The homebuilding industry, already grappling with rising costs and labor shortages, has been keeping a close watch on President Donald Trump’s trade policies. Homebuilders rely heavily on materials imported from Canada, Mexico, and China—three countries that have been at the center of Trump’s tariff plans. Additionally, the president’s promise of mass deportations raises concerns about further disruptions to an already strained construction labor market.

A Temporary Reprieve, but Uncertainty Remains

Last week, Trump announced a pause on tariffs for Canadian and Mexican imports, providing temporary relief for homebuilders who feared sharp cost increases in essential materials like lumber, steel, and aluminum. This decision, along with the fact that deportation operations have yet to significantly impact the workforce, has eased immediate concerns within the industry.

However, while these short-term developments may seem like a win, the long-term risks remain substantial. Trump has signaled that his trade policies are far from settled, and any future escalation in tariffs could drive up material costs, increase project delays, and put additional financial strain on developers and homebuilders.

Why Tariffs Matter to Homebuilders

The U.S. construction industry imports a significant portion of its materials, particularly from Canada and Mexico. Lumber from Canada, for instance, plays a crucial role in residential home construction, and any increase in import costs directly affects housing prices. A 2018 report from the National Association of Home Builders (NAHB) estimated that previous tariffs on Canadian softwood lumber added nearly $9,000 to the price of an average new home.

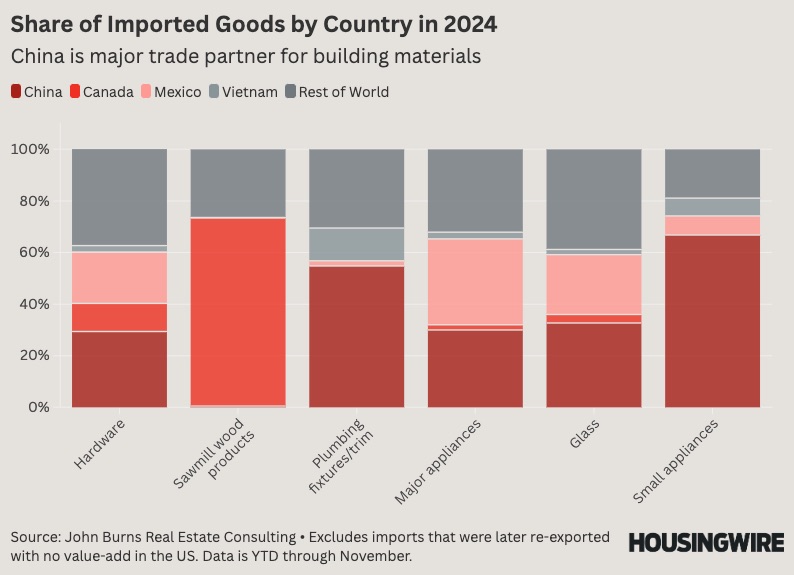

China also supplies a wide range of construction materials, from flooring to lighting fixtures. If Trump reintroduces tariffs on Chinese imports, supply chain disruptions and cost increases could ripple across the entire housing sector.

The Labor Factor: Will Deportation Policies Disrupt Construction?

Beyond tariffs, homebuilders are also watching the administration’s immigration policies, which could significantly impact the construction workforce. The construction industry has long relied on undocumented workers, who make up a substantial percentage of the labor force. A report by the Pew Research Center found that over 13% of U.S. construction workers are undocumented immigrants.

Trump’s promise of mass deportations has raised concerns that these workers might either be removed from the country or go into hiding, making it even harder for builders to fill critical labor gaps. Although these large-scale deportation operations have not yet materialized at the level some feared, the uncertainty alone is enough to impact hiring and workforce stability.

What’s Next for Homebuilders?

While the temporary pause on tariffs has given homebuilders some breathing room, the industry remains on high alert. The long-term outlook will depend on whether Trump reinstates or expands tariffs and how aggressively his administration pursues immigration enforcement policies.

For now, homebuilders are strategizing ways to navigate potential disruptions by:

• Diversifying supply chains to reduce reliance on tariff-affected countries

• Investing in domestic manufacturing to mitigate potential import cost increases

• Exploring workforce development programs to address labor shortages in case of stricter immigration policies

The bottom line? The pause in tariffs is a short-term win, but the long-term risks for homebuilders remain very real. Developers and builders will need to remain agile, adjusting their strategies to adapt to the unpredictable policy landscape ahead.

Leave a comment