The US housing crisis is one of the most pressing issues facing real estate developers and investors. With limited supply, high land costs, and restrictive zoning laws, many metro areas are struggling to meet housing demand.

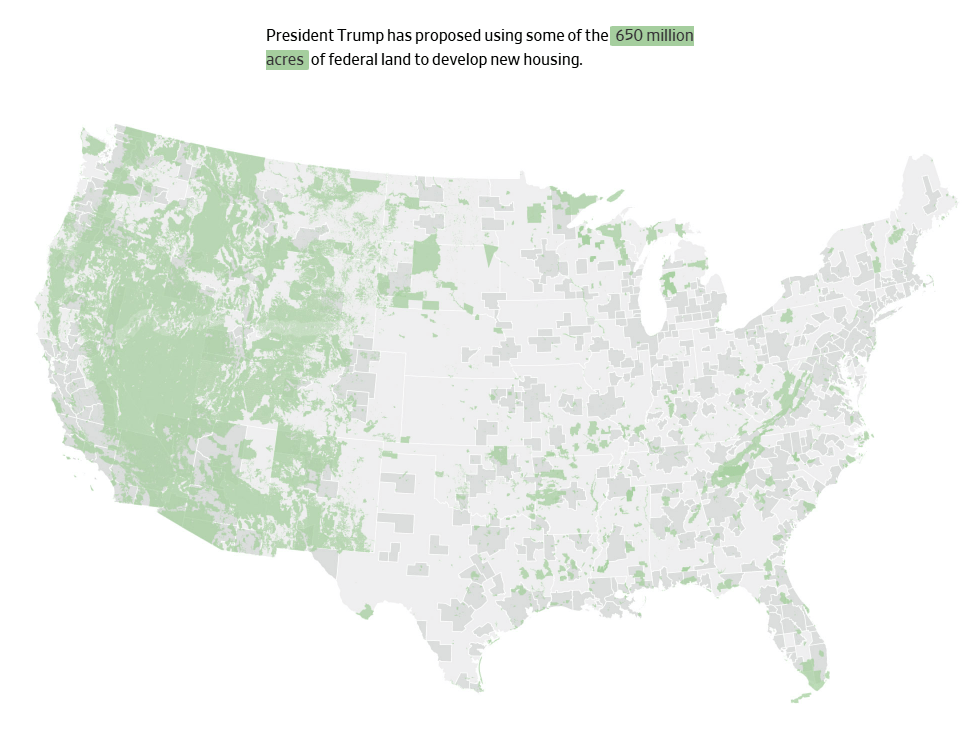

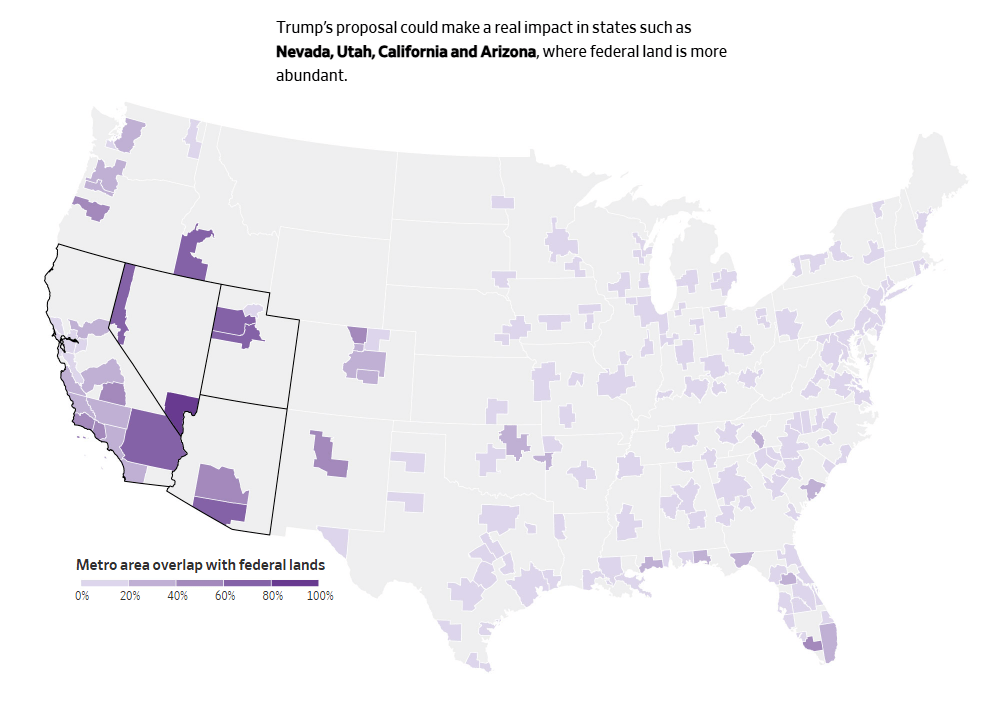

Recently, President Donald Trump proposed unlocking federal land for housing development as a way to ease the shortage. On paper, this could open up millions of acres for new residential projects, particularly in Western states like Nevada, Utah, California, and Arizona. But is this a real solution—or just another bureaucratic headache?

