As we look ahead to 2025, the multifamily real estate market is shaping up for a promising year, driven by strong fundamentals despite rising operational costs. Whether you’re an investor, developer, or simply someone keeping an eye on market trends, it’s clear that multifamily remains a resilient cornerstone of the real estate landscape.

Multifamily’s Continued Dominance in Commercial Real Estate

In 2024, multifamily assets accounted for 35% of total commercial real estate sales—a testament to their enduring appeal in an uncertain market. Experts expect 2025 to bring further momentum as declining interest rates later in the year unlock sidelined capital, creating new opportunities for acquisitions.

At the same time, affordability challenges persist. With mortgage rates still hovering around 7.5% and home prices at record highs, renting continues to be the more viable option for many households.

Occupancy Rates and Rent Growth: A Healthy Rebound

Occupancy rates, currently at 93%, are projected to bottom out mid-year before climbing back to 94% by the end of 2025. While 2024’s rent growth stagnated at 1.2%, analysts predict a healthy increase of 3–4% this year.

For real estate investors, this signals a return to stronger fundamentals that could drive new development and acquisition strategies.

Regional Standouts: The Midwest and Northeast Lead the Way

Not all regions are created equal when it comes to rent growth:

• Midwest and Northeast: These regions are projected to see rent growth of 4.5% and 4.2%, respectively, thanks to limited supply and steady demand.

• Sun Belt: Despite high demand, rent growth in markets like Austin and Tampa is expected to slow to 2–3% due to elevated vacancy rates from overbuilding.

However, key markets in the Sun Belt—such as Atlanta, Phoenix, and Dallas—are still seeing strong renter demand, positioning them for a rebound as supply normalizes.

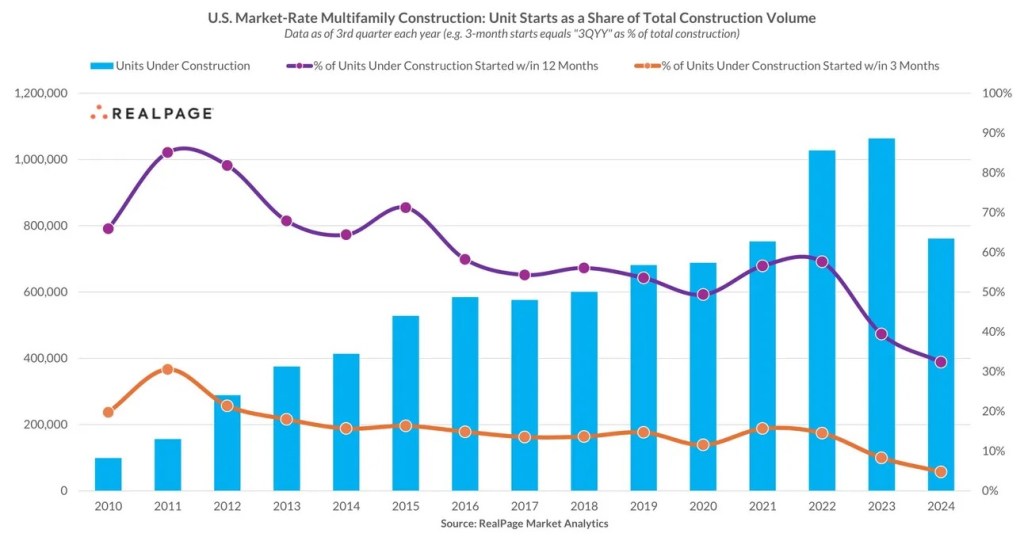

Supply Slowdown: A Key Driver for Future Growth

New multifamily permits dropped 20% in 2024, with completions expected to decline another 15% in 2025. This slowdown in new deliveries will drive rents higher in competitive markets where housing supply hasn’t kept up with demand.

Operational Costs and NOI Challenges

Despite the positive demand outlook, rising costs continue to challenge net operating income (NOI):

• Insurance premiums: Up 15–20% due to an active 2024 hurricane season.

• Labor and materials: Increased 5% and 3%, respectively, adding pressure to operating margins.

• Oversupply in the Sun Belt: Colliers reports that some Sun Belt markets have seen occupancy rates decline by 10–15% due to aggressive overbuilding, especially in luxury-class assets.

For investors, this means understanding which markets are poised for stabilization versus which are at risk of further NOI compression.

Opportunities in the 2025 Market

Amid rising costs and shifting fundamentals, 2025 presents a rare window of opportunity for savvy investors:

• Acquiring Below Replacement Costs: In high-growth secondary markets like Raleigh and Nashville, cap rates are averaging 5.5%, compared to 4.8% in primary markets. These higher yields, combined with stabilizing fundamentals, make secondary markets attractive for long-term investments.

• Class B and C Assets: With affordability top of mind for renters, Class B and C properties are expected to see stronger occupancy rates compared to luxury Class A assets, especially in overbuilt markets.

What It Means for Friends, Family, and Investors

For those considering investing in real estate or reallocating portfolios, the multifamily sector offers a compelling case for 2025. Developers can capitalize on supply slowdowns to bring thoughtful projects to market, while investors can leverage higher cap rates in growth markets. Families looking to rent may face higher costs but could benefit from new developments designed to offer more affordability and amenities.

Connect with Daniel Kaufman

Whether you’re a seasoned investor or just starting out, navigating the multifamily market requires the right strategy and insights. Daniel Kaufman is here to help you identify opportunities and make informed real estate decisions.

Visit www.danielkaufman.info or reach out directly for expert guidance on your next steps in real estate investing. Let’s make 2025 a year of smart growth and success—together!

Leave a comment