and The Villages

Beyond the top five, Orlando deserves attention. Active listings are up nearly 39%, and homes are sitting 25% longer. That’s not a pricing crash yet—but it’s a leading indicator.

And then there’s The Villages. Long seen as bulletproof due to retiree demand, inventory jumped 41% in May while new listings declined. Homes are also staying on the market 40% longer. That’s a meaningful shift.

What This Means for Real Estate Pros

If you’re operating in Florida—or underwriting deals there—this is a moment to reassess. Resale sellers are facing real headwinds. Builders are resetting their pricing strategies. And affordability is finally putting a ceiling on what the market can bear.

But this isn’t necessarily bad news. For investors, developers, and brokers, price discovery is a good thing. It creates entry points, stirs demand, and gives serious players the chance to separate signal from noise.

Florida’s not falling apart. It’s recalibrating. The question is: are you positioned to take advantage?

📩 For more insights like this, subscribe to my newsletter or check out our latest market reports at www.danielkaufmanrealestate.com.

Leave a comment