Real estate investors and developers looking for high-growth opportunities should take note: Home prices surged across most U.S. metros in the last quarter, with 10 cities posting year-over-year price gains of at least 14.9%, according to the latest National Association of Realtors® (NAR) quarterly report.

While high-demand coastal markets continue to command top dollar, the real story for investors is unfolding in the Midwest and South, where affordability and strong local economies are fueling rapid appreciation.

Why This Matters for Investors

For those with existing holdings, skyrocketing home values are translating into significant equity gains. However, for investors looking to acquire new properties, rising prices in these metros signal both opportunity and potential entry challenges. With inventory remaining tight, strategic investments in up-and-coming markets could yield strong returns.

“The Midwest is the most affordable region in the country, which has enabled buyer demand to hold steady despite affordability headwinds,” says Realtor.com® senior economic research analyst Hannah Jones. “As a result, many Midwest towns have seen home prices climb significantly as buyers compete for available inventory.”

Meanwhile, Southern markets remain a magnet for job growth and migration, keeping housing demand strong despite rising interest rates.

Where Prices Are Rising the Fastest

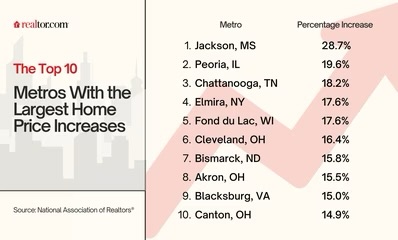

Jackson, MS, led the nation with a 28.7% increase in home prices, closing out the year with a median price of $251,600. With limited supply and strong demand, investors who secured properties in this market have seen exceptional appreciation.

In second place, Peoria, IL, posted a 19.6% price gain, with median home values rising to $172,500—still highly affordable compared to national trends.

Southern markets like Chattanooga, TN, where prices jumped 18.2% to $346,700, continue to attract both investors and homebuyers priced out of larger metros.

Meanwhile, Elmira, NY, the only Northeastern city on the list, saw prices rise 17.6%, reaching a median of $167,800.

Ohio is proving to be a hotspot for value appreciation, with Cleveland (16.4%), Akron (15.5%), and Canton (14.9%) all ranking among the top 10. Investors targeting cash flow properties in these areas may also benefit from continued long-term appreciation.

Opportunities and Challenges for Investors

Opportunities:

• High appreciation potential: Rapid price growth in these metros indicates strong demand, making them attractive for long-term buy-and-hold strategies.

• Affordability advantage: Compared to major coastal cities, median home prices in these metros remain accessible, allowing investors to enter at a lower cost.

• Strong rental demand: Rising home prices may push more potential buyers into the rental market, creating opportunities for landlords and multifamily investors.

Challenges:

• Rising acquisition costs: As competition increases, securing deals below market value is becoming more difficult.

• Limited inventory: In high-growth areas, supply shortages could make it harder to find investment properties.

• Interest rate impact: While mortgage rates remain elevated, affordability concerns could slow appreciation in some markets.

National Market Trends

Overall, home prices increased in 89% of U.S. metro areas in Q4, with the national median single-family home price rising 4.8% year over year to $410,000. Notably, median prices have surged nearly 50% since 2019, underscoring the strong long-term trajectory of real estate as an asset class.

Regionally, the South led in total sales (45.1%) and saw a 2.1% price increase, while the Midwest (8%), Northeast (10.6%), and West (4%) all posted gains.

For those targeting high-end markets, California continues to dominate, with San Jose’s median home price nearing $1.9 million, up almost 10% year over year.

The Bottom Line for Investors

While rising prices can make new acquisitions more challenging, they also confirm the strength of real estate as a wealth-building tool. Investors who identified these high-growth metros early are seeing substantial gains, and those looking to enter now may need to act fast to secure properties before prices rise further.

With the right strategy—whether flipping, long-term rentals, or development—investors can still find profitable opportunities in these rapidly appreciating markets.

Top 10 Metros With the Largest Home Price Increases

1

Jackson, MS

28.7%

$251,600

2

Peoria, IL

19.6%

$172,500

3

Chattanooga, TN

18.2%

$346,700

4

Elmira, NY

17.6%

$167,800

5

Fond du Lac, WI

17.6%

$263,800

6

Cleveland, OH

16.4%

$221,900

7

Bismarck, ND

15.8%

$312,200

8

Akron, OH

15.5%

$209,600

9

Blacksburg, VA

15.0%

$311,900

10

Canton, OH

14.9%

$207,000

For investors and developers, these cities offer compelling opportunities—but time is of the essence. With strong demand, low inventory, and continued migration patterns fueling growth, the right investment now could lead to significant returns in the coming years.

Leave a comment