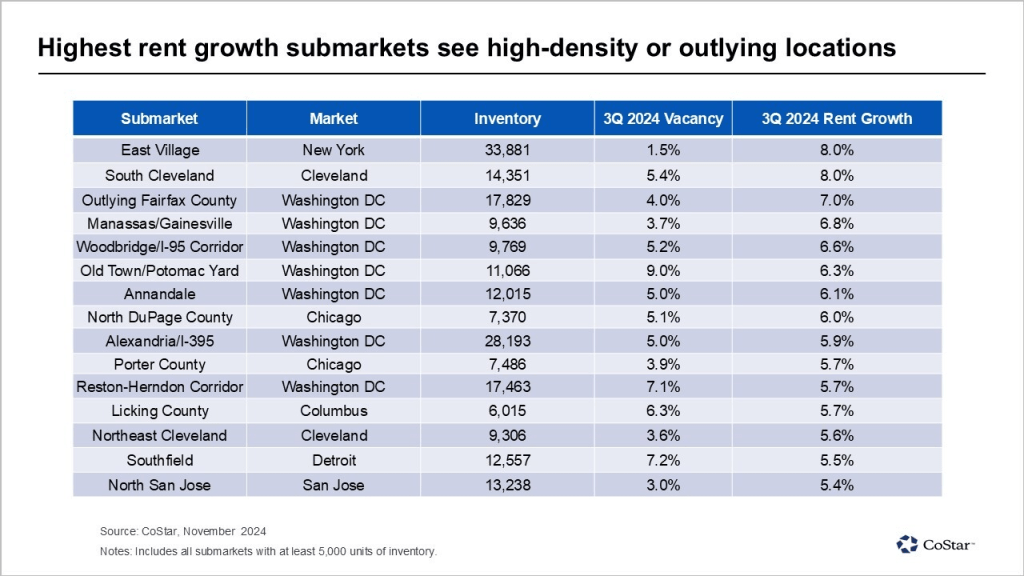

The multifamily rental market is painting a strikingly mixed picture. According to recent data from CoStar, while annual multifamily rent growth remained steady at 1.2% in Q3, local submarkets revealed a stark contrast in performance. Rent increases soared as high as 8% in some areas while plummeting by as much as -7.6% in others. These disparities expose the influence of oversupply and shifting renter demand on submarket performance.

A Tale of Two Rental Markets

The data tells a story of two distinct types of markets:

Resurgent Urban Cores

Urban areas are seeing renewed demand, particularly in high-density, walkable neighborhoods with access to amenities and transit.

• East Village, NY: A leader in rent growth, boasting an 8% annual increase.

• Old Town/Potomac Yard, VA: A strong performer near Washington, D.C., with rents climbing 6.3%, thanks to its proximity to vibrant urban amenities and robust transit options.

Supply-Constrained Suburban Markets

Suburban submarkets with limited new construction and steady demand also posted impressive growth.

• Manassas/Gainesville, VA: A standout performer, with rents up 6.8% due to tight inventory and no new units added since 2019.

• Washington, D.C. Submarkets: Dominated the top 15 list for rent growth, demonstrating the resilience of well-positioned suburban areas.

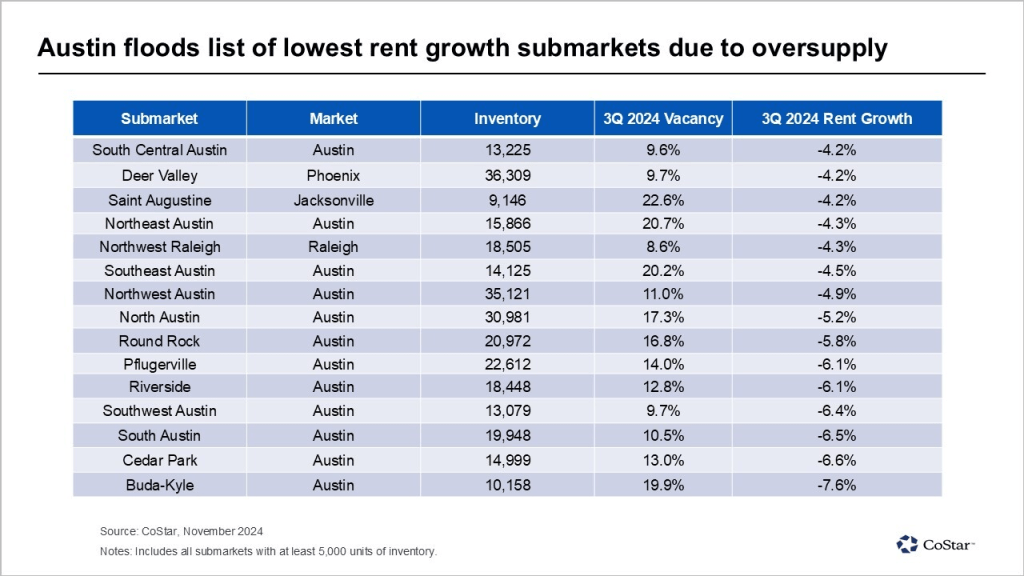

The Challenge of Oversupply

On the flip side, oversupply is dragging down rents in key markets, with Austin, TX, serving as the most notable example:

• Austin’s Oversupply Crisis: Since 2020, Austin has added 85,000 apartment units, far outpacing the demand for just 50,000 units. This imbalance has pushed vacancy rates to 15.1%—the highest among the nation’s top 50 markets—and led to rent declines of up to -7.6% in oversupplied submarkets.

• Broader Impact: Twelve of the 15 weakest-performing submarkets in the U.S. are in Austin, underlining the risks of overbuilding without corresponding demand.

Key Takeaways for Real Estate Developers and Investors

These trends offer crucial insights for industry stakeholders:

• Urban Revival: The resurgence of high-density neighborhoods signals opportunities for projects in walkable, amenity-rich areas.

• Strategic Development in Tight Markets: Outlying submarkets with limited new construction and strong demand remain promising for stable returns.

• Oversupply Risks: Markets like Austin highlight the consequences of overbuilding, emphasizing the importance of aligning supply with local demand.

Looking Ahead: Navigating Localized Dynamics

The multifamily rental market is increasingly localized, with performance shaped by factors such as urban demand, construction pipelines, and renter preferences. To succeed, developers and investors must tailor their strategies to specific submarket conditions:

• Focus on Walkability and Amenities: Urban cores are likely to remain attractive as renters prioritize vibrant communities.

• Cautious Expansion in High-Supply Markets: Avoid overcommitting in markets with aggressive construction pipelines and weak demand.

• Embrace Data-Driven Decisions: Use localized market data to identify submarkets with favorable supply-demand dynamics.

As the multifamily market evolves, these strategies will be critical for mitigating risk and capitalizing on emerging opportunities. What are your thoughts on these trends? Are there specific submarkets catching your attention? Let’s discuss in the comments below.

Leave a comment