After years of oversupply and declining rents, the self-storage sector is showing early signs of stabilization. While national rents are still down 1.2% YoY as of January, this represents a marked improvement from steeper declines in late 2023.

More importantly for real estate investors and developers, the pipeline of new self-storage projects is shrinking—setting the stage for a potential return to pricing power in 2025.

Key Market Trends

1. Rent Declines Are Slowing

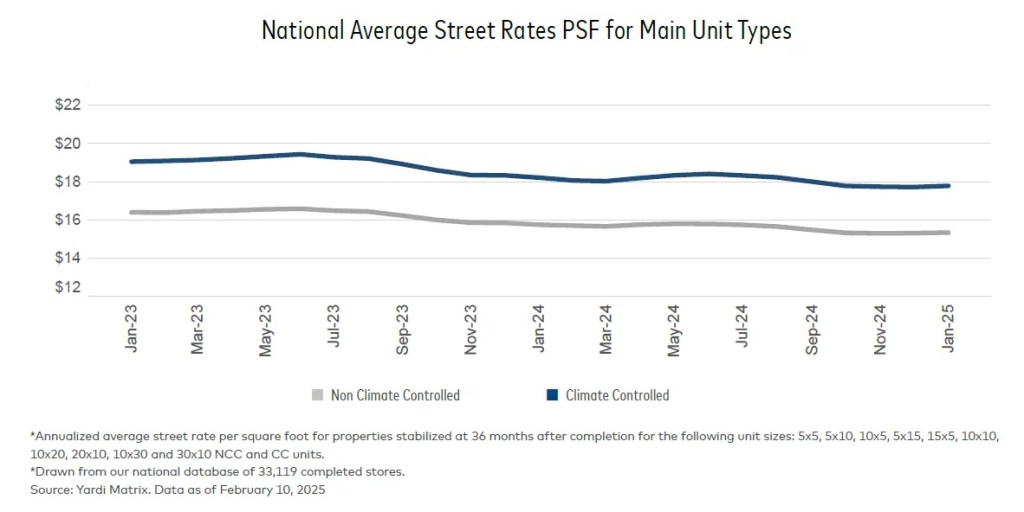

According to Yardi Matrix, national self-storage rents ticked up 0.3% month-over-month in January to $16.32 per square foot. While YoY declines persist, the pace of rent drops has eased compared to late 2023 (-2.4% in November, -2.2% in December).

This suggests the market may be reaching an inflection point, particularly as new supply pressures fade.

2. Development Pipeline is Shrinking

The self-storage construction boom is winding down.

• The three-year supply pipeline has shrunk from 9.1% YoY to lower levels.

• Yardi Matrix predicts a 15% drop in new self-storage supply in 2025, which could help further stabilize rents.

For developers, this means fewer competitive pressures in many markets—a stark contrast to the recent years of aggressive expansion.

3. Stronger Markets vs. Weak Spots

Some markets are already benefiting from this shift, while others remain oversupplied:

✅ Washington, D.C. leads the market, likely due to limited new supply—though potential government layoffs could introduce volatility.

✅ Tampa remains strong, despite high levels of new properties in lease-up. Hurricane-related demand is helping support rents.

❌ Phoenix remains an outlier, with the highest pipeline of new self-storage projects. This is keeping rent growth in check and extending lease-up periods.

For investors, market selection is critical. Cities with shrinking pipelines and resilient demand will be best positioned for rent growth and occupancy stability in 2025.

4. REITs vs. Private Operators: A Pricing Divide

• Self-storage REITs are holding firm on pricing, prioritizing rent hikes for existing customers rather than deep discounts for new tenants.

• Private operators are more aggressive with promotions, reflecting localized oversupply pressures in some markets.

For developers and investors, this highlights a key takeaway: operators with pricing discipline will likely outperform in a stabilizing market.

What’s Next for Self-Storage in 2025?

With new supply slowing, self-storage operators may finally be regaining pricing power—but much will depend on demand trends:

📉 If consumer demand softens, rent growth may remain limited in high-supply markets.

🌪️ Extreme weather events could continue driving regional rent surges—as seen in Florida.

Key Takeaway for Investors & Developers:

Markets with limited new supply, strong demand drivers, and disciplined pricing strategies will present the best opportunities in 2025.

For developers, new projects should be highly targeted—focusing on locations where supply-demand fundamentals remain favorable. For investors, existing stabilized assets in undersupplied markets may present attractive opportunities for long-term yield growth.

Final Thought: After years of aggressive expansion, the self-storage sector is shifting into a more sustainable cycle. For those who adapt to this new reality—focusing on market selection, pricing discipline, and supply constraints—the next phase of self-storage investing could be one of renewed profitability and stability.

Leave a comment