What Real Estate Developers and Investors Need to Know About Upcoming Ballot Measures

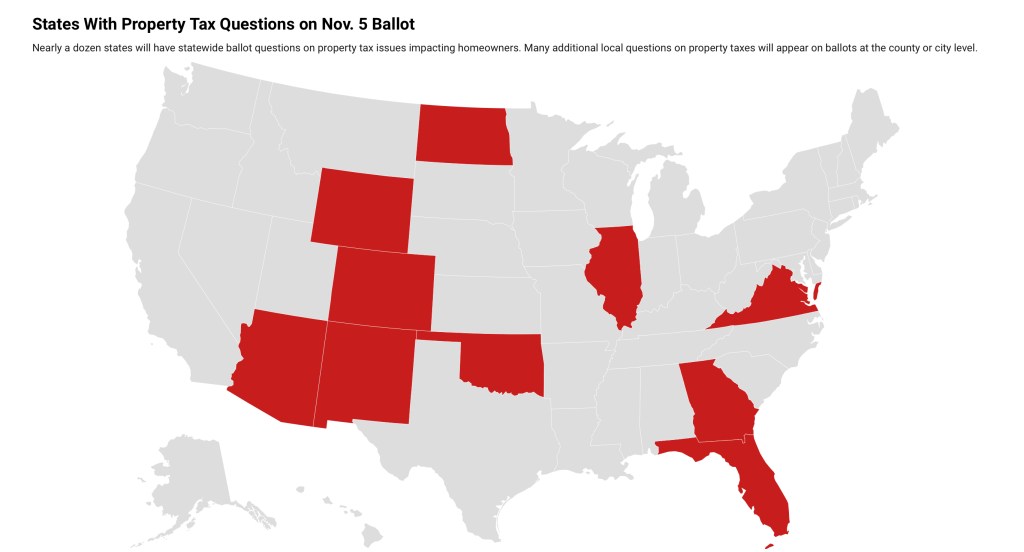

As the presidential election approaches, real estate developers and investors should pay close attention to several ballot measures across the states that could significantly impact property ownership and investment strategies. On November 5, voters will not only cast their ballots for presidential candidates but also decide on key measures related to property taxes that could shape the landscape for homeowners and investors alike.

The Stakes: Understanding Property Tax Proposals

This election, a range of proposals from capping property taxes to eliminating them entirely is up for debate. As highlighted by Realtor.com® chief economist Danielle Hale, “While lower property taxes might seem appealing, it’s crucial to consider the broader implications. The services funded by these taxes—like education, public safety, and infrastructure—are essential for maintaining property values and community stability.”

As developers and investors, understanding these dynamics is vital. A change in property tax policies can affect market conditions, investment returns, and the overall desirability of specific areas.

Key Ballot Measures to Watch

Here’s a closer look at some of the most impactful measures you should be aware of:

Arizona Proposition 312

This measure allows property owners to apply for a tax refund if local laws concerning public safety and order are not enforced. Proponents argue that it would ensure cities uphold quality-of-life standards, while opponents worry it could detract from addressing homelessness effectively. As a developer, consider how this could influence property values in affected areas.

Colorado Amendment G

This amendment expands property tax exemptions for disabled veterans, now including those with individual unemployability status. The bipartisan support suggests a strong community backing, which could enhance neighborhood stability and appeal for investors focused on community development.

North Dakota Initiated Measure 4

This radical proposal seeks to eliminate property taxes altogether. While it may attract some property owners, it raises serious concerns about funding for essential services. For developers, this could alter the fiscal landscape dramatically and may lead to new forms of taxation or funding that impact profitability.

Florida Amendment 5

Proposed inflation adjustments for Florida’s homestead exemption could provide much-needed relief for homeowners, but might also shift the tax burden to landlords and potentially increase rental prices. Investors should analyze how these changes could affect rental market dynamics.

Georgia Amendment 1

This local option for homestead property tax exemptions could provide relief for current homeowners but may dissuade new buyers, altering market dynamics. Developers should weigh these factors when planning new projects or investments in the region.

Oklahoma State Question 833

Allowing municipalities to create public infrastructure districts might empower neighborhoods but raises concerns about potential misuse by developers. Careful scrutiny of how these districts operate could be crucial for investors looking to navigate local governance.

The Bigger Picture

With nearly a dozen states weighing in on property-related questions this election cycle, the outcome could have lasting ramifications for real estate development and investment strategies. It’s essential to approach these measures with a critical eye, considering both immediate impacts and long-term trends.

As you prepare for the upcoming election, stay informed about these ballot measures and their potential effects on your investments. Engage in discussions within your networks and consider how these changes could present both challenges and opportunities in the real estate landscape. Your proactive approach could make all the difference in navigating the evolving market.

Leave a comment