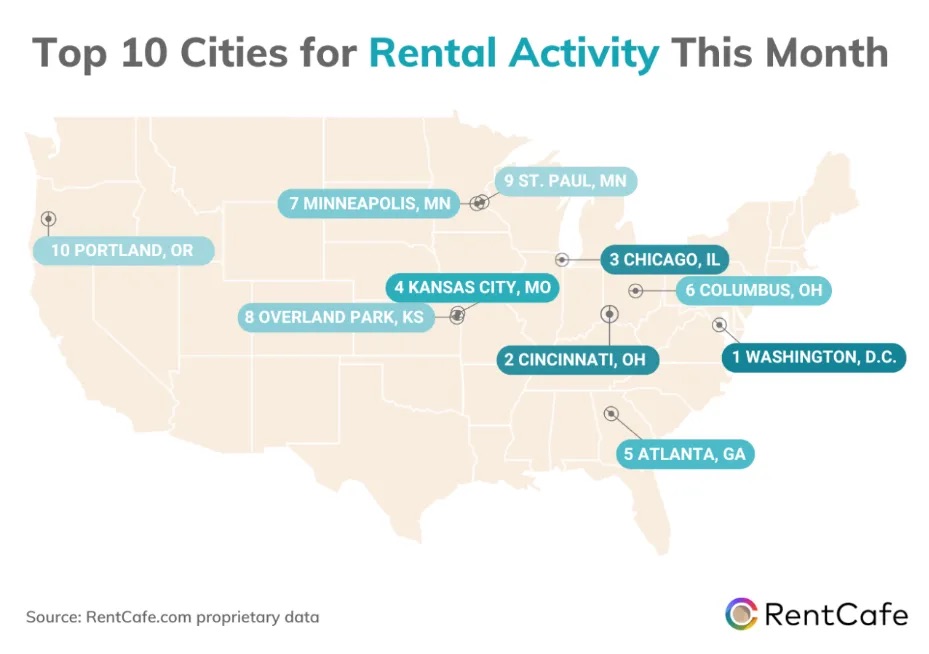

February’s rental activity tells a clear story: Washington, D.C. remains the hottest market in the country—but the Midwest is mounting a serious charge, and developers should be paying close attention.

According to RentCafe’s latest national rankings, D.C. held the top spot for the fifth consecutive month, driven by a 66% surge in favorited listings—a key sign that renters are being highly selective. And that interest isn’t just local. Prospective tenants from Baltimore, NYC, and Boston are showing strong demand for apartments in the nation’s capital.

But while the East Coast headlines are familiar, what’s happening in the Midwest is a much bigger shift—and one with real implications for developers and investors.

For the first time, the Midwest is tied with the South, each region locking down 11 of the top 30 cities for renter activity. More notably, Midwestern cities claimed seven of the top 10 spots, a clear indicator that migration patterns are diversifying and renter behavior is shifting toward affordability, supply, and lifestyle factors outside traditional gateway markets.

Some highlights:

#2 – Cincinnati: Despite a 38% drop in saved searches, the market climbed two spots, thanks to a 14% increase in favorited listings and a 39% rise in available inventory—signals of healthy demand paired with renewed supply. #3 – Chicago: Listings are down 10% year-over-year, but interest is strong, with activity coming not only from within the metro but also from Phoenix, NYC, and inner suburbs like Wheaton. #4 – Kansas City, MO: Fewer listings, but 23% more favoriting activity—suggesting a patient, high-intent renter base.

Meanwhile, the South is showing signs of renter fatigue. Atlanta dropped to #5, despite solid engagement. A decline in favorited properties and saved searches signals a slower decision-making process, even as Miami and NYC renters continue to browse the market.

What This Means for Developers

According to Daniel Kaufman, “We’re seeing the national renter mindset shift. Markets that were once considered ‘secondary’ are now seeing ‘primary’ levels of demand. The fundamentals—jobs, affordability, inventory—are pushing renters toward cities where developers can still build at scale.”

Kaufman points to Midwestern cities like Cincinnati and Kansas City as ripe with opportunity, especially as construction costs stabilize and institutional capital begins to reevaluate its geographic footprint.

D.C. is still king—for now. But the real story is the rise of the Midwest and the broader regional balancing happening across the country. As renters chase a new mix of affordability, quality of life, and availability, smart developers will follow the data—and start looking beyond the usual suspects.

Leave a comment