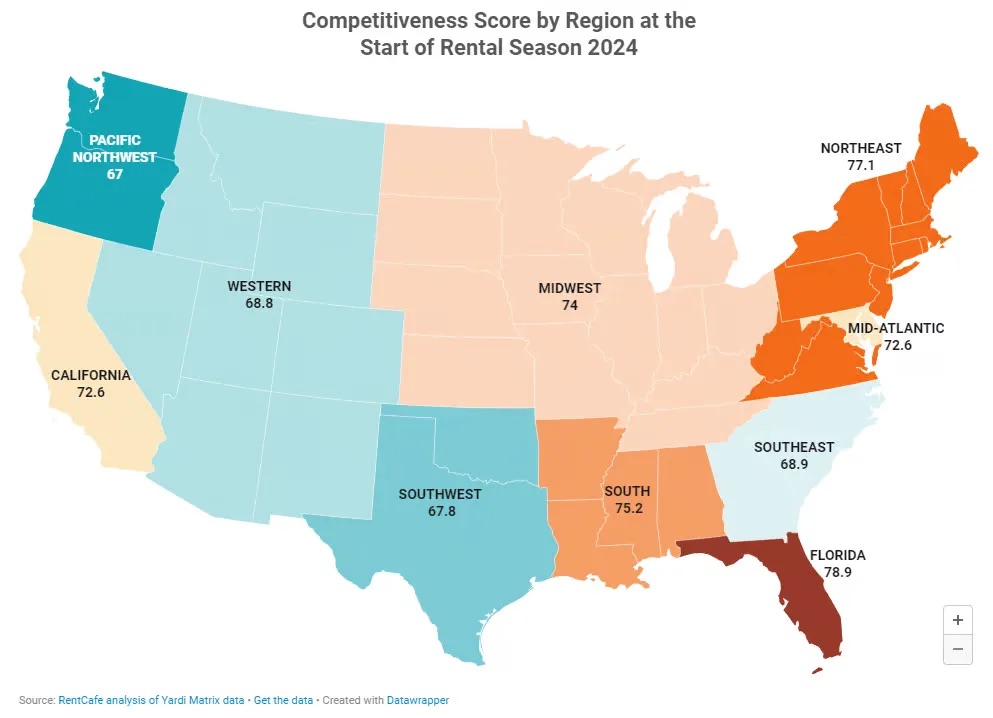

The 2024 rental market has been defined by fierce competition, with strong demand meeting limited availability across many metros. While Miami remains at the top, rising supply and increased affordability in the Midwest are signaling a geographic shift in rental dynamics—one that real estate investors and developers should watch closely.

National Snapshot: Demand Holds Steady Despite New Supply

Despite a wave of new apartment deliveries, the rental market remained tight in 2024. According to RentCafe’s Rental Competitiveness Index (RCI), nationally:

• 62.2% of renters renewed their leases, tightening availability.

• Apartments averaged 40 days on the market.

• Each unit attracted 8 prospective renters, maintaining competition.

The index held firm at 74.4, a clear indicator that demand outpaced supply across many markets.

Miami: Still King, but Cracks Begin to Show

With an RCI score of 91.2, Miami once again topped the list of the nation’s most competitive rental markets. Its global appeal, booming economy, and favorable tax climate continue to draw renters. Key data points include:

• 33 days on average to rent an apartment—well below the national average.

• 18 renters competing per unit—double the U.S. average.

However, Miami’s reign is showing early signs of softening. A 4.12% increase in apartment supply reflects the city’s strong development pipeline. While absorption remains high, growing inventory could gradually ease competition in 2025. For investors, this signals a need for sharp focus on location, tenant demand, and product differentiation to sustain NOI growth.

