By Daniel Kaufman

A new report reveals a startling statistic: more than 11 million homes across the U.S. are currently uninsured, representing roughly 1 in every 7 owner-occupied homes. As home insurance premiums continue to climb, affordability is pushing more homeowners—particularly in high-risk markets—out of coverage entirely.

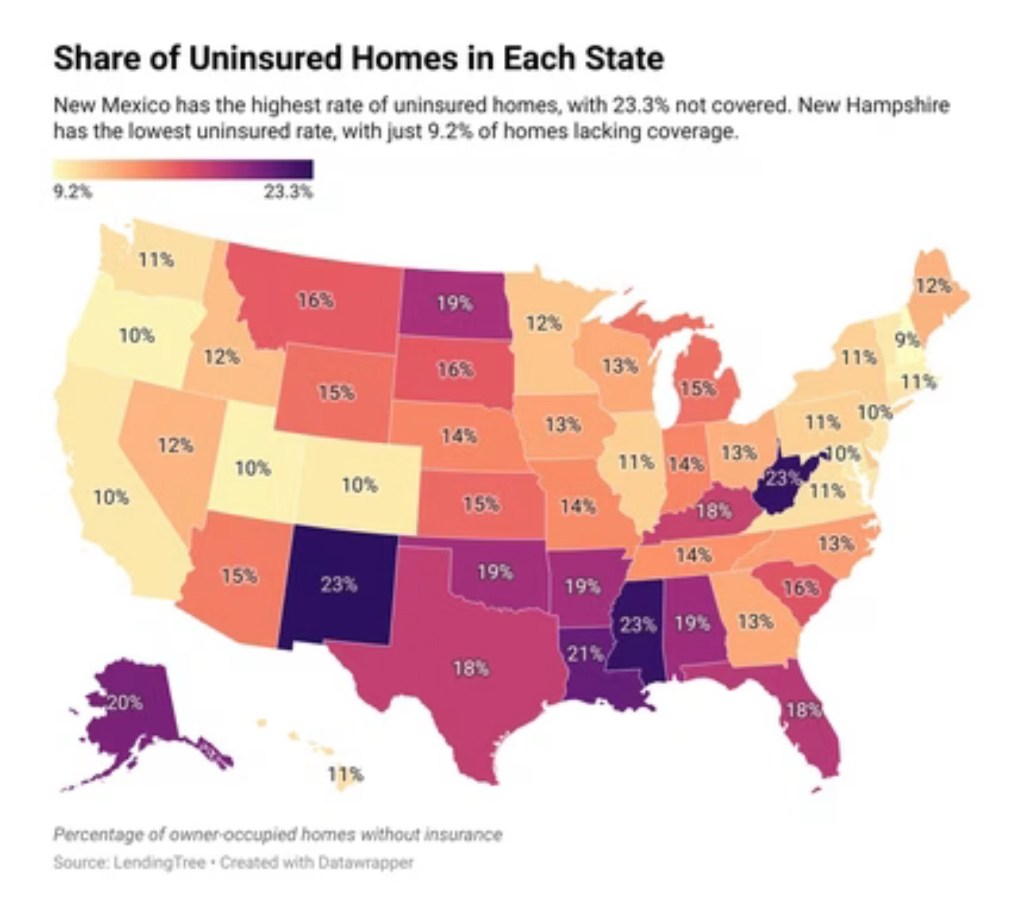

According to LendingTree’s analysis of U.S. Census Bureau data, 13.6% of owner-occupied homes are uninsured, a number that has grown significantly alongside insurance premium hikes. From 2020 to 2023, the average cost of home insurance rose 33%, now reaching $2,530 per year. In states like Florida, where natural disaster risks are high, 1 in 5 homeowners pay more than $4,000 annually—if they can get coverage at all.

The Geography of Risk

Unsurprisingly, states most exposed to natural disasters—hurricanes, floods, wildfires—are also where uninsured rates are climbing fastest.

• New Mexico leads the nation, with 23.3% of homes uninsured.

• West Virginia and Mississippi follow closely.

• In McAllen, TX, a staggering 43.3% of homes are without coverage.

• Even in Miami, despite its extreme hurricane risk, 21% of homes are uninsured.

What’s even more concerning is that many of these uninsured homes are located in the highest-risk counties, according to FEMA’s National Risk Index. In Florida alone, 18% of homes lack insurance.

Why It Matters to Buyers, Sellers, and Developers

This trend has real consequences for the housing market. As premiums rise, buyers must adjust their budgets not just for price and interest rates—but now also for rising insurance costs. In some cases, buyers are choosing to go without coverage entirely, especially if they’ve paid off their mortgage and insurance is no longer mandatory.

“Homeownership is already stretched to the financial limit for many Americans,” says Daniel Kaufman, President of Kaufman Development and Daniel Kaufman Real Estate. “Now add rising insurance premiums to that equation, and we’re seeing some buyers either priced out of the market—or taking on unnecessary risk by going uninsured. It’s a dangerous tradeoff.”

What Investors and Agents Should Watch For

• Investor risk increases in markets with high uninsured rates. If disaster strikes, uninsured homes can become instant liabilities—both financially and structurally.

• Home values may soften in high-risk, high-premium areas as buyer demand shifts toward more insurable regions.

• Transaction timelines may slow down in insurance-constrained markets as buyers struggle to secure affordable policies during escrow.

The Bottom Line

Home insurance is no longer a simple checkbox—it’s a critical budget line item and a growing factor in deal viability. Whether you’re buying, selling, or building, understanding the insurance landscape is now as essential as tracking interest rates or property taxes.

Stay informed, ask smart questions, and make sure you’re factoring insurance availability and affordability into every real estate decision.

For more insights and updates, visit the link in bio or follow along at www.danielkaufmanre.com.

Leave a comment