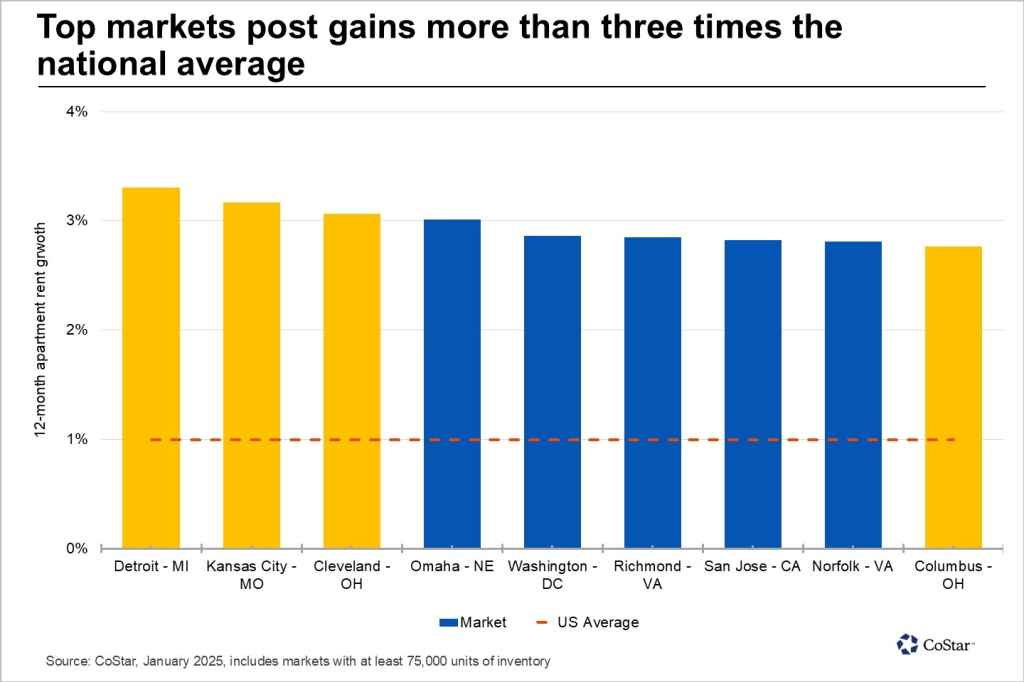

As national rent growth slowed to just 1% by the end of 2024, the Midwest emerged as a bright spot for real estate investors and developers. Cities like Detroit, Kansas City, Cleveland, and Columbus led the way with above-average rent increases, driven by robust demand and a pullback in new construction activity. These markets are shaping up to be key opportunities for those looking to stay ahead of the curve in 2025.

Key Trends and Insights

While Sun Belt markets grapple with oversupply and slowing demand, Midwest metros are thriving. National rent growth dropped from 9.9% in Q1 2022 to just 1% in Q4 2024, but cities like Detroit (3.3%), Kansas City (3.2%), Cleveland (3.1%), and Columbus (2.8%) are outperforming, proving that careful market selection remains critical for investors.

Midwestern Moves

Detroit, Michigan

2024 Rent Growth: 3.3% (3x YoY)

Detroit ranked #1 nationwide for rent growth among metros with at least 75K units. A three-year high in demand compressed vacancies to 7.2%, while average monthly rent remained affordable at $1,320—23% below the national average. With growth expected to exceed 5% by mid-2025, Detroit is proving itself a hotbed for investment potential.

Kansas City, Missouri

2024 Rent Growth: 3.2%

Kansas City’s multifamily market saw a remarkable 130% year-over-year increase in absorption, coupled with a 90-basis-point improvement in vacancy rates. Rent growth exceeded pre-pandemic averages, and developers should take note of the city’s sustained demand and tightening inventory.

Cleveland, Ohio

2024 Rent Growth: 3.1%

Cleveland recorded its highest absorption total in three years, with 1,600 units absorbed in 2024. A 30% year-over-year decline in new completions eased supply pressures, helping vacancy rates drop and rent growth accelerate. The city’s low construction pipeline indicates continued rent growth over the next 12–18 months.

Columbus, Ohio

2024 Rent Growth: 2.8%

Columbus posted strong demand, doubling its pre-pandemic absorption average with 6,000 units in 2024. A 33% reduction in completions allowed demand to surpass supply for the first time since 2021. These tight conditions will likely sustain rent growth well into 2025.

Expert Insights: Daniel Kaufman

Real estate expert Daniel Kaufman, known for his deep understanding of development opportunities and his strategic guidance, sees the Midwest as a goldmine for investors in 2025. As Kaufman notes on his site, “Investors are increasingly drawn to markets with strong fundamentals and less speculative oversupply.” With his experience in identifying emerging trends, Kaufman emphasizes that smart investments in the Midwest can yield consistent returns, particularly in resilient metros like Cleveland and Kansas City. His strategies focus on navigating shifting market dynamics while leveraging long-term growth potential.

The Takeaway for Investors

The Midwest offers a rare combination of affordability, growing demand, and limited supply, making it an ideal region for multifamily investments. For developers, focusing on these key markets can provide a hedge against stagnating growth elsewhere in the U.S.

As we move further into 2025, staying informed and agile is critical. Subscribe to my blog for more insights into where the market is heading—and where your next big opportunity might be.

What do you think of these Midwest markets? Let’s discuss in the comments or connect directly!

Leave a comment