Despite Social Media Panic, DC’s Housing Market Holds Steady

If you’ve been keeping an eye on real estate chatter, you might have heard claims that Washington, DC’s housing market is in free fall—allegedly triggered by Elon Musk’s cost-cutting at the newly minted Department of Government Efficiency (DOGE). These reports, however, are wildly exaggerated.

For real estate professionals, developers, and investors, understanding the true market dynamics is crucial. While inventory has been rising and prices cooling, these trends are neither sudden nor unique to DC. Instead, they reflect a broader national slowdown that began well before President Donald Trump took office in January.

What the Data Actually Says

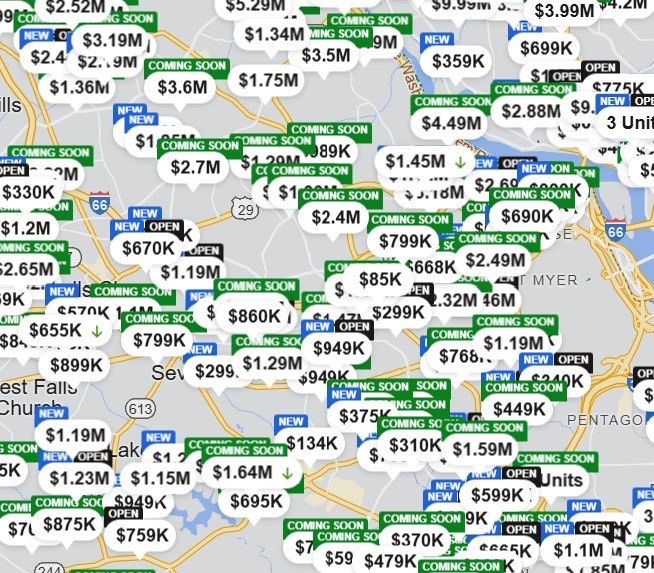

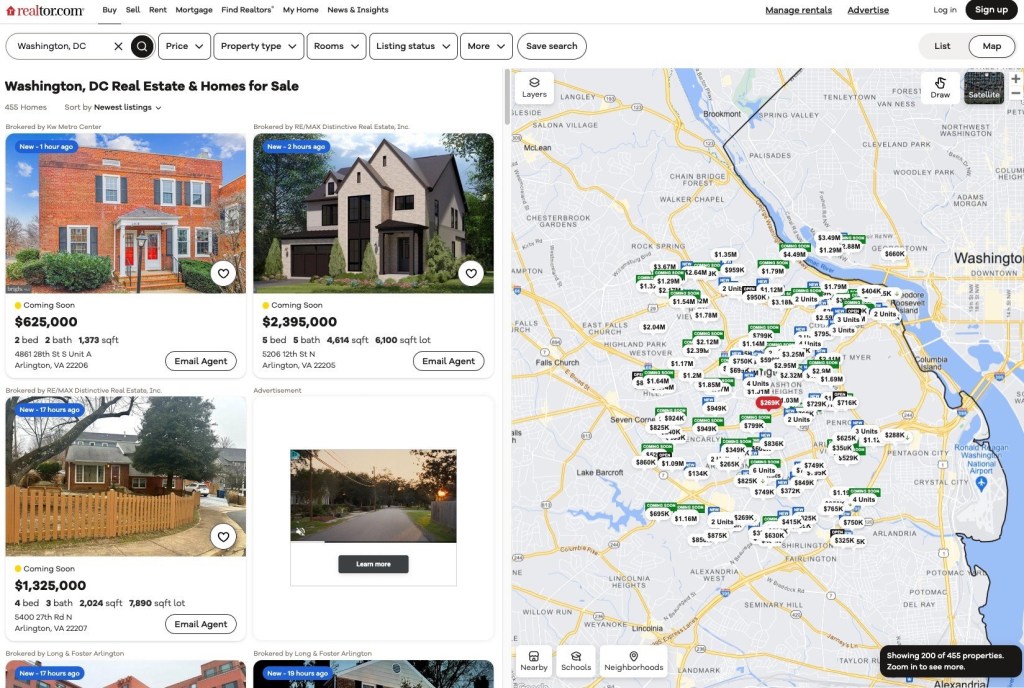

Recent viral images purporting to show an explosion of listings in DC suburbs, particularly Arlington, VA, have been misleading. One widely shared Realtor.com® map was cropped and zoomed in a way that exaggerated the number of available properties.

In reality, listing data does not support the claim of a sudden inventory surge or price collapse:

• Steady Inventory Growth: In the first two weeks of February, 2,829 homes were listed for sale in the DC region—just nine more than during the same period last year.

• In Line With National Trends: Overall, active listings in metro DC are up 40% year-over-year, but this mirrors national trends as markets adjust from the historically low inventory levels of 2021-2022.

• Prices Cooling, Not Crashing: Median listing prices in DC are down 3% annually, a slight decline but still comparable to the 1.4% drop nationwide.

• Time on Market is Shrinking: Homes are selling faster than they were last year, indicating that demand remains strong.

Investor & Developer Insights: What’s Next?

While there’s no fire sale happening yet, that doesn’t mean the DC market is immune to shifts driven by Trump’s policies or Musk’s restructuring efforts. Here’s what real estate professionals should watch:

1. Government Hiring & Layoffs

A significant reduction in federal hiring or large-scale layoffs could depress home demand. However, only 9% of the DC metro workforce is directly employed by the federal government, meaning the local economy is more diversified than many assume.

2. Return to In-Person Work

Trump’s push to bring federal employees back to the office could increase demand for housing closer to government hubs. This might favor certain neighborhoods and commercial developments.

3. Seasonal Market Shifts

Spring typically brings an uptick in real estate activity. If DC follows national trends, expect a moderate increase in transaction volume, but not a drastic pricing rebound.

4. Investment Opportunities in a Stabilizing Market

For investors and developers, a cooling market presents opportunities for strategic acquisitions. While prices have softened, demand indicators—such as lower time on market—suggest that well-positioned properties can still move quickly.

The Bottom Line for Real Estate Professionals

While social media may be sounding alarms about DC’s real estate market, the actual data tells a more nuanced story. The market is adjusting, not collapsing, and for savvy investors, agents, and developers, this could be a time of opportunity rather than crisis.

As we move into the spring selling season, monitoring government policy shifts, buyer sentiment, and local economic trends will be key to making informed decisions in the DC housing market.

Leave a comment