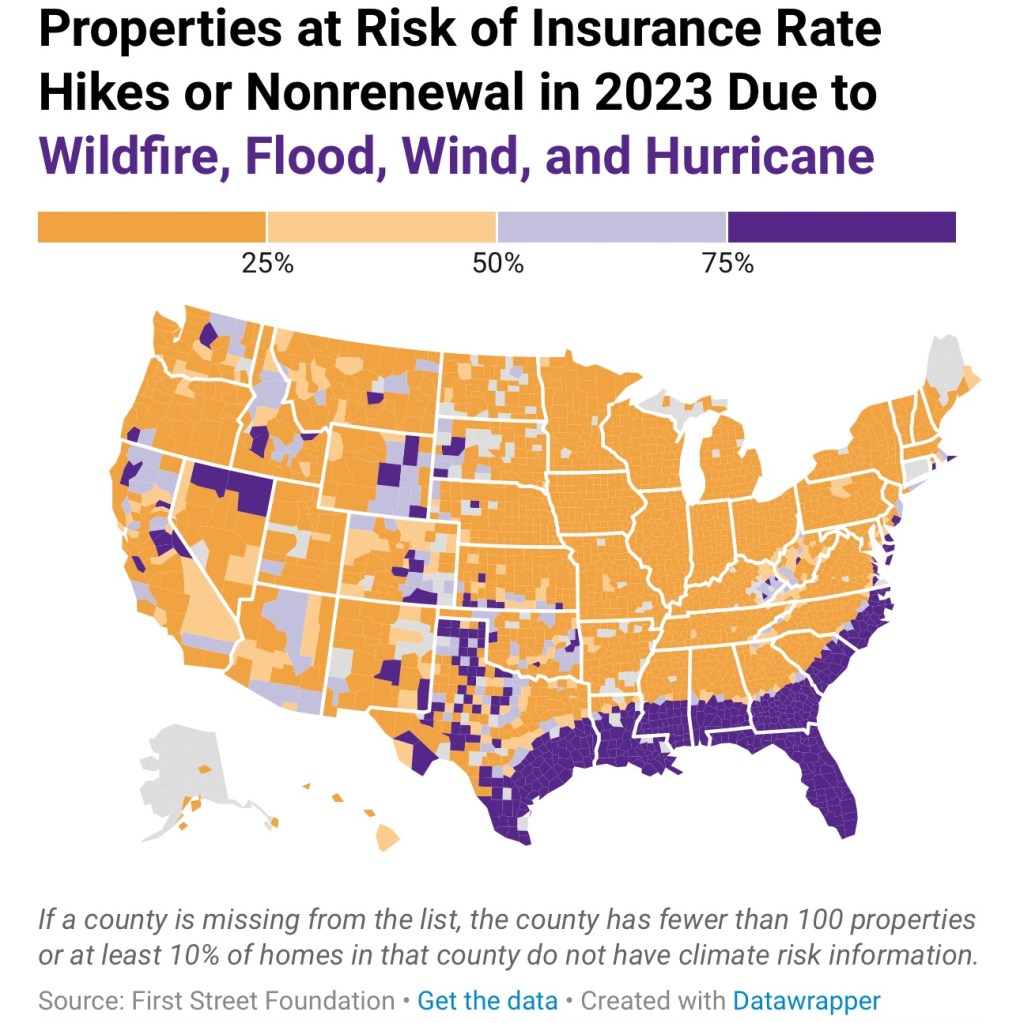

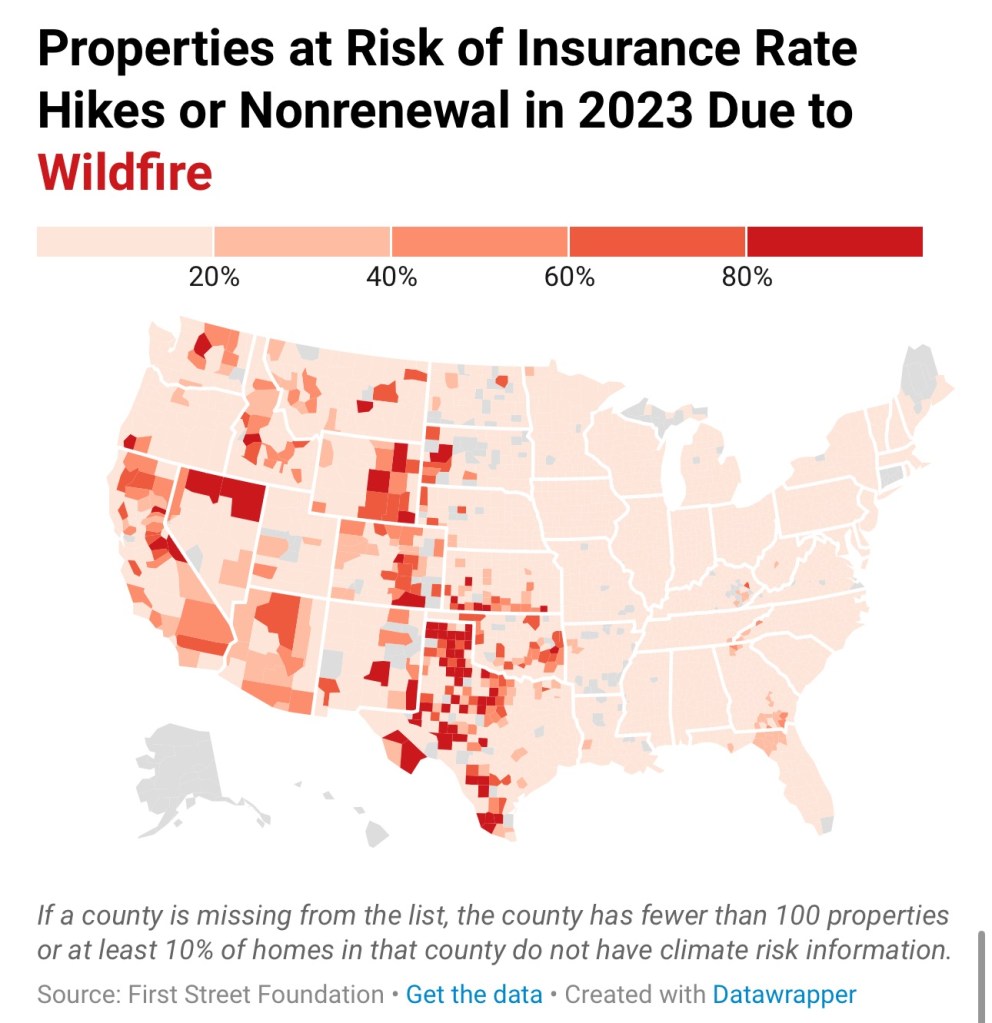

Climate risks are reshaping the U.S. real estate landscape, forcing developers, investors, and homeowners to grapple with the rising costs of insuring properties. From extreme weather events like wildfires in California to rare snowstorms in Florida, the frequency and severity of these disasters are creating unprecedented challenges. For real estate developers and investors, understanding these risks is essential to navigating an evolving market.

