By Daniel Kaufman

www.danielkaufmanrealestate.com

Spring is supposed to be prime time for new-home sales—but in 2025, the season has been a letdown across much of the country. While most markets are cooling or outright stalling, four metros are swimming against the current: Indianapolis, Chicago, San Diego, and Orange County.

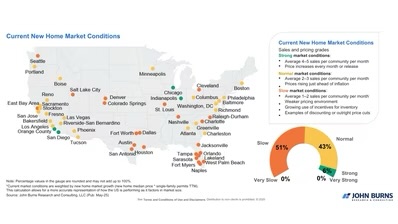

At Kaufman Development, we’ve been closely tracking builder sentiment, absorption rates, and regional demand shifts. The latest data from John Burns Research confirms what many of us have been seeing anecdotally: most of the U.S. is slowing down, especially high-growth states like Florida and Texas. Yet these four metros are performing with real strength—some even posting monthly price increases.

Let’s break down what’s happening and why it matters.

Where the New-Home Market Is Still Hot

According to John Burns’ April 2025 evaluation of 50 major metros, only four earned a “strong” rating, while over half were marked “slow.” That’s a startling reversal for what should be a robust spring cycle.

What makes Indianapolis, Chicago, San Diego, and Orange County stand out?

1. Undersupply Meets Demand in California

Southern California’s affordability issues are well known—but so is its resilience. Despite interest rate headwinds and international buyer pullback, San Diego and Orange County are holding up. Why? Supply is severely constrained, yet demand persists.

Builders here aren’t slashing prices—they’re raising them. Median sale prices for new construction in Orange County and San Diego sit at $1.6M and $1.03M, respectively.

2. Chicago’s Quiet Strength

In Chicago, larger builders are thriving in a market where new inventory remains well below demand. With fewer competitors and a disciplined pipeline, builders are seeing an average new-home price of $482,000 and maintaining strong absorption.

3. Indianapolis: Growth Fueled by Migration and Jobs

Unlike the other markets, Indianapolis is a classic growth story. With a median new-home price around $411,000, it remains affordable and continues to benefit from corporate relocations, job growth, and positive domestic migration. It’s a winning formula for steady sales volume and upward pricing pressure.

Lessons for Developers and Investors

So what can real estate professionals take away from these outliers?

Inventory discipline matters. Markets that haven’t overbuilt are holding pricing power. Builders in Indy, Chicago, and Southern California didn’t flood the market with new supply over the last cycle, and now they’re reaping the benefits.

Location quality still trumps macro drag. Even with high mortgage rates and affordability headwinds, buyers will show up in high-demand markets—especially where supply is scarce.

Florida and Texas aren’t bulletproof. Despite being darlings of migration in recent years, metros like Orlando, Tampa, West Palm Beach, Dallas, Houston, and Austin are struggling to maintain momentum. Oversupply and softening demand have turned these once-hot markets “slow,” according to John Burns’ map.

Final Thoughts

At Kaufman Development, we’re using insights like these to shape our acquisition and development strategy. While national headlines talk of a housing slowdown, real opportunity is hiding in plain sight. It’s not just about where people are moving—it’s about where builders have room to run.

As always, we’re keeping a close eye on data—but we’re also talking to builders, brokers, and buyers on the ground. The takeaway is clear: 2025 is not a one-size-fits-all market. For those of us willing to dig deeper and move decisively, there are still markets where new homes are flying off the shelves.

Let’s be the ones building in the right places.

Want more insights like this? Follow along at www.danielkaufmanrealestate.com and sign up for my investor newsletter.

Leave a comment