The housing market continues to evolve, reflecting broader economic trends and shifts in consumer behavior. The National report from Matrix provides key insights into current market conditions, highlighting the interplay between supply, demand, and economic factors that are shaping the landscape for real estate developers and investors.

Key Takeaways

- Strong Demand Amid Supply Constraints

The multifamily sector has shown resilience in the face of economic fluctuations. Despite ongoing challenges related to supply chain disruptions and construction costs, demand for rental units remains robust. Many urban areas are experiencing a surge in occupancy rates, fueled by an influx of renters seeking flexible living arrangements and affordable housing options. - Rising Rental Rates

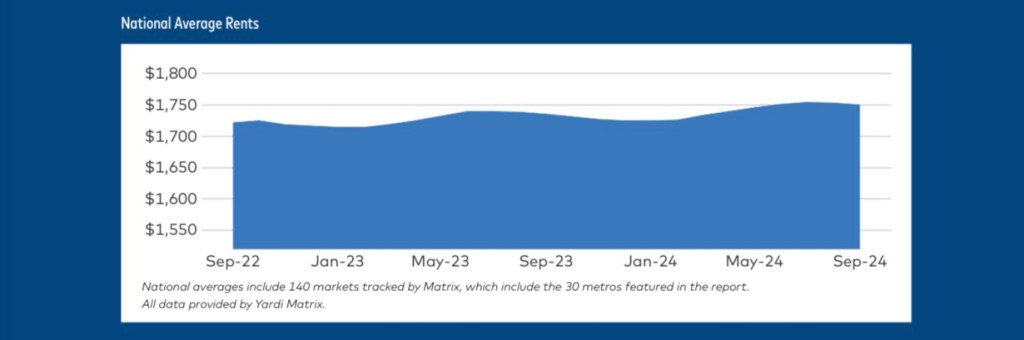

Rental rates have continued to rise, albeit at a more moderate pace compared to previous years. The national average rent saw a notable increase, reflecting the ongoing demand for quality rental units. This trend underscores the importance for developers to focus on delivering high-quality, amenity-rich properties that meet the evolving needs of tenants. - Investment Opportunities in Emerging Markets

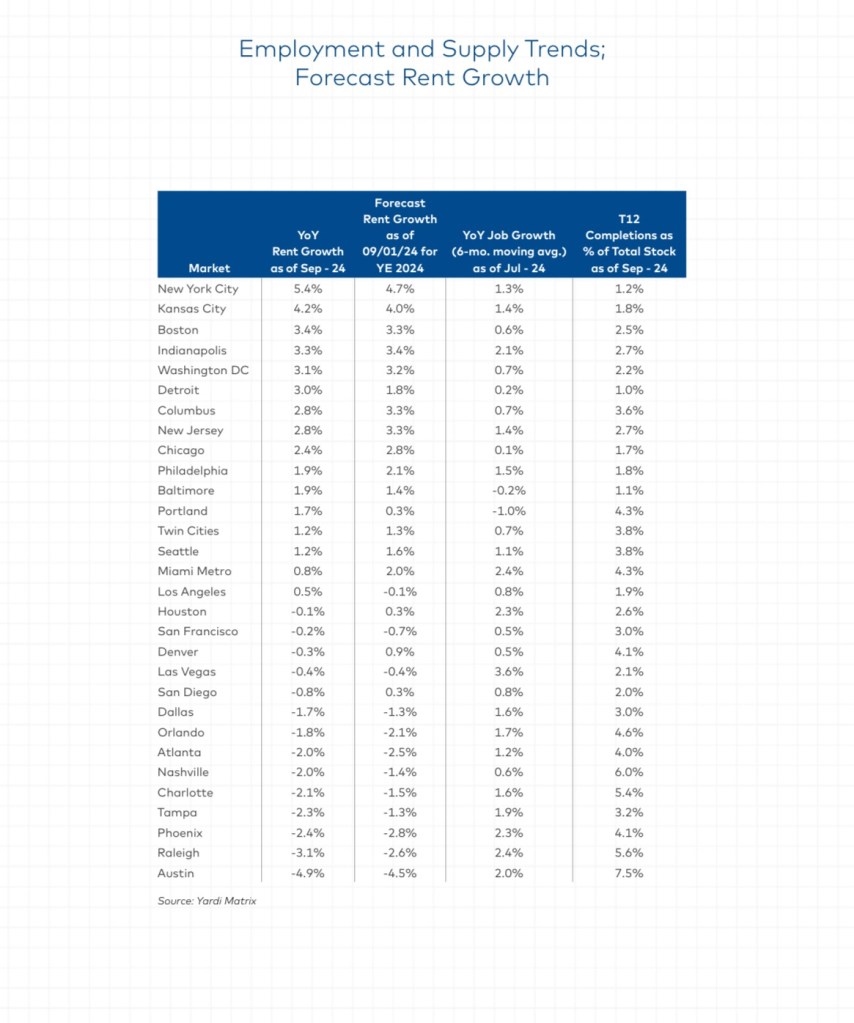

Emerging markets present significant opportunities for multifamily investors. Cities that were previously overlooked are gaining traction due to lower entry costs and the potential for substantial appreciation. Investors are increasingly looking toward secondary and tertiary markets where job growth and population influx are driving demand for rental housing. - Impact of Interest Rates on Financing

As interest rates fluctuate, financing options for multifamily developments are becoming more complex. Developers and investors need to stay informed about the latest market trends and economic indicators that could affect financing conditions. Exploring alternative financing strategies and partnerships may be necessary to navigate the current landscape. - Sustainability and Innovation

Sustainability remains a critical factor for today’s multifamily developments. Investors are prioritizing properties that incorporate green building practices and energy-efficient technologies. Innovations such as smart home features and eco-friendly amenities are increasingly sought after by tenants, making them essential considerations for developers looking to stay competitive.

Regional Highlights

