If the first quarter of 2025 is any indication, multifamily isn’t just stabilizing—it’s stepping back into growth mode.

According to CBRE’s latest data, net absorption surged to over 100,000 units in Q1, pushing the national vacancy rate down to 4.8%. That’s the largest Q1 decline on record and a clear signal that renter demand is outpacing new supply—by a wide margin.

Absorption Is Back. Supply Can’t Keep Up.

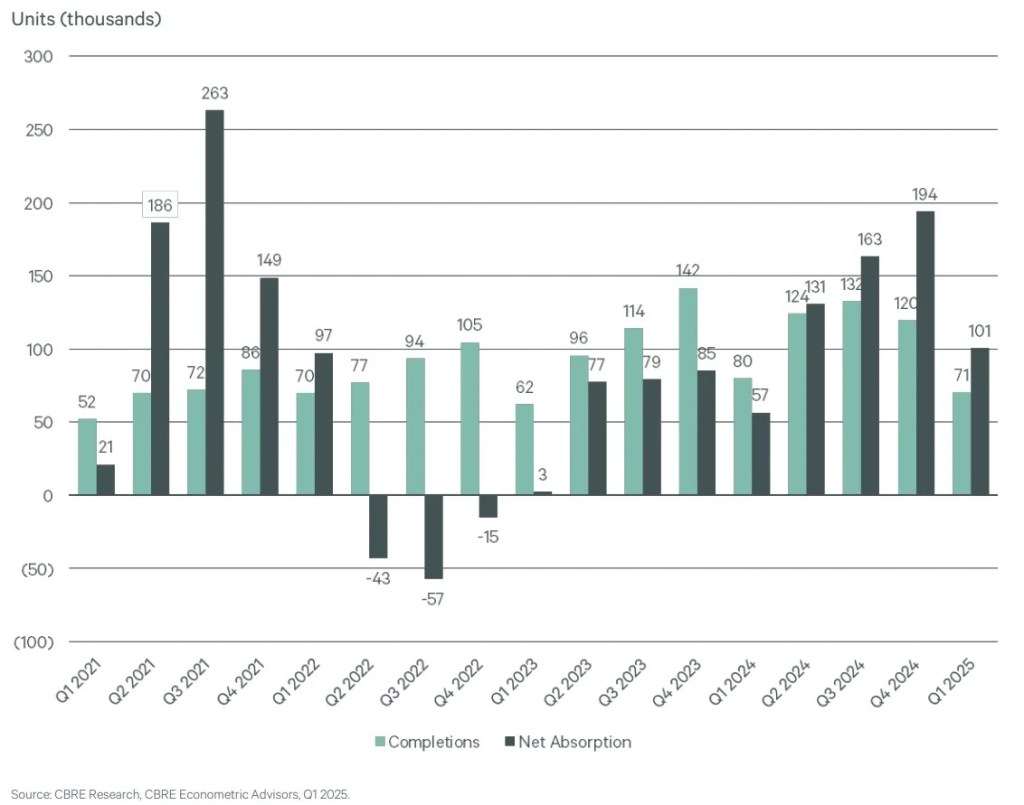

We’ve now logged four straight quarters where demand beat deliveries. In Q1 alone, 100,600 units were absorbed while only 70,600 units came online. That imbalance is helping to reset the playing field after 18 months of construction-heavy turbulence.

Some of the strongest absorption gains came out of New York, Dallas, and Phoenix—three very different metros, each signaling a unique demand driver. Whether it’s high-wage job growth, relative affordability, or sustained in-migration, the common denominator is this: people still want to rent, and investors are starting to believe in that thesis again.

Rents Rising, Cautiously

While not spectacular, rent growth is starting to reemerge. Average national rents climbed 0.9% year-over-year to $2,184. That may not sound like much, but it’s the first Q1 gain since 2022—and a big improvement from the rent rollbacks we saw last year.

The Midwest is quietly leading on the rent front, posting a 3.3% YoY increase. Meanwhile, the Southeast and Mountain regions—after years of outperformance—are showing some softness as supply works through the system.

Capital Is Coming Back

Multifamily investment volume reached $28.8 billion in Q1, up 33% from a year ago. That’s the highest first-quarter total since 2022—and perhaps more importantly, it accounted for a third of all commercial real estate investment activity.

Cap rates ticked down slightly to 5.6%, a sign that buyer confidence is building. Investors are starting to sharpen their pencils again, especially in markets with improving fundamentals and clearer pricing discovery.

Market Leaders to Watch

New York led the country in both absorption and investment, notching 8,600 units leased and $10.6 billion in capital commitments over the past year. Dallas, Phoenix, and Atlanta posted strong absorption as well, highlighting continued population and job growth. Los Angeles, D.C., and San Francisco saw major year-over-year gains in investment volume, signaling renewed interest in high-barrier coastal markets.

What It All Means

This isn’t a boom. It’s a recalibration. But that’s what makes it so interesting.

With fewer units slated for delivery in the back half of the year, vacancy rates are likely to tighten further. That gives landlords more leverage to push rents, while investors have a clearer backdrop to re-engage. Barring any macro shocks, 2025 could shape up to be the year multifamily finds its rhythm again.

For developers, it’s time to lean back in. For lenders and capital allocators, the window to underwrite the next cycle is opening.

Leave a comment