For real estate professionals navigating today’s housing market, understanding buyer access to credit is just as critical as tracking inventory, pricing, and interest rates. A new report from the National Association of Realtors® reveals that where a buyer lives plays a significant role in their likelihood of securing financing—and in many parts of the country, the numbers are working against them.

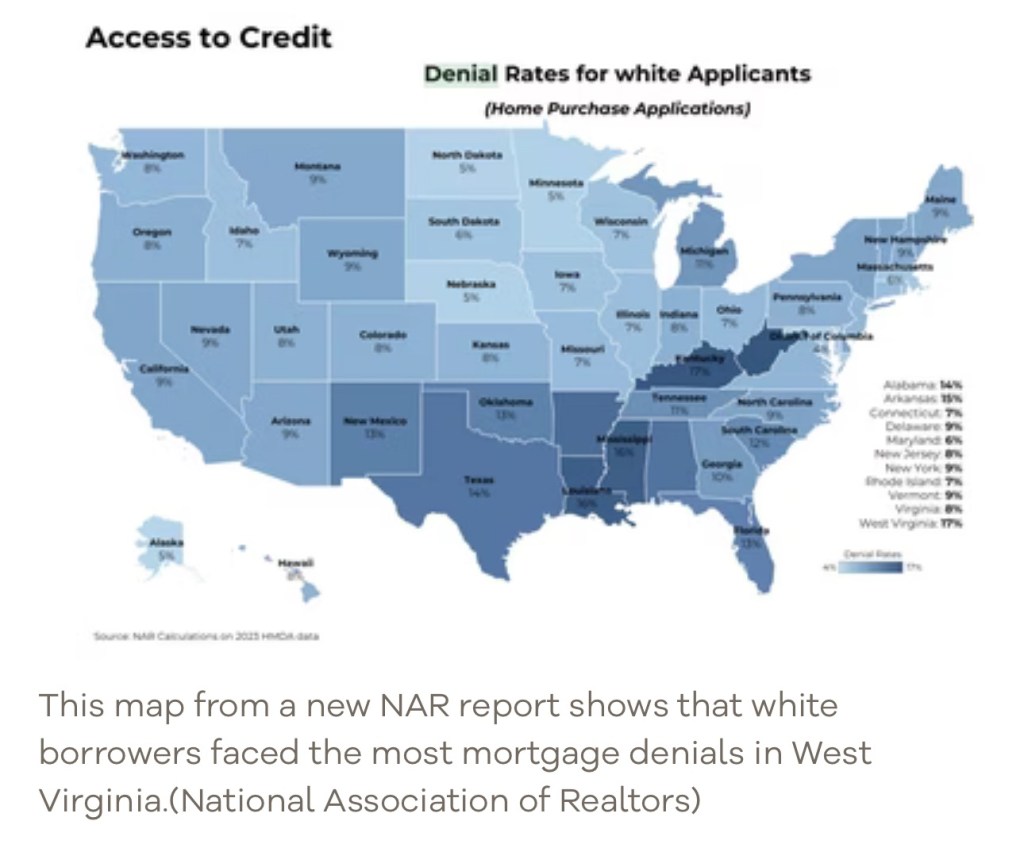

Three Southern states—Mississippi (19%), Louisiana (18%), and West Virginia (15%)—led the nation in mortgage denial rates, according to the NAR’s latest Snapshot of Race and Home Buying in America. Meanwhile, states like Alaska, North Dakota, and Nebraska reported some of the lowest denial rates.

For agents and developers operating in higher-risk regions, these denial rates can derail deals, lengthen sales timelines, and limit buyer pools.

“As real estate professionals, we can’t ignore the financial gatekeeping happening in certain markets,” said Daniel Kaufman, founder of Daniel Kaufman Real Estate. “We often think of affordability purely in terms of listing prices and rates, but access to mortgage credit is becoming just as decisive in determining who can buy and where.”

Why Are Mortgages Being Denied?

The reasons behind these denials are complex but follow a few clear themes:

Insufficient credit or a recent credit score drop High debt-to-income (DTI) ratios Changes in income or job status Appraisal values impacting loan-to-value (LTV) ratios

According to Realtor.com® Chief Economist Danielle Hale, nonconventional and jumbo loans see higher rejection rates. With the FHFA’s conforming loan limit now at $806,500 for a single-family home, more buyers in high-cost states are bumping up against these caps, creating additional obstacles to approval.

Racial and Ethnic Disparities

The NAR report also highlights persistent racial gaps in mortgage access:

Black applicants: 21% denial rate Hispanic applicants: 17% White applicants: 11% Asian applicants: 9%

Black and Hispanic borrowers are more likely to use FHA-insured loans, which have lower down payment thresholds but higher rates and fees—ironically making homeownership more expensive and out of reach in the long run.

State-by-state breakdowns show troubling disparities:

In Louisiana, 34% of Black applicants were denied. In Mississippi, 20% of Hispanic buyers were turned away. Maine, Florida, and Montana had the highest denial rates for Asian applicants.

“The data tells a clear story,” Kaufman added. “If we want to build a more equitable and sustainable real estate market, we have to confront the structural lending issues head-on.”

What This Means for Real Estate Professionals

Whether you’re working in sales, lending, or development, these numbers should inform how you guide clients through the buying process. For developers, it may mean recalibrating unit mix or pricing strategy to match the credit realities of the local buyer base. For brokers, it underscores the importance of vetting financing early and often, especially in markets with higher denial rates.

Access to financing isn’t just a consumer issue—it’s a business reality. The more you know about the dynamics shaping mortgage approvals, the better positioned you’ll be to close deals in 2024 and beyond.

About Daniel Kaufman Real Estate

Daniel Kaufman Real Estate is a Los Angeles-based brokerage and advisory platform focused on providing real estate professionals, investors, and developers with the insights and market intelligence needed to navigate a rapidly evolving housing landscape. Led by industry expert Daniel Kaufman, the firm delivers strategic solutions across residential and multifamily markets nationwide.

Learn more at www.danielkaufmanre.com

Leave a comment