Listen, if you grew up in Boston, you know the Celtics aren’t just a team—they’re a legacy. And now, that legacy has a new price tag: $6.1 billion.

A private equity investor-led group—fronted by Bill Chisholm, a Boston guy himself—just secured a majority stake in the franchise. This isn’t just another sports deal; this is the biggest private equity-backed sports acquisition in history, outpacing even the Washington Commanders’ $6.05 billion sale last year.

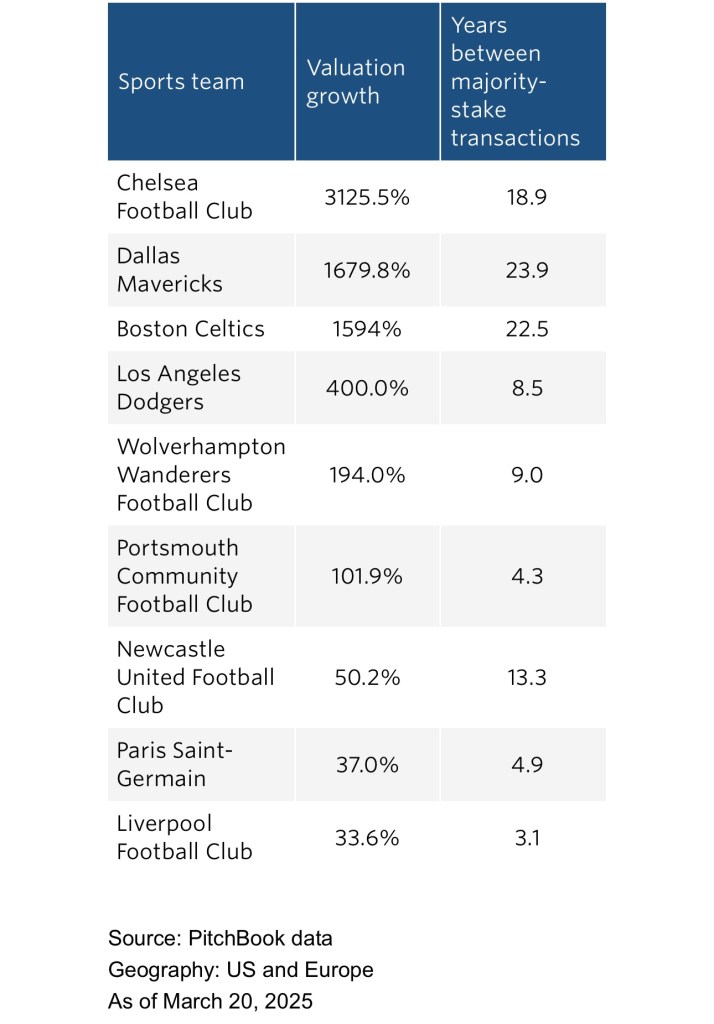

The deal isn’t done growing, either. Axios reports the full valuation could hit $7.3 billion—not bad for a team that sold for just $360 million back in 2002. That’s a 1,594% increase in value over 22 years. Think about that for a second.

Why This Deal Matters for Investors

Private equity firms are diving headfirst into sports franchises, and for good reason:

✔️ Reliable long-term appreciation – As the Celtics deal shows, premier teams see exponential valuation growth. Chelsea FC, Dallas Mavericks, and the Dodgers have also seen multi-thousand-percent gains.

✔️ Scarcity factor – There are only so many elite teams. Investors who get in early lock in value as the market keeps rising.

✔️ New revenue models – Broadcast rights, sponsorships, streaming, and global fan engagement keep pushing valuations higher.

“Owning a sports franchise is one of the best inflation hedges you can find,” one industry insider put it. And private equity firms know it.

Who’s Behind the Deal?

• Bill Chisholm (Symphony Technology Group): Boston-born, PE veteran, leading the charge.

• Sixth Street Partners: Just threw $1 billion into this deal—on top of buying 10% of the San Francisco Giants last week. These guys aren’t messing around.

• Wyc Grousbeck & Steve Pagliuca: The longtime Celtics owners since 2002. Grousbeck stays in charge until at least 2027-28, while Pagliuca made a strong (but unsuccessful) bid to buy the team outright.

What’s Next?

• Institutional capital in sports is only going to accelerate. PE groups aren’t just chasing NBA teams—they’re making moves across the NFL, MLB, European soccer, and more.

• Celtics ownership is staying Boston-rooted for now, but future buy-ins could open new investor opportunities.

• Private market liquidity for sports franchises is evolving. We’re seeing a shift where secondary transactions—selling fractional stakes in teams—could become a real asset class.

Investor Takeaway

If you’re paying attention, the playbook is clear:

✔️ Owning elite sports teams is one of the safest, highest-growth asset classes available.

✔️ Institutional investors and private equity are leading the charge.

✔️ This is just the beginning.

Want to talk sports deals, private equity, or how to get into this space? Let’s connect.

Leave a comment