Contrary to the headlines, there’s no reason to panic.

Yes, Q1 data from the National Association of Realtors® shows that home prices fell in nearly 17% of U.S. markets—with Florida accounting for more than a quarter of those declines. But let’s be clear: this is not 2008, and this is not a sign of systemic weakness.

Third is a normalization.

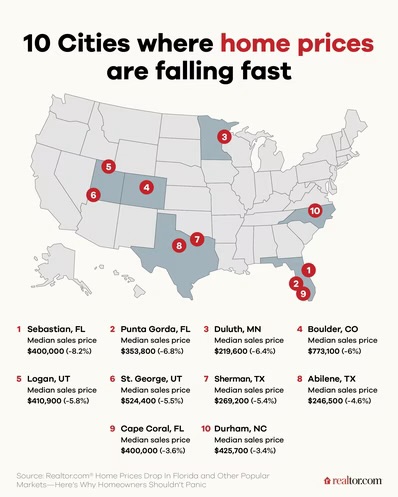

In fact, what we’re seeing across Florida—and select markets in Texas, Utah, and the Carolinas—is a healthy correction following years of outsized growth. Eleven Florida metros saw prices flatten or fall year-over-year, led by Sebastian (-8.2%) and Punta Gorda (-6.8%). But homeowners in these areas are still well above water. Most bought years ago and remain in positive equity territory.

Meanwhile, markets like Duluth, MN; Boulder, CO; and St. George, UT also posted meaningful drops. But they’re outliers, not a trend.

What’s Driving the Dip? Inventory, Not Instability

According to NAR Chief Economist Lawrence Yun, much of the price pressure stems from rising inventory—particularly in the Sun Belt, where builders have been busy catching up to pandemic-era demand. Florida and Texas saw surges in new supply this past year, and that’s finally giving buyers options.

Still, demand hasn’t disappeared. Migration patterns, job creation, and demographic tailwinds continue to favor states like Florida, where the fundamentals remain strong.

In fact, Yun believes many of these down markets—especially those with solid labor markets like Austin, San Antonio, and Myrtle Beach—are primed for a quick rebound. And he’s not alone.

Why Homeowners (and Investors) Should Hold Steady

This is not a distressed market. Defaults and foreclosures are still near record lows. The average homeowner is sitting on significant appreciation from the last five years. And while some may be adjusting pricing expectations, most are still exiting with gains.

Here’s the broader context: over 80% of U.S. homeowners are sitting on a profit. Nearly 88 million households have benefited from this historic wealth creation cycle—many of them in the very regions seeing a short-term pullback now.

For Real Estate Professionals, It’s Time to Rethink the Opportunity

These price corrections aren’t red flags—they’re buying windows.

Investors and developers who understand the fundamentals know this is when the smart capital moves. Strong markets don’t stay discounted for long. The same Florida metros seeing modest declines today are still benefiting from net in-migration, high construction costs (which put a floor under pricing), and long-term housing shortages.

We’re already seeing early signs of stabilization in many of these areas. The right strategy now? Underwrite conservatively, target infill and workforce segments, and keep a close eye on permitting pipelines.

Top 10 Markets with Price Drops in Q1 2025

(Source: NAR / Realtor.com)

Bottom Line:

Don’t let short-term softness cloud the long-term picture. For those of us in the business of development, acquisition, and strategy—this is when the real work (and real opportunity) begins.

Leave a comment