Key Takeaways for Developers & Investors

✔️ A Federal Task Force Is Evaluating Land for Housing Development

✔️ 512K acres could potentially yield 3M to 4M new homes

✔️ Most federal land is in rural areas, far from metro housing demand centers

✔️ Infrastructure, zoning, and environmental regulations could stall progress

Let’s break down what this means for real estate developers, homebuilders, and investors looking for new opportunities.

Could Federal Land Unlock New Development Potential?

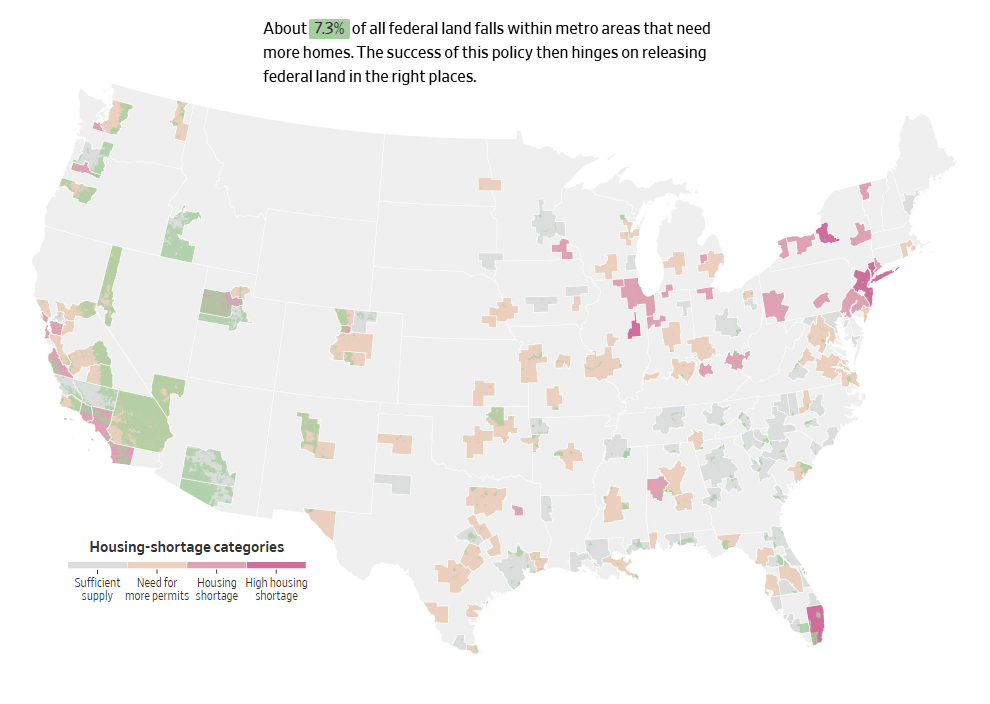

The federal government owns approximately 650 million acres of land, but only 7.3% of that is within metropolitan areas facing housing shortages.

