Something strange is happening in the housing market: brand-new homes are getting smaller—and cheaper. That may sound like good news for affordability, but don’t get too comfortable. As usual, policy and pricing pressures are lurking just beneath the surface.

What’s Going On?

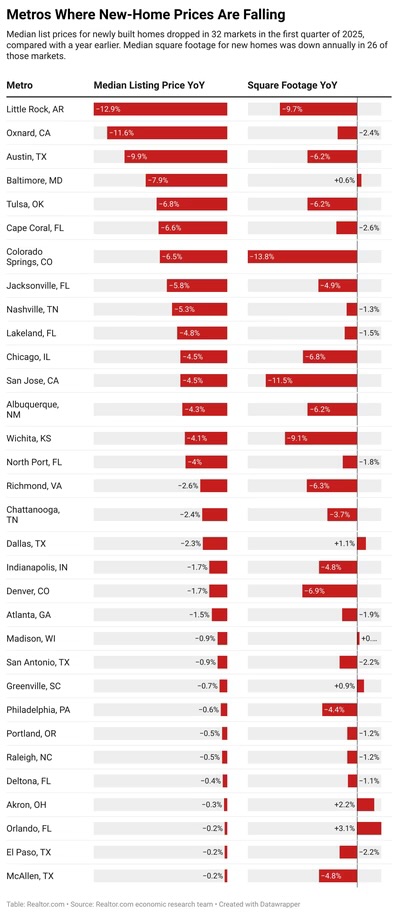

According to Realtor.com’s latest New Construction Quarterly Report, prices for newly built homes declined in a third of the top 100 U.S. metros over the past year. That’s not just statistical noise—it’s the market responding to relentless affordability challenges and high mortgage rates.

Take Little Rock, for example. New-home prices dropped a staggering 13% year-over-year in Q1 2025. But it’s not just the South. Markets like Dallas, Orlando, and Baltimore also saw price declines—even as home sizes grew in some of these areas.

Smaller Footprints, Bigger Impact

The shift is intentional. Builders are scaling down floor plans and price points, pairing leaner homes with more buyer incentives to nudge deals over the finish line. It’s a strategy that speaks to the moment: build smarter, not bigger.

In 55 of the top 100 metros, the average size of new builds decreased this year. And in over two dozen of those cities, prices dropped as well. That’s a notable move in a market still reeling from supply shortages and pricing pressure.

Why It Matters for Investors and Developers

If you’re in development, construction, or capital allocation, this trend matters. Not just because it signals where consumer demand is headed—but because it’s happening alongside a national housing shortfall that’s approaching 4 million units.

This is the market telling us where the opportunity is: smaller homes, faster deliveries, tighter budgets. The question isn’t whether the model is changing—it’s whether your pipeline is ready to follow it.

The Tariff Threat

Just as builders and buyers start finding some breathing room, here comes the policy drag. A proposed hike in Canadian lumber duties (from 14% to 34%), plus tariffs on drywall and other key materials, could push builder costs—and ultimately, prices—right back up.

Realtor.com’s Joel Berner put it bluntly: “Builders’ costs will increase, which means that the price of homes will increase, and the affordability challenges facing prospective homebuyers will only worsen.”

Here’s the Catch:

For the first time in a long time, the median sales price of new homes dropped below that of existing homes. That’s a rare inversion. Builders finally found a formula to compete—but the margin for error is thin. If input costs spike, affordability slips right back out of reach.

Final Word:

We’re entering an era where efficiency wins. Smaller homes, more targeted design, fewer frills, and smarter site selection. For developers, it’s about value engineering with purpose. For investors, it’s about backing the builders who know how to navigate cost volatility while still hitting a price point the market can support.

Let’s not waste this affordability window—before it gets priced out of reach again.

Leave a comment