The Rising Cost of Insurance: A Challenge for the Industry

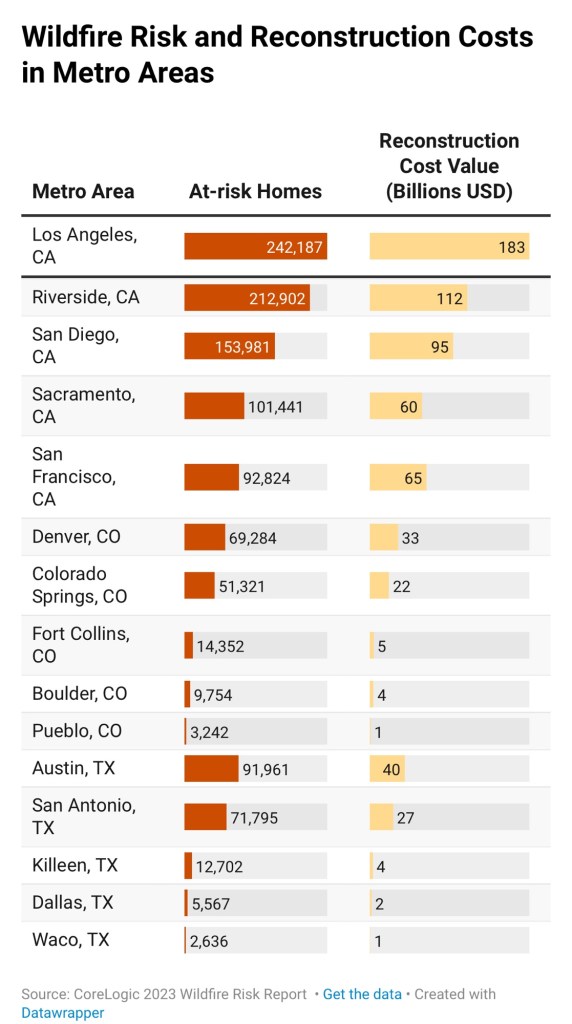

Home insurance costs are climbing rapidly. Between 2020 and 2023, premiums rose 33%, from $1,902 to $2,530 annually. Areas prone to disasters—such as wildfires, floods, and hurricanes—have seen the steepest increases, with homeowners in high-risk locations paying up to $500 more annually than those in safer regions.

In California’s wildfire-prone Pacific Palisades neighborhood, exposure under the state’s FAIR Plan (an insurer of last resort) soared from $436 million in 2020 to nearly $3 billion by late 2024. Private insurers like State Farm have pulled out of high-risk areas, leaving homeowners with fewer and more expensive options.

These rising insurance premiums pose significant hurdles for real estate developers and investors, who must factor escalating costs into project budgets and tenant affordability.

Why This Matters to Developers and Investors

1. Affordability Challenges:

Rising insurance premiums directly impact the cost of homeownership. In high-risk areas, this creates additional financial burdens, reducing demand for new developments and making homes harder to sell or rent.

2. Strain on Project Viability:

Increased costs of insurance, combined with already high land and construction costs, can render projects financially unfeasible in high-risk regions.

3. Shifting Demand Patterns:

As insurance costs rise, homeowners and renters may migrate to regions with lower risk and more affordable coverage. Developers and investors should monitor these migration trends to capitalize on emerging demand in lower-risk markets.

4. Credit Risks for Buyers:

Higher housing costs in high-risk areas may lead to higher default rates among homeowners, affecting property values and the stability of local housing markets.

Opportunities to Adapt and Mitigate Risk

While the challenges are significant, there are strategies for developers and investors to mitigate the impact of rising insurance costs:

1. Incorporate Climate-Resilient Design

Investing in resilient infrastructure is crucial. Features like fire-resistant materials, hurricane-proof windows, and flood mitigation systems can reduce property vulnerability, lower insurance premiums, and enhance marketability.

2. Leverage State Programs

Programs like Alabama’s Strengthen Alabama Homes initiative provide grants to retrofit properties, improving resilience to extreme weather. Developers should seek similar programs in their markets to reduce project costs and improve property durability.

3. Diversify Investment Portfolios

Investing in regions with lower climate risk can help balance the potential financial impact of properties in high-risk areas. Identifying emerging markets less exposed to extreme weather events will be critical for long-term profitability.

4. Engage with Policymakers

Advocating for smarter, stronger infrastructure at local and federal levels can help reduce climate-related risks. Developers and investors should support policies that promote resilient building standards and incentivize climate adaptation measures.

The Broader Impact on the Housing Market

The rising cost of insurance isn’t just a problem for individual homeowners—it’s reshaping the housing market as a whole. High insurance premiums in disaster-prone areas are deterring buyers, reducing housing demand, and putting downward pressure on property values.

At the same time, migration away from high-risk regions is creating opportunities in safer areas. Developers and investors should closely track these shifts to identify markets where demand is growing and risk exposure is lower.

Looking Ahead: Preparing for a Climate-Driven Market

The frequency of billion-dollar weather disasters in the U.S. continues to rise, with 2024 ranking as the fourth-costliest year on record. These trends highlight the urgent need for developers and investors to adapt to a climate-driven market.

Key Takeaways for Real Estate Developers and Investors:

• Rising insurance costs will remain a significant factor in project feasibility and market demand.

• Climate-resilient designs and retrofits can lower insurance costs and enhance property appeal.

• State and federal programs can provide financial support for adaptation efforts.

• Shifting demographics and migration patterns present opportunities to invest in emerging, low-risk markets.

As climate risks grow, proactive adaptation will be the key to navigating this challenging landscape. By embracing resilience and strategically positioning investments, real estate professionals can mitigate risks and capitalize on opportunities in this rapidly changing market.

What strategies are you considering to address rising insurance costs and climate risks in your portfolio? Let’s discuss ways to adapt and succeed in this evolving market!

Leave a comment