In markets like New York City, Los Angeles, and Washington, D.C., where housing affordability is a crisis, there’s very little federal land available for development. However, states like Nevada, Utah, and Arizona, where the government owns over 80% of land, could see major opportunities.

Possible Benefits for Developers:

✅ Lower Land Costs – If federal land is sold or leased at discounted rates, it could provide affordable entry points for development.

✅ Increased Housing Supply – With proper planning, this could increase housing availability in key markets, especially in fast-growing Western states.

✅ Potential Tax Incentives & Fast-Track Permitting – If the government provides incentives for private developers, this could accelerate housing projects.

But the real question is: where is the land, and is it actually usable?

The Major Challenges Developers & Investors Must Consider

While developing federal land sounds promising, it comes with a long list of challenges—some of which could make projects financially unfeasible or politically impossible.

1. Infrastructure Costs Could Be Enormous

Much of the available federal land is in remote areas, meaning developers would need to invest heavily in roads, utilities, water, and public services to make these sites livable.

💡 Investor Takeaway: Unless the government provides major infrastructure funding, developers could face significant upfront costs—raising questions about project viability.

2. Zoning & Environmental Regulations Could Delay or Kill Projects

Environmental restrictions on federal land are far stricter than those on private property. This means developers could face long approval timelines, lawsuits, and potential project cancellations if conservation groups push back.

💡 Investor Takeaway: Investors should expect long permitting timelines, potential legal battles, and uncertainty around environmental regulations.

3. Political & Community Resistance (“NIMBYism”)

Even if the government allows housing development, local opposition could kill projects before they begin.

• Communities often resist large-scale housing developments near existing neighborhoods.

• Local governments may impose strict zoning laws, limiting the type and density of housing.

• Politicians might use housing as a political bargaining chip, creating uncertainty for developers.

🔹 Pete Carroll, a public policy expert at CoreLogic, put it simply:

“There’s plenty of land, no doubt, but the trick is releasing the right land in the right places.”

💡 Investor Takeaway: Expect strong opposition from local governments and residents—especially in desirable metro-adjacent areas.

Will This Actually Fix the Housing Shortage?

While developing federal land could help in some regions, it’s not a silver bullet for the housing crisis.

📉 The Real Issue? Local zoning laws, construction costs, and financing constraints are the real barriers. Simply unlocking federal land won’t fix housing shortages in major metros like New York or San Francisco.

What Investors Should Watch For:

✔️ Which parcels of federal land are actually released for development?

✔️ Will the government offer tax incentives, infrastructure support, or fast-track approvals?

✔️ Will local and state governments support or resist these projects?

The success of this initiative will depend on how well policymakers navigate these challenges. For now, developers and investors should monitor legislation, identify potential opportunities, and be prepared for a slow rollout.

Final Thoughts: Should Developers & Investors Be Paying Attention?

🔹 If well-executed, developing federal land could unlock major investment opportunities—particularly in states like Nevada, Arizona, and Utah.

🔹 However, infrastructure, zoning laws, and environmental concerns pose serious hurdles that could delay or even cancel projects.

🔹 Investors and developers should monitor the political landscape carefully before committing to projects tied to federal land.

🚀 Bottom Line: This proposal has potential—but the real opportunities will depend on where and how the land is made available.

📊 Stay updated on the latest real estate insights at www.danielkaufmanrealestate.com.

#RealEstateInvesting #HousingMarket #LandDevelopment #MultifamilyDevelopment #AffordableHousing #CRE #HousingCrisis #FederalLand #ZoningReform

Leave a comment