Despite challenging conditions in the housing market, first-time homebuyers, especially millennials, are making significant strides in certain states. The latest market outlook report from Freddie Mac reveals interesting trends that real estate developers and investors should pay close attention to as we move forward into 2025.

Rising Share of First-Time Buyers

Freddie Mac reports that the share of conventional conforming mortgages going to first-time buyers has grown steadily over the past two decades, from around 20% in 2004 to over 50% in the second quarter of this year. Key drivers include the demographic wave of millennials reaching prime home-buying ages and a decline in overall transactions due to the mortgage “lock-in” effect, which has boosted the share for first-time buyers.

State-Level Insights

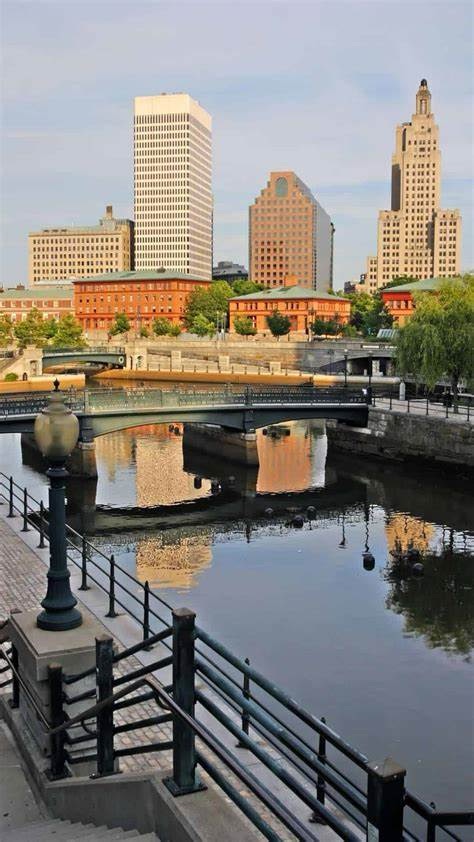

At the state level, Rhode Island has seen the most significant increase in first-time buyer market share, jumping 14.3 percentage points from 2019 to 2024. This is notable given Rhode Island’s high median listing price of $569,950, well above the U.S. median price of $425,000. The state’s small size and relatively few home transactions may amplify the relative share of first-time buyers.

Other states with notable gains include:

- Iowa: 12.4%

- Nebraska: 11.3%

- Wisconsin: 10.9%

- Connecticut: 10.8%

States in the Northeast and Midwest generally saw the biggest gains for first-time buyers. Conversely, states popular with retirees, like Arizona and Florida, have seen slower growth in first-time buyer share.

Challenges and Market Dynamics

Despite these gains, first-time buyers face significant hurdles. The report highlights that entry-level home prices have grown 63% more than high-end home prices from January 2000 to July 2024, making starter homes less affordable. Additionally, the tight supply of homes, with about 30 renter households for each available home for sale, compounds the difficulty.

The supply shortage dates back to the Great Recession, which severely impacted new-home construction. While construction has increased, it hasn’t kept pace with demand, resulting in a shortage of at least 1.5 million homes.

Investment Implications

For real estate developers and investors, these trends highlight the importance of targeting markets with significant first-time buyer activity. The rising share of first-time buyers in certain states presents opportunities for developing entry-level housing and affordable living spaces. Additionally, understanding the demographic shifts and market dynamics can help investors navigate the complexities of the current housing market.

Conclusion

The increasing share of first-time homebuyers, particularly in states like Rhode Island, Iowa, and Nebraska, signals shifting market dynamics. Real estate developers and investors should consider these trends as they plan their strategies for 2025. Addressing affordability and supply challenges will be crucial for capitalizing on these emerging opportunities.

Join the Conversation: What are your thoughts on the rising share of first-time homebuyers in these states? How do you plan to navigate these trends in your investments? Share your insights and engage with our community!

RealEstateTrends #FirstTimeHomebuyers #InvestmentOpportunities #HousingMarket

What are your views on the current state of the housing market for first-time buyers? Let’s discuss below! 💬🏢

In Rhode Island, the first-time buyer share of home sales surged by 14.3 percentage points from 2019 to 2024, marking the highest increase in market share across the states. 📈🏡

Rhode Island’s small size and limited home transactions boost the share of first-time buyers, with gains seen in nearly every state. In September, Rhode Island had only 1,465 active listings—the fewest in any state. 📊🏡

Leave a comment