Montana is experiencing a population surge that is reshaping its housing market, presenting both opportunities and challenges for real estate developers and investors. With home prices skyrocketing and out-of-state buyers flocking to the state, the trends are transforming Montana’s real estate landscape—while also pushing many longtime residents and younger generations out of the market.

A Decade of Growth Accelerated by the Pandemic

Between 2010 and 2020, Montana’s population grew by nearly 10%, but housing construction lagged behind, increasing by just 7%. This mismatch between supply and demand set the stage for a sharp rise in home prices. The COVID-19 pandemic further amplified the trend, as Montana’s population grew by an additional 5% between 2020 and 2023, fueled by remote work and a growing interest in the state’s breathtaking natural beauty and outdoor lifestyle.

“Montana is really a year-round travel destination,” says Nick Zimmer, broker and owner of Crosscurrent Real Estate in Bozeman. “It’s not just summer or winter; it’s a lifestyle draw for people who can work from anywhere.”

A Market for Out-of-State Buyers

Montana has become a magnet for cash buyers from high-priced coastal markets who are leveraging their equity to secure homes. Kristen Campbell, a real estate agent with Homes of Big Sky in Bozeman, notes, “We have a ton of out-of-staters moving in and a lot of cash buyers.”

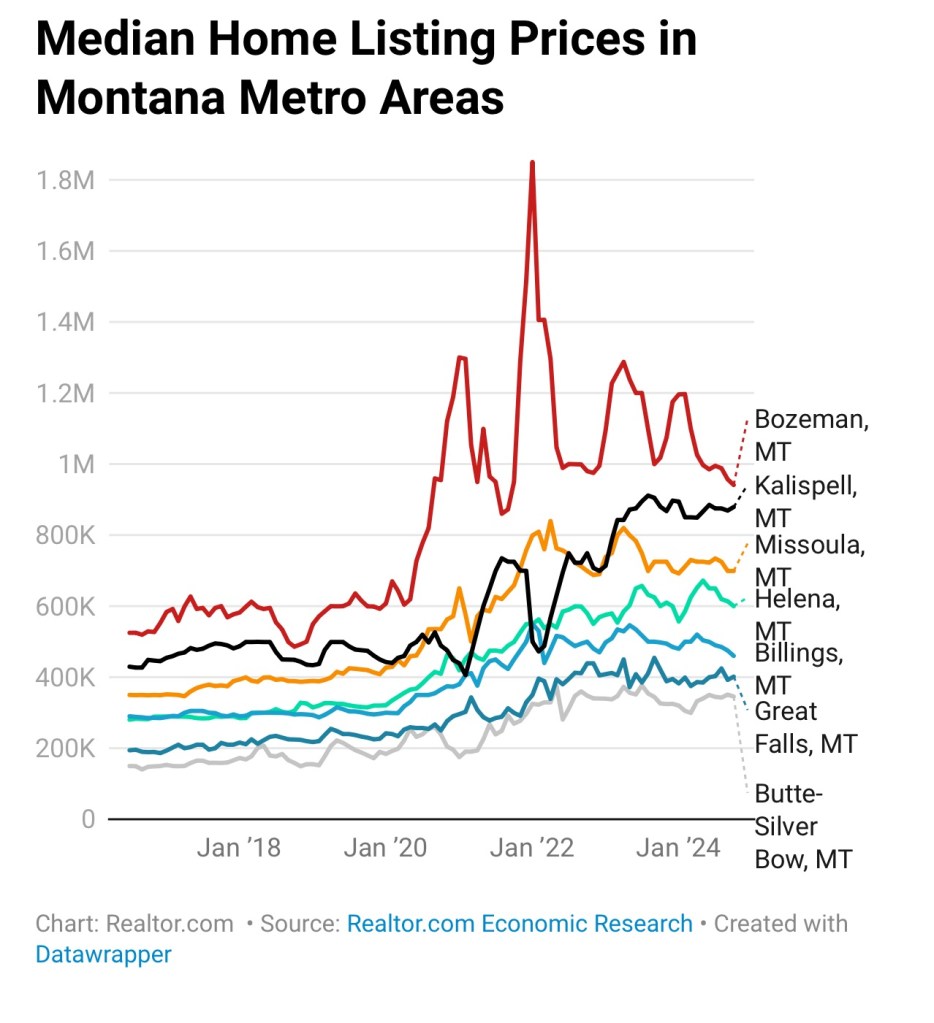

This influx has driven home prices to unprecedented levels. Over the past five years, median home listing prices in Montana have surged 85%, the fastest increase of any state in the nation. In October 2024, the median listing price reached $646,975, making Montana the fifth most expensive state for homebuyers, surpassed only by Hawaii, California, New York, and Massachusetts.

Rising Prices Across the State

While Bozeman is often considered the epicenter of Montana’s real estate boom, smaller markets like Missoula, Kalispell, Helena, and Butte have seen even sharper price increases. Over the past five years, median listing prices have risen:

• 57% in Bozeman

• 66% in Missoula

• 85% in Kalispell

• 91% in Helena

• 92% in Butte

The high demand has driven Montana’s median price per square foot to $318, the highest among landlocked states and the eighth highest nationwide.

The Downside: Affordability Crisis

While existing homeowners have benefited from rising equity, many younger Montanans find themselves priced out of the market. A Realtor.com® analysis earlier this year revealed that Montana is the least affordable state when comparing local incomes to home prices.

“It’s pretty much impossible for first-time homebuyers,” Campbell says. “I have two sons—33 and 29—and unless we help them, they’re not buying houses. It’s gotten ridiculous.”

The affordability crunch has led to a wave of local residents seeking homes in more affordable states. Zimmer notes, “There are still a number of people leaving. Bozeman is an expensive place to live, and some people are fed up with it.”

What This Means for Developers and Investors

For developers, Montana’s growing population and rising home prices signal significant opportunities to build higher-density housing and affordable options to meet the demand. Investors, meanwhile, can leverage the state’s strong appreciation potential—but must remain mindful of the affordability gap and potential regulatory challenges as local governments respond to the housing crisis.

Join the Conversation

What’s your perspective on Montana’s real estate market? Is it a land of opportunity for developers and investors, or a cautionary tale about affordability? Share your thoughts and insights in the comments—we’d love to hear from you!

By staying informed and engaged, real estate professionals can navigate Montana’s dynamic market and contribute to solutions that benefit both newcomers and longtime residents alike.

Leave a comment