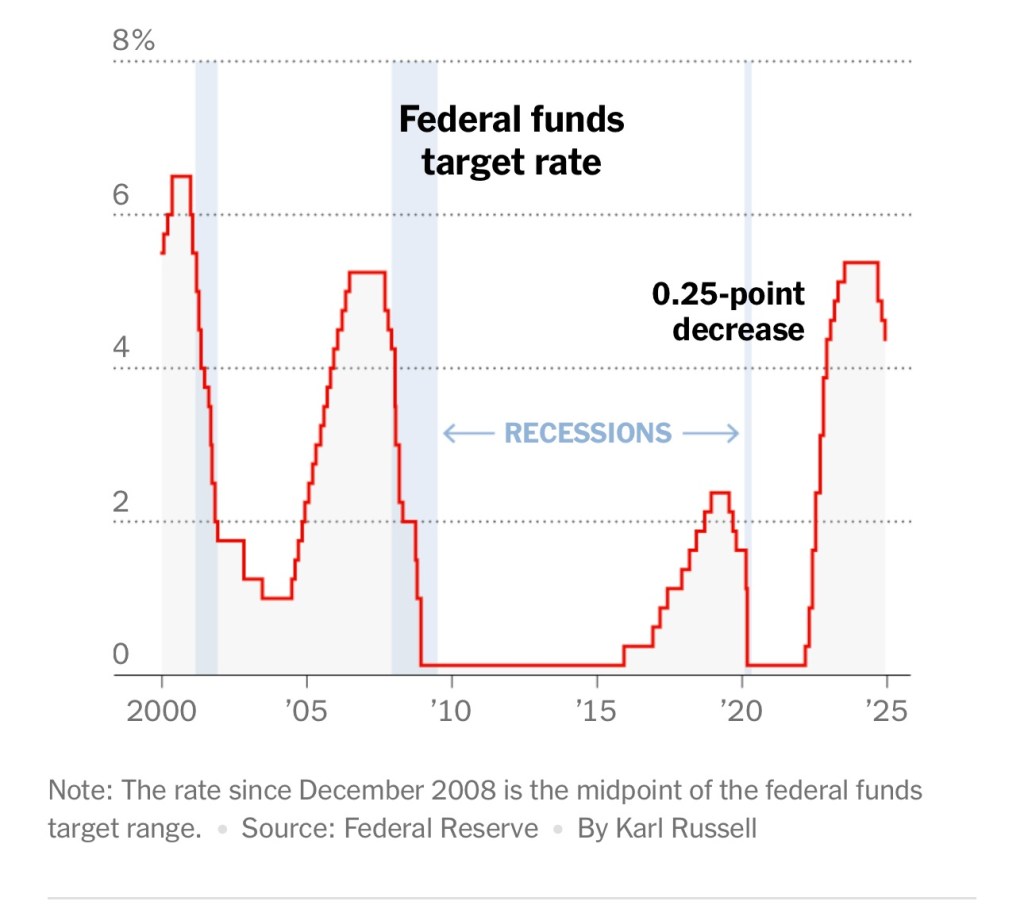

The Federal Reserve just cut interest rates again, bringing the benchmark rate to its lowest point in two years (4.25%–4.5%). But here’s the catch: they’re signaling fewer rate cuts in 2025. For those of us in real estate—whether you’re a developer, investor, or closely tied to the industry—this shift carries major implications.

Rates have dropped by a full percentage point since September, which offers some relief. But long-term borrowing costs like mortgages and corporate debt remain high. That means the sectors most sensitive to interest rates, like housing, are still feeling the crunch. Builders are sitting on record-high inventory, and buyers are hesitant as affordability remains a challenge.

Why This Matters to You

If you’re developing, investing, or even buying property, here are the key takeaways:

• Higher Borrowing Costs: Financing deals and new developments will remain expensive, so it’s critical to rethink budgets and returns.

• Shifting Housing Demand: Multifamily and affordable housing markets may weather this better than single-family projects, but the landscape is shifting.

• Inflation Risks: Rising costs for labor and materials—especially in light of potential new tariffs and immigration changes—could further squeeze margins.

What’s Next?

This isn’t just a challenge; it’s an opportunity to get ahead of the curve. Staying informed and adapting to these trends can make or break your projects in 2025. For those of you planning developments, acquisitions, or investments, now’s the time to take a strategic approach.

If you’d like to discuss how these changes could impact your business or investments—or if you just want to swap ideas—feel free to reach out.

📧 daniel@kaufmanredev.com

Let’s navigate this market together—because there’s always an opportunity for those ready to seize it.

Leave a comment