In the lead-up to recent elections, we heard bold promises and urgent calls for building millions of new homes to address the nation’s housing crisis. Yet, the latest data on housing starts and building permits tells a much different story — one of stagnation, recession-level activity, and unmet expectations. For real estate professionals, investors, and developers, these insights aren’t just numbers; they’re critical signals for strategy and investment.

So why aren’t we building millions of new homes?

Let’s unpack the disconnect between political rhetoric, economic reality, and housing market dynamics.

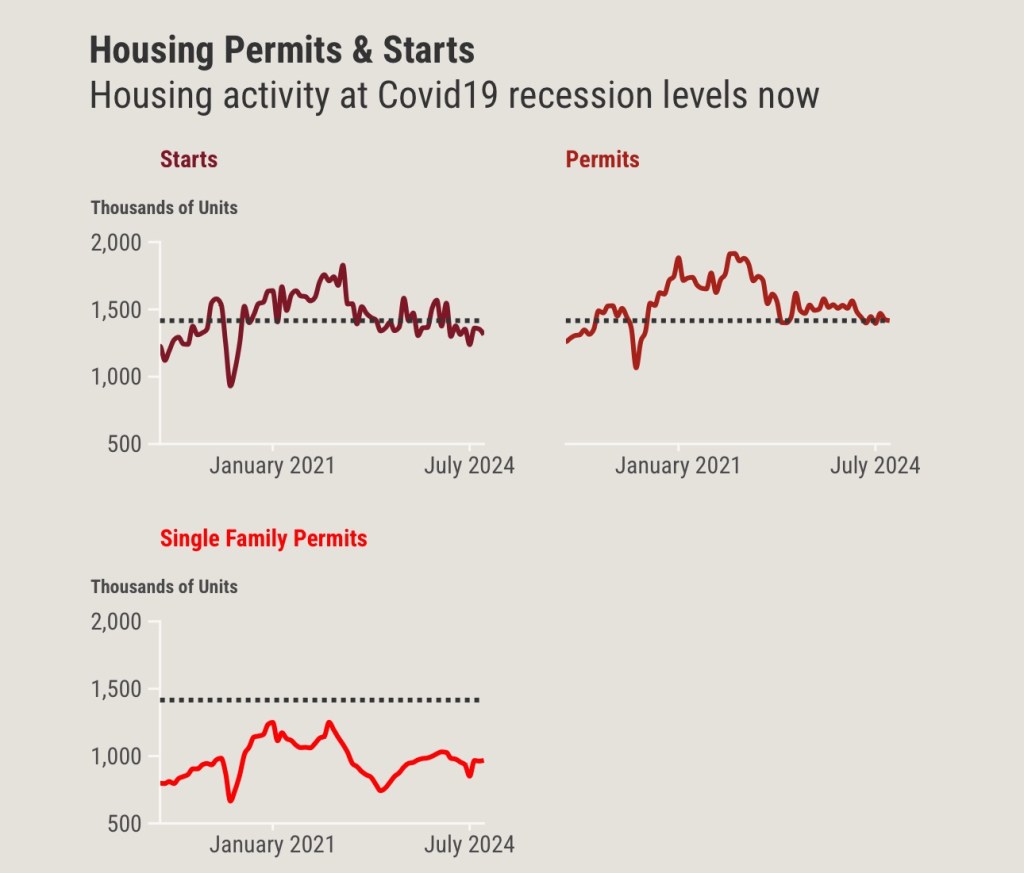

The Data Doesn’t Lie: Housing Activity Is at Recession Levels

The October housing starts report paints a sobering picture. According to the U.S. Census Bureau:

• Housing Starts: Down 3.1% from September and 4% from October 2023, at a seasonally adjusted annual rate of 1.31 million units.

• Building Permits: Down 0.6% from September and 7.7% year-over-year, at a seasonally adjusted annual rate of 1.42 million units.

For perspective, these figures are reminiscent of early pandemic lows, not the robust growth needed to meet housing demand. Add to this the fact that existing home sales remain at historically low levels relative to workforce size, and it becomes clear: The demand needed to sustain a construction boom simply isn’t there.

The Interest Rate Squeeze

Minneapolis Fed President Neel Kashkari recently attributed the sluggish housing market to high demand and advocated for even higher mortgage rates as a “clearance rate” mechanism. But here’s the issue: The data doesn’t back him up.

Mortgage rates between 6.75% and 7.5% have throttled buyer activity, especially in the new home market. While builders have managed to incentivize sales by buying down mortgage rates when they dip closer to 6%, these windows are fleeting. Higher rates not only suppress buyer demand but also discourage builders from starting new projects. This cycle underscores a critical reality: Builders, who operate for profit, won’t build unless the numbers make sense.

Multifamily Construction: A Silent Collapse

While single-family housing permits show sporadic signs of life, multifamily construction — specifically 5-unit permits — has been in steady decline, sitting firmly in recession territory. Without significant demand for new apartments, coupled with elevated financing costs, the pipeline for multifamily development remains constrained. The long-term consequence? Persistent rent inflation as supply fails to meet growing demand in key markets.

Builder Confidence: A Fragile Bright Spot

There’s a sliver of optimism: Builder confidence improved when mortgage rates dipped briefly from 7.5% to 6%. However, confidence eroded again as rates climbed back up. This fluctuation underscores how sensitive the market is to borrowing costs. Builders can stimulate demand through strategic incentives like rate buydowns, but without sustained low rates, these measures offer only temporary relief.

The Long Road Ahead

What’s the solution? Unfortunately, there’s no quick fix. Lowering the Federal Funds Rate could eventually ease land acquisition and development costs, spurring activity in the apartment sector. But these changes take time to ripple through the economy, and the lag means we’re unlikely to see significant gains in housing starts anytime soon.

In the meantime, builders are in survival mode, prioritizing profitability over volume. This dynamic has ripple effects across the industry, from developers seeking viable projects to investors weighing the risks and rewards of a constrained housing market.

What This Means for Real Estate Professionals and Investors

For real estate professionals, developers, and investors, today’s housing landscape presents both challenges and opportunities:

1. Strategic Land Investment: With fewer housing starts, now may be the time to acquire land in high-demand areas, positioning for a potential rebound when rates normalize.

2. Focus on Incentives: Builders and developers can leverage creative financing options to attract buyers, such as temporary rate buydowns or other concessions.

3. Prepare for Rental Market Growth: With new apartment construction slowing, demand for rental properties is set to rise, creating opportunities for multifamily investors.

4. Monitor Rate Trends: A sustained drop in mortgage rates closer to 6% could signal a turning point. Until then, expect tepid activity.

The Bottom Line

The dream of building millions of homes isn’t just on hold — it’s a distant prospect under current economic conditions. The path forward depends heavily on sustained rate relief, renewed buyer confidence, and a shift in builder sentiment. For now, the housing market is in a holding pattern, and savvy professionals must adapt accordingly.

So, let’s keep the conversation going. How are you adapting to these challenges in your market? Share your insights and let’s connect. Together, we can find solutions that move the industry forward.

Leave a comment