By Daniel Kaufman

If you’ve been waiting for signs that multifamily demand might falter in the face of economic headwinds—keep waiting.

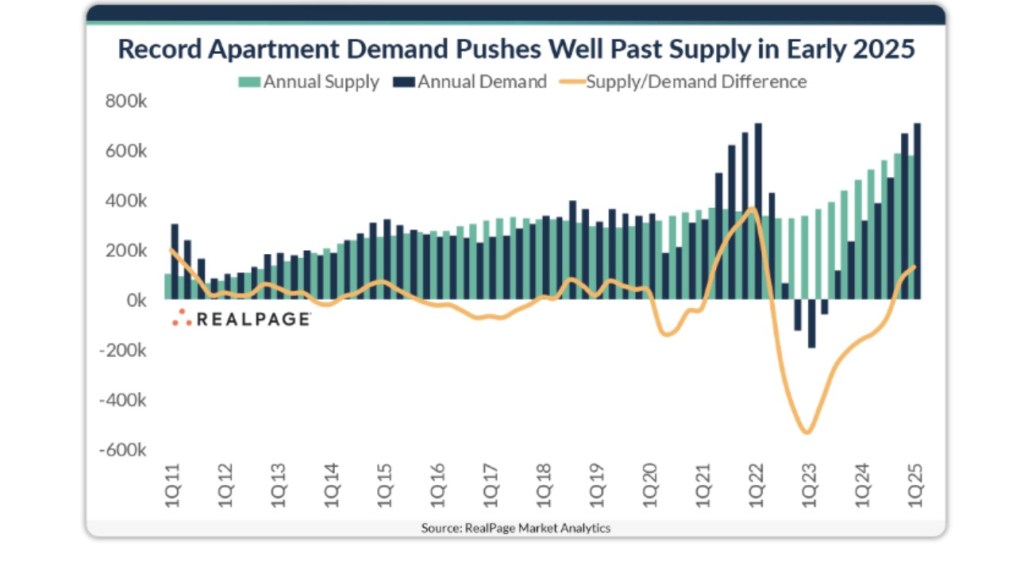

Despite a slowing labor market, rising inflation pressure, and widespread uncertainty, U.S. apartment demand came out swinging in Q1 2025. According to RealPage, more than 138,000 units were absorbed—the highest first-quarter total on record. That’s not just resilience. That’s a market still very much in motion.

Atlanta, Phoenix, and Dallas led the nation in leasing activity, underscoring the staying power of Sun Belt demand drivers. The lone standout on the downside? Anaheim, where net move-outs were the exception to the rule.

Developers Are Hitting the Brakes

We’re also seeing a sharp pullback in new deliveries. Just 116,000 units came online in Q1, and projections for the year point to 431,000 total units—down a steep 26% from 2024. That’s a clear sign developers are recalibrating in response to softer lease-ups, tighter capital markets, and construction costs that refuse to come down.

We’ve been through cycles like this before, and one thing is consistent: when supply slows and demand holds, pricing power starts to shift back toward owners.

Rent Growth Finds Its Footing

For the first time since 2022, rents posted a Q1 gain, ticking up 0.3% nationwide. While modest, it’s an important directional change—and it comes as RealPage projects 2.3% rent growth for the year, with nearly half of all major markets expected to see gains between 2.0% and 2.9%.

Richmond is currently leading the way on the upside, while Austin, Denver, and Phoenix may face some softness—but that’s more a story of absorption catching up with overbuilding than waning demand.

The Macro Is Mixed

Not everything is rosy. Job growth is slowing—Q1 marked the weakest first quarter for employment gains since 2011 (excluding the pandemic disruption). Federal hiring freezes, layoffs, and the ripple effects of new tariffs are hitting public sector and trade-heavy markets hard.

Meanwhile, inflation is back in the spotlight. The core PCE Index—the Fed’s preferred measure—rose 40 basis points in February, after a 30-bps rise in January. That puts renewed pressure on policymakers and raises the question of whether rate relief is really on the near-term horizon.

Even in a volatile environment, multifamily fundamentals remain remarkably strong. With new construction tapering and rents stabilizing, the setup is looking increasingly favorable for landlords and long-term investors.

RealPage is now projecting nearly 460,000 units will be absorbed in 2025. If inflation doesn’t derail the recovery and the job market holds the line, we could be looking at another strong run for multifamily.

Leave a comment