As we step into the first quarter of 2025, the U.S. apartment market is positioned for a strong start, building on the momentum of late 2024. Real estate developers and investors should take note of the key trends and data from the fourth quarter of 2024, which indicate a shifting market dynamic and new opportunities for multifamily investment.

Demand Outpaces Supply in Q4 2024

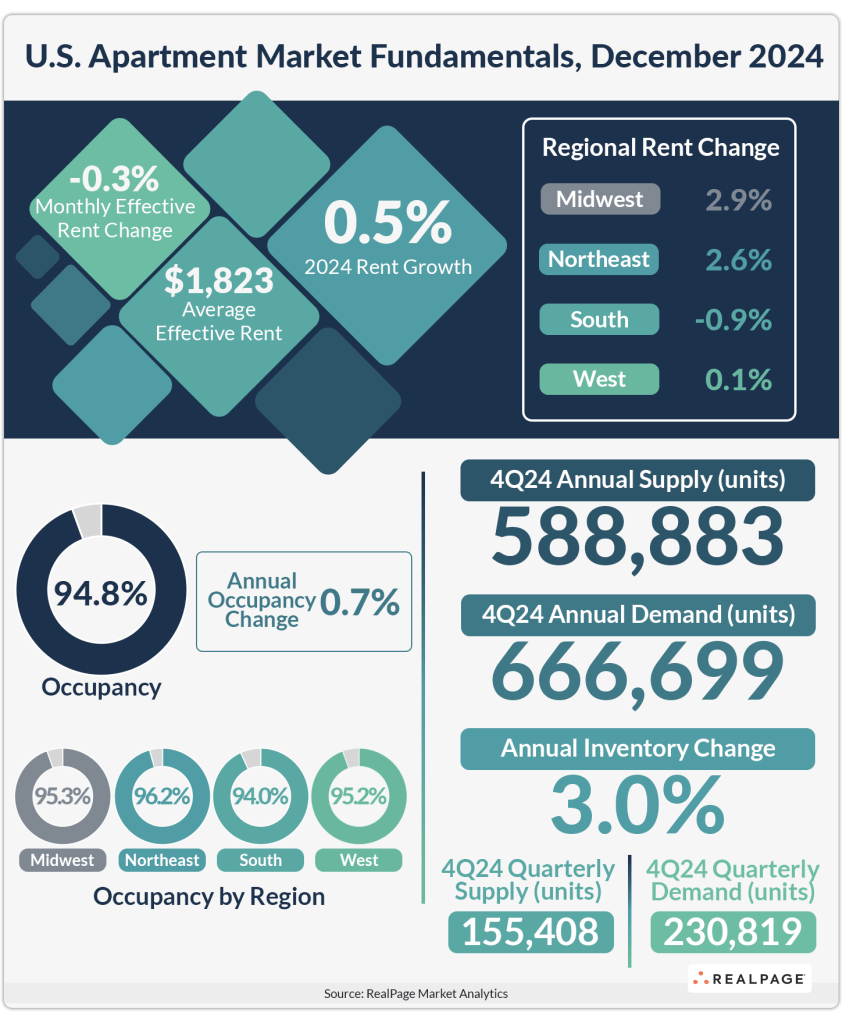

The U.S. apartment market demonstrated remarkable resilience in the fourth quarter of 2024, with demand for apartments reaching its highest level in nearly three years. According to RealPage Market Analytics, the U.S. absorbed 230,819 market-rate apartment units in Q4 alone, contributing to a total annual demand of 666,699 units, the largest since Q1 2022.

At the same time, new supply hit a decades-long high, with 155,408 units delivered in Q4 2024 and a total annual supply of 588,883 units. Despite fears of oversupply earlier in the year, demand outstripped supply by a significant margin, resulting in the first true absorption surplus since mid-2022.

This reversal in the supply-demand imbalance pushed national occupancy rates to 94.8% by December 2024, a meaningful increase. While rent growth remained muted, with a slight 0.5% increase for the year, the stabilization of rent cuts toward year-end suggests potential for improvement in 2025.

