The real estate cold front isn’t just about interest rates anymore. A new chill is settling over U.S. housing markets—and it’s coming from the north.

A steep drop in Canadian buyer interest is reshaping demand in traditionally hot second-home markets like Naples, North Port, and Phoenix. And while Florida continues to pull in international eyeballs, data shows that Trump’s tariffs and tough immigration rhetoric are pushing Canadian snowbirds to look elsewhere.

For developers and investors, that’s not just a political story—it’s a market shift with real implications for seasonal housing demand, luxury inventory turnover, and even tourism-driven rental yields.

Canadian Buyers Pull Back—Fast

According to Realtor.com’s International Demand Report, Canadian interest in U.S. real estate fell sharply between Q4 2024 and Q1 2025. The country still ranks as the top source of international home shoppers, but its share of online traffic dropped from 40.7% to 34.7% in just a few months.

The pullback aligns with several escalations:

A doubling of tariffs on Canadian steel and aluminum (effective June 4) A proposed 30-day registration requirement for foreign nationals in the U.S. Trump’s inflammatory suggestion that Canada should become “America’s 51st state”

While much of this is political theater, it’s having a real impact on buyer sentiment—particularly among the seasonal, high-end demographic that has long favored U.S. sunbelt markets.

Florida Feels the Frost

Naples, FL, once the darling of Canadian snowbirds, saw a stunning 13.5-point decline in Canadian online views—from 73.1% in late 2024 to just 59.6% in early 2025. That trend showed up in real-world tourism data too, with visitation from Canada down 23% year-over-year in February.

Other Florida cities took a hit:

North Port: -13 percentage points Cape Coral: -10.8 points Tampa: -10.1 points

Even Phoenix, AZ—another seasonal hotspot—saw a major drop of 11.8 percentage points in Canadian online interest.

What’s behind it? In addition to tariffs and policy shifts, a weaker Canadian dollar, uncertainty at the border, and increased scrutiny on foreign nationals are all adding friction to what used to be a low-barrier investment move for Canadians.

Not All Sunshine is Lost

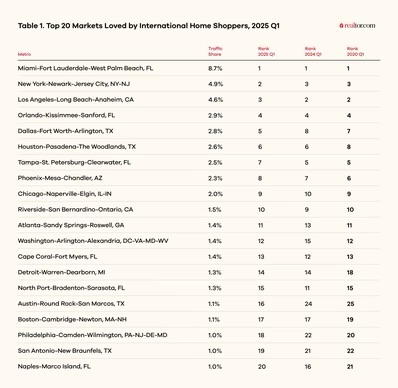

While Florida’s Gulf Coast markets are cooling, Miami is still holding its title as the most sought-after metro for international buyers overall, accounting for 8.7% of all foreign search traffic. It’s followed by:

New York City (4.9%) Los Angeles (4.6%) Orlando (2.9%) Dallas (2.8%)

And even Tampa and Phoenix, despite losses among Canadians, remain in the top 10 globally for foreign buyer interest.

This tells us one thing: the macro demand for U.S. real estate hasn’t vanished—it’s just shifting sources.

Meanwhile, Mexico Holds the Line

Despite also facing a 25% tariff on most exports to the U.S., Mexican buyer interest dipped only slightly—from 5.8% to 5.4% of all international online traffic.

The top U.S. markets for Mexican buyers remain predictable and proximate:

San Diego San Antonio Dallas El Paso Houston

Proximity, family ties, and cultural familiarity continue to drive steady interest across the border, even amid trade headwinds.

What It Means for Investors

The Canadian retreat is more than a headline—it’s a rebalancing of international demand that affects:

Luxury second-home absorption in Florida and Arizona Short-term rental yields in tourism-driven markets Investor underwriting assumptions for seasonal product

If you’re building or acquiring in snowbird markets, pay attention to the composition of your buyer pool. If Canadians pull back, who steps in? Are you positioned to appeal to Mexican buyers, Latin American investors, or the domestic affluent class shifting south?

Markets are being reshaped not just by rates and inventory—but by geopolitics, migration policy, and foreign capital flight.

Bottom Line

What happens in Ottawa doesn’t stay in Ottawa. For real estate developers, the cross-border chill is a reminder that international demand is anything but guaranteed. As Canadians scale back and political rhetoric ramps up, expect secondary markets to adjust—some more sharply than others.

Stay nimble. Know your buyer. And don’t bet on yesterday’s demand to power tomorrow’s deals.

Leave a comment