The recent wildfires in Los Angeles have left an indelible mark, with damages projected to shatter records. A new CoreLogic analysis estimates insured losses from the Palisades and Eaton fires could reach an unprecedented $45 billion, dwarfing the $11.5 billion insured losses from Northern California’s 2018 Camp Fire. For real estate developers and investors, these figures underscore the growing need to navigate an increasingly volatile landscape.

A Record-Breaking Disaster

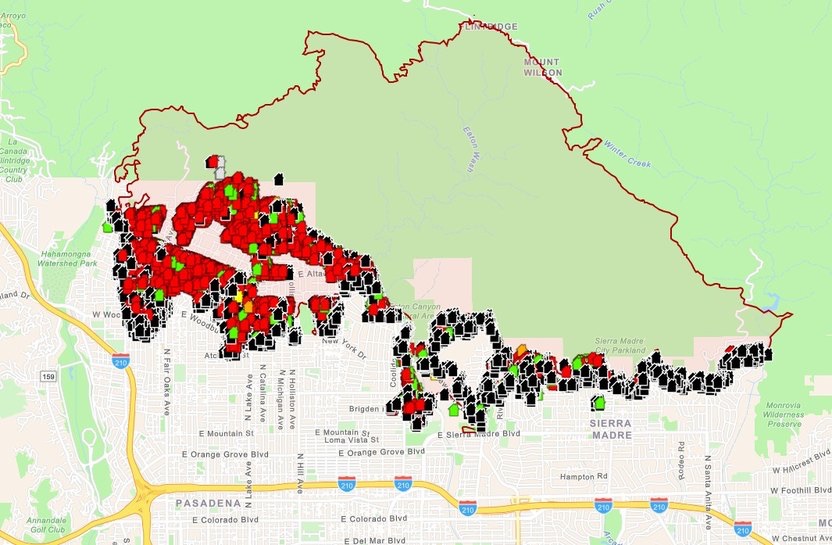

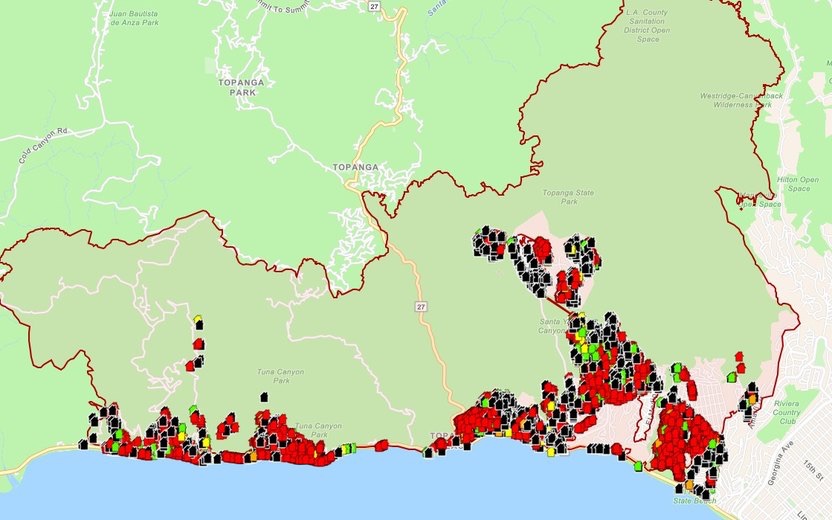

According to CoreLogic’s senior director Tom Larson, nearly 20,000 structures with a combined value of $50 billion have been impacted, with over 12,500 structures suffering significant damage. While these numbers are staggering, they also highlight the vulnerabilities in our infrastructure and the risks developers must consider.

The losses encompass both residential and commercial properties, including homes, their contents, permanent structures, and business interruptions. For investors, this raises important questions about asset protection, insurance adequacy, and the long-term viability of investing in fire-prone regions.

The Role of Extreme Weather

Unprecedented weather conditions have been a driving force behind the devastation. CoreLogic’s wildfire scientist, Thomas Jeffrey, detailed how a combination of severe drought, record-breaking heat, low humidity, and hurricane-force winds fueled the fires.

These extreme factors are becoming more common, with implications for real estate in high-risk areas. Developers must now consider not only building standards but also the broader climate resilience of their projects.

The Human Element: A Harrowing Tale

The personal account of Garret Gray, president of CoreLogic Insurance Solutions, brings the disaster into sharp focus. Forced to evacuate his children from a school surrounded by flames, Gray’s experience underscores the urgency of preparedness.

His story also highlights the importance of proactive mitigation measures. By clearing vegetation around his home, Gray was able to prevent potentially catastrophic damage. For developers, these lessons emphasize the need to prioritize fire-resistant landscaping, defensible spaces, and modern building materials in projects.

Implications for Real Estate Developers and Investors

1. Insurance Costs and Coverage Gaps: With losses climbing, insurance premiums in wildfire-prone areas will likely continue to rise. Developers and investors must budget for these costs and evaluate policies for adequate coverage.

2. Mitigation as a Value Proposition: Incorporating fire-resistant materials, defensible spaces, and other mitigation measures can not only protect assets but also serve as a selling point for buyers.

3. Market Dynamics: The destruction of thousands of homes creates an immediate need for housing, presenting opportunities for developers. However, navigating local zoning laws, insurance challenges, and community rebuilding efforts will require strategic planning.

4. Climate Resilience as a Priority: These wildfires are a stark reminder that climate risks are no longer a future concern—they are here now. Investors should prioritize projects designed with resilience to extreme weather in mind.

Engaging the Real Estate Community

The Los Angeles wildfires present both challenges and opportunities for the real estate community. What strategies can developers adopt to build more resilient communities? How can investors balance risk and reward in a changing climate?

Let’s start the conversation. Share your thoughts on how the industry can adapt to these growing challenges. Together, we can chart a path forward.

This blog post is designed to inform, engage, and inspire real estate professionals while fostering meaningful dialogue around pressing issues like climate resilience and disaster preparedness.

Leave a comment