Texas Markets Lead the Charge

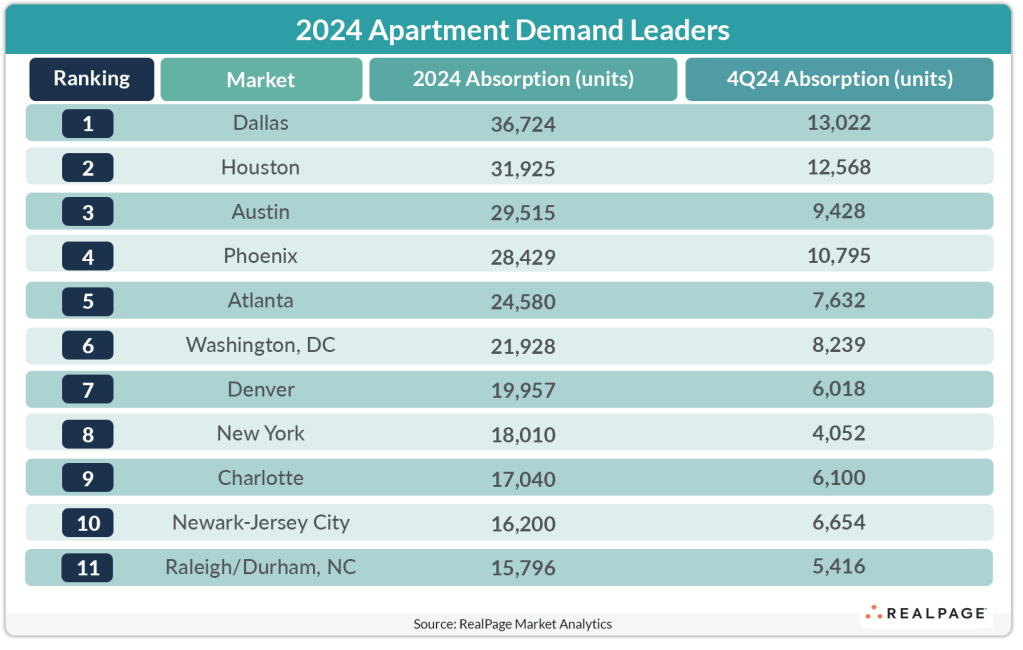

Texas continues to dominate as the national leader in both apartment demand and supply, with Dallas, Houston, and Austin posting the strongest performance:

• Dallas: Absorbed 36,724 units in 2024.

• Houston: Absorbed 31,925 units with a demand surplus of over 6,800 units.

• Austin: Absorbed 29,515 units.

Other markets also saw notable demand surpluses in 2024, including:

• Washington, D.C.: Absorption exceeded supply by 7,700 units.

• Las Vegas, Los Angeles, and Indianapolis: Each posted demand exceeding new supply by over 3,000 units.

These trends point to opportunities in high-growth regions, particularly for developers targeting areas with favorable job and population growth.

Key Drivers for 2025

The Q4 2024 data highlights several factors that will likely shape the multifamily market in Q1 2025 and beyond:

1. Economic Stability: Stable job growth and cooling inflation are boosting consumer sentiment, fueling household formation.

2. Wage Growth vs. Rent Growth: Wage increases outpaced rent growth in 2024, easing rent-to-income ratios and encouraging lease renewals.

3. Renewal Rates: Current renters renewed leases at higher rates, reflecting confidence in the market and limiting turnover.

4. Market Normalization: After several turbulent years, 2024’s performance indicates that the apartment market is stabilizing, setting the stage for more predictable conditions in 2025.

What to Watch in Q1 2025

While many markets are expected to build on their 2024 successes, developers and investors should remain mindful of areas still adjusting to significant waves of new supply. Markets with localized softness may take longer to fully stabilize, but the broader apartment market appears poised for continued improvement.

Carl Whitaker, Chief Economist at RealPage, summarized the outlook:

“The past year has set the stage for arguably the most ‘normal’ market conditions since the start of the decade. While some regions will face supply challenges, the multifamily industry at large has turned a corner, with 2025 shaping up as a year of steady improvement.”

Opportunities for Developers and Investors

The data tells a clear story: demand for apartments remains strong, and occupancy rates are rising, even in the face of elevated supply levels. For developers and investors, this means:

• Target Growth Markets: Areas like Texas, Washington, D.C., and other regions with demand surpluses are ripe for investment.

• Focus on Affordability: With wage growth outpacing rent growth, the demand for market-rate apartments with competitive pricing will likely increase.

• Adapt to Normalization: As the market stabilizes, operators and investors can plan with greater predictability, enabling more strategic, long-term investments.

A Promising Start to 2025

The multifamily market begins 2025 on strong footing, with Q4 2024 serving as a clear turning point. Developers and investors who capitalize on these trends and adapt to shifting dynamics stand to benefit from the ongoing demand and market normalization.

Daniel Kaufman’s Perspective:

“As we move into the first quarter of 2025, it’s clear that the multifamily market has stabilized and is primed for growth. For developers and investors, the key to success will be understanding local market dynamics and staying agile in response to evolving demand patterns.”

Stay ahead of the curve, and let’s make 2025 a year of strategic growth in real estate. What’s your next move?

Leave a comment