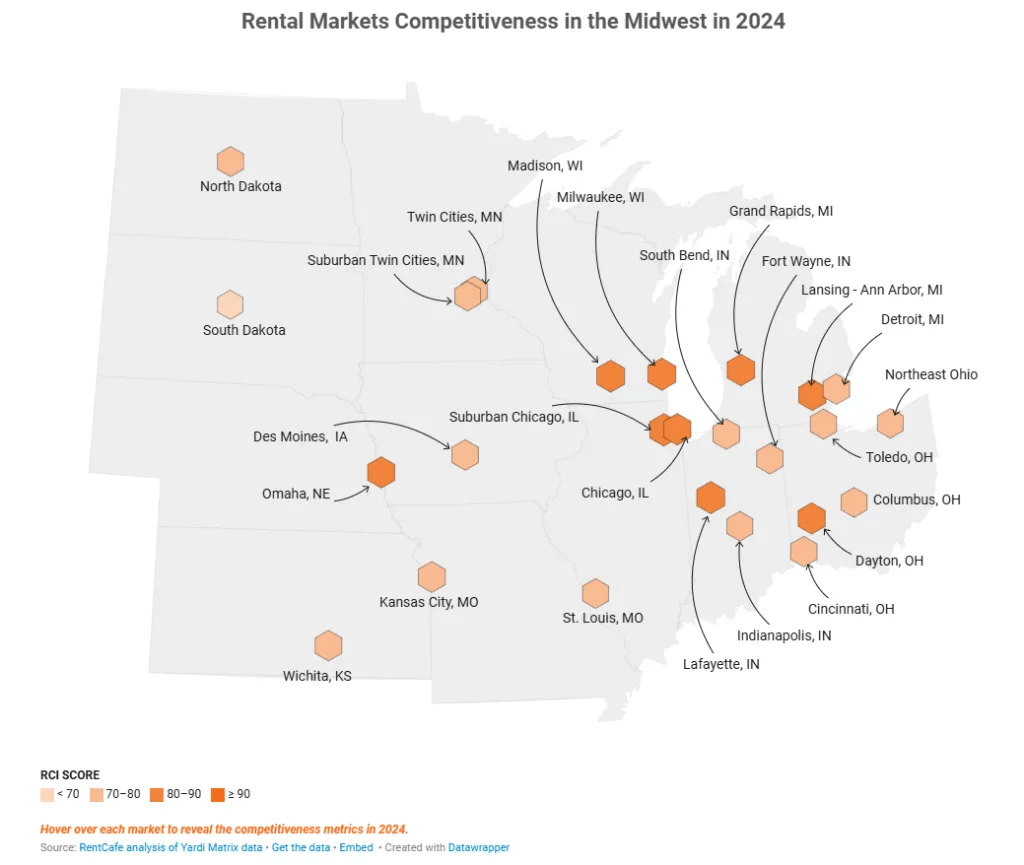

The Midwest: Rising Stars of Affordability and Appeal

The story of 2024 was the Midwest’s emergence as a dominant force in the rental market. Affordable, job-rich metros drew renters priced out of coastal markets and urban hubs. Nine Midwest metros claimed top-30 spots in RentCafe’s rankings.

Leading Midwest Performers:

• Suburban Chicago (#2): With an RCI of 88, areas like Naperville and Evanston combined affordability with lifestyle appeal, drawing young professionals and families seeking quality living at lower costs.

• Milwaukee (#3): A standout performer with 70% lease renewal rates and apartments leasing within 36 days.

For developers and investors, these Midwest metros present opportunities to capitalize on growing demand through new construction or value-add projects.

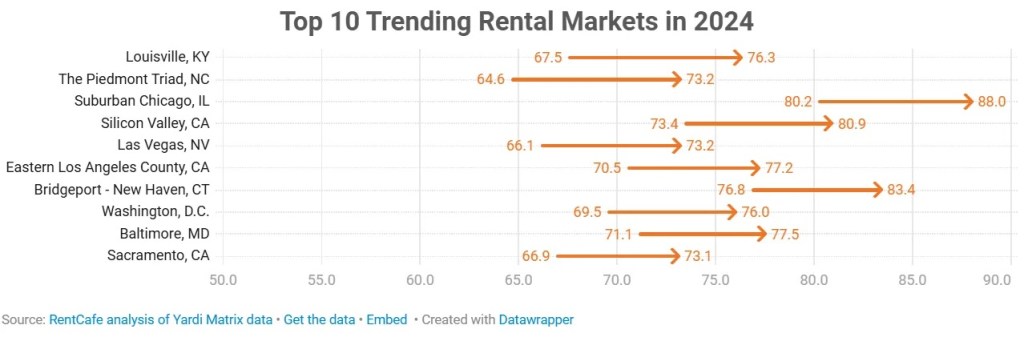

Markets to Watch: Affordable and Job-Rich Regions

Beyond the Midwest, smaller markets are heating up, driven by job growth and limited supply:

• Louisville, KY: The city leads the next tier with an RCI of 76.3, thanks to high lease renewals and low new construction activity.

• Piedmont Triad, NC: A notable 8.6-point RCI jump, fueled by strong job growth in manufacturing and transportation.

• Fayetteville, AR: Economic momentum paired with supply constraints is driving increased competition.

Looking Ahead: 2025 Trends to Monitor

The outlook for 2025 suggests a mixed landscape for rental demand:

1. New Supply Impact: A significant wave of new apartment deliveries may ease competition in certain markets, especially in overbuilt urban cores.

2. Lease Renewals: High renewal rates will remain a headwind for availability, limiting turnover and opportunities for new tenants.

3. Affordability Factor: Elevated homebuying costs will keep renters in place, maintaining strong demand in budget-friendly markets.

4. Job Growth & Migration: Regions with strong employment in manufacturing, logistics, and tech—particularly in affordable metros—will continue to see heightened competition.

Strategic Takeaways for Real Estate Professionals

For developers, owners, and investors, the 2024 data highlights key opportunities:

• Midwest Markets: Increasing demand combined with affordability offers strong development and acquisition potential.

• Miami & Major Sunbelt Metros: While competition remains fierce, rising inventory requires a targeted approach to tenant amenities and pricing strategies.

• Secondary Markets: Cities like Louisville, Piedmont Triad, and Fayetteville are positioned for strong rent growth amid limited new supply.

The evolving rental market landscape is both a challenge and an opportunity. Understanding local dynamics, tenant behavior, and supply trends will be critical to maximizing ROI in 2025 and beyond.

For more insights or to discuss strategic opportunities in these markets, feel free to reach out:

Stay ahead of the curve—because opportunities in real estate belong to those who see them first.

Leave a comment