The rental market in early 2025 is heating up, and one of the biggest surprises is Chicagoland’s suburban boom, which is putting pressure on longtime leader Miami. While Florida’s rental demand has been cooling after years of red-hot growth, Suburban Chicago is emerging as a serious contender, ranking as the second most competitive rental market in the U.S.. Meanwhile, Chicago itself has jumped into the top 20, highlighting the increasing demand for rentals in the region.

At the same time, the Midwest as a whole is seeing an unprecedented surge in rental competitiveness, with 10 metros ranking in the top 20—a clear indication that affordability, job growth, and strong local economies are fueling demand in ways we haven’t seen before.

If you’re an investor, developer, or landlord, this shift is a key trend to watch. Let’s break down what’s driving this transformation and what it means for the real estate market.

Key Trends Shaping the 2025 Rental Market

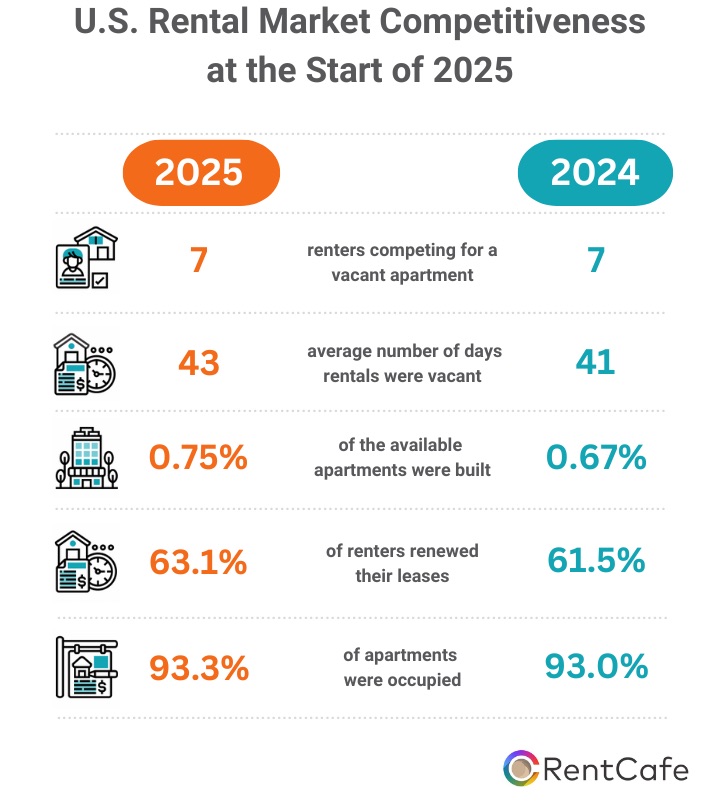

• Competition remains high nationwide: The Rental Competitiveness Index (RCI) for early 2025 sits at 75.7, signaling a highly competitive market. More renters are choosing to stay put due to limited supply and rising costs, keeping vacancy rates low.

• Miami is still king, but competition is growing elsewhere: Despite cooling from its peak, Miami remains the most competitive rental market in the country. However, its lead is shrinking as Midwestern and suburban markets become more attractive.

• Suburban Chicago is the rising star: With strong demand and limited new supply (0.26% growth in available units), Suburban Chicago has become the second most competitive rental market in the U.S.

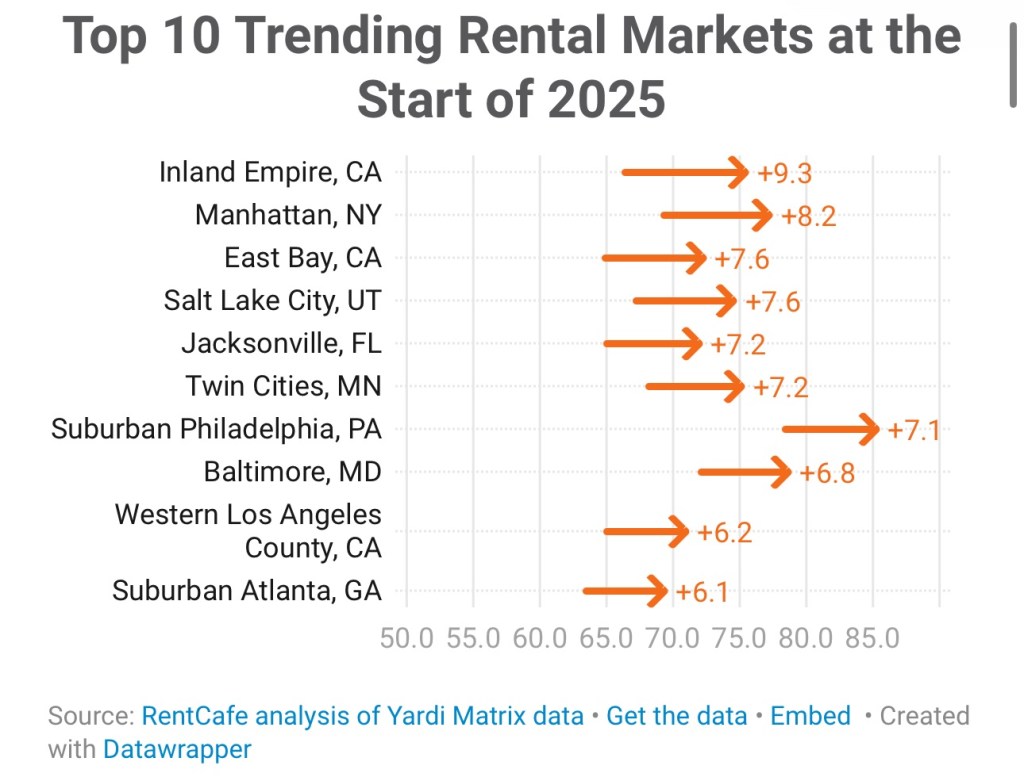

• California metros are rebounding: While some parts of California have struggled, the Inland Empire and the East Bay are becoming significantly more competitive, driven by migration patterns and a slowdown in new construction.

