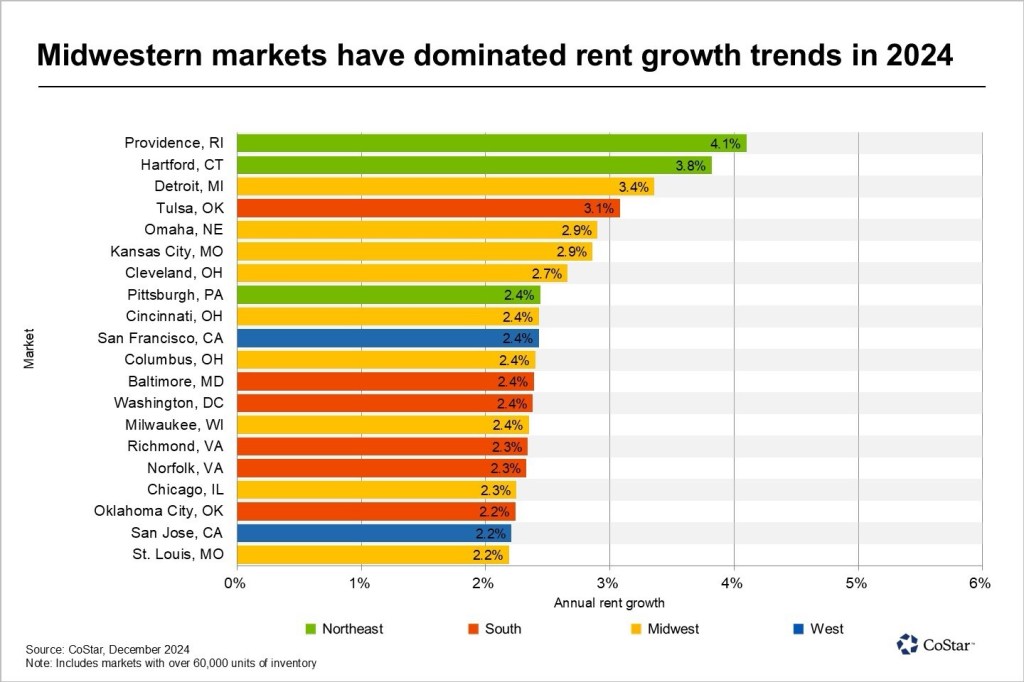

As 2024 nears its conclusion, two Northeastern cities—Providence, Rhode Island, and Hartford, Connecticut—have emerged as national leaders in multifamily rent growth. Despite the broader region’s lagging performance in recent years, these markets have surged ahead, showcasing robust rent increases of 4.1% and 3.8%, respectively, according to CoStar’s latest December 2024 data.

This upward trend contrasts sharply with the slower rent growth observed in other parts of the Northeast, underscoring the unique dynamics at play in these two cities. Factors such as limited housing supply, sustained demand, and economic resilience appear to have contributed to their standout performance in a region that typically experiences more modest rent growth.

Rent Growth Across Regions: A Midwestern Dominance

While Providence and Hartford lead overall, the Midwest has dominated the broader rent growth landscape in 2024, with cities such as Detroit, MI (3.4%), Tulsa, OK (3.1%), and Omaha, NE (2.9%) showing significant annual increases. Kansas City, MO, and Cleveland, OH, each recorded a 2.9% rent growth, adding to the region’s prominence.

This strong performance in Midwestern markets reflects a growing trend of affordability-driven demand and population shifts away from pricier coastal metros. Many Midwestern cities are also benefiting from relatively stable economic conditions and diversified job markets, which continue to attract renters seeking more affordable housing options.

Comparisons with Other Major Markets

The West, typically a hotbed for rent growth, saw a relatively muted performance in 2024. San Francisco and San Jose both posted annual rent growth rates of just 2.4% and 2.2%, respectively, signaling a cooling in these traditionally high-cost cities. Meanwhile, markets in the South, including Tulsa, OK (3.1%), and Oklahoma City, OK (2.2%), have seen more varied growth rates, indicating a mixed landscape for rent growth in the region.

Broader Implications

The strong showing by Providence and Hartford demonstrates that smaller and less historically prominent markets can lead national trends under the right conditions. This could signal opportunities for investors and developers to explore these markets further as they continue to outperform larger metropolitan areas in the region.

However, with most markets showing annual rent growth of around 2.2%–2.4%, the data suggests a stabilization trend across the board. This stability could reflect broader economic uncertainties and renters’ cautious responses to ongoing affordability challenges in 2024.

As 2025 approaches, monitoring these standout markets and regional trends will be crucial for stakeholders across the multifamily housing landscape.

Leave a comment