• Midwest and Northeast markets dominate: The Midwest now boasts half of the top 20 rental markets, with Michigan, Indiana, and Ohio cities seeing intense demand. Meanwhile, Northeast metros like North Jersey, Suburban Philadelphia, and Bridgeport-New Haven are seeing soaring lease renewal rates.

Miami Still Holds the Top Spot—For Now

Despite some cooling, Miami remains the nation’s most competitive rental market with an RCI score of 93.1—a staggering 17.4 points above the national average. This is due to:

• Strong job growth in finance, tech, and healthcare.

• A booming population, with professionals flocking to Miami for its tax benefits and economic opportunities.

• A tight housing supply, with vacancy rates at just 3.7%, meaning apartments are snapped up in an average of 36 days—far below the national average of 43 days.

However, Miami isn’t untouchable. More than 76% of renters in the metro renewed their leases, reflecting concerns over rising costs and limited availability. This could pave the way for other metros to challenge its top spot in the coming years.

Chicagoland’s Suburbs Are On Fire

The biggest story of early 2025 is Suburban Chicago’s surge to the #2 spot in the rankings. With an RCI score of 88.4, competition for apartments in the area is fiercer than ever.

What’s Driving Suburban Chicago’s Rental Boom?

• The “Hipsturbia” movement is real – Renters are flocking to walkable, amenity-rich suburban downtowns like Oak Brook, Evanston, Naperville, and Arlington Heights.

• Job growth and affordability – Compared to Miami or the coasts, the Chicago area remains relatively affordable while offering strong employment opportunities.

• Limited new construction – New housing supply only grew by 0.26%, down from 0.51% last year, creating a severe housing shortage.

• High lease renewal rates – Over 70% of renters are choosing to stay put, further tightening the market.

With 10 renters competing for every available unit and apartments being leased in an average of 39 days, suburban Chicago is proving to be an investor’s dream—high demand, low vacancies, and stable returns.

Chicago Joins the Top 20 as Demand Spills Over

While the suburbs are attracting more renters, Chicago itself has jumped into the #18 spot in the rankings. This is a significant leap from 31st place last year, signaling that demand for urban rentals remains strong.

Key Data on Chicago’s Rental Market:

• Lease renewals are rising – 59.2% of renters chose to renew their leases, up from 58.1% last year.

• Occupancy rates are climbing – The city now sits at 94.4% occupancy, compared to 93.8% a year ago.

• Competition is heating up – Eight renters are competing for each available unit, up from six last year.

While new construction is growing (0.54% increase in supply), it’s not enough to meet the rising demand, keeping the competition intense for those looking to rent in the city.

North Jersey, California, and the Midwest See Strong Growth

Outside of Miami and Chicago, several key markets are becoming significantly more competitive:

• North Jersey (#3 nationally) – With its proximity to Manhattan and Philadelphia, plus strong demand from young professionals and high-income renters, North Jersey remains one of the most sought-after rental markets.

• Inland Empire & East Bay, CA – These California metros saw some of the biggest jumps in rental competition, largely due to migration from more expensive coastal cities and limited new construction.

• Midwest metros continue to dominate – Lansing-Ann Arbor, Grand Rapids, and Detroit have all cracked the top 20, reflecting the Midwest’s growing appeal for renters looking for affordability and strong local economies.

What This Means for Investors & Developers

If you’re looking to invest or develop in 2025, here’s what you need to know:

1. Suburban markets are goldmines – The demand for suburban rentals is at an all-time high, especially in Chicagoland and commuter-friendly markets like North Jersey and Suburban Philadelphia.

2. The Midwest is the next big thing – The region’s affordability and strong job growth are making cities like Grand Rapids, Detroit, and Indianapolis prime investment targets.

3. New supply isn’t keeping up with demand – Even though apartment construction was strong last year, renewal rates and occupancy levels remain extremely high, meaning developers should consider projects in high-growth areas with supply constraints.

4. Lease renewals are driving competition – With more renters choosing to stay put, available inventory is shrinking. Investors should focus on value-add strategies to retain tenants and push rents sustainably.

Final Thoughts

While Miami still leads the pack, Suburban Chicago’s rise to #2 signals a shift in the rental market landscape. Investors and developers who recognize this early could capitalize on the Midwest’s growing strength, as well as the sustained demand in suburban and commuter-friendly locations.

For those looking to expand their portfolios or break into emerging markets, now is the time to pay attention to Chicagoland, North Jersey, and the Midwest’s rising metros.

What’s your take? Are you considering investing in any of these hot rental markets in 2025? Let’s discuss in the comments or reach out for insights on navigating today’s competitive real estate landscape!

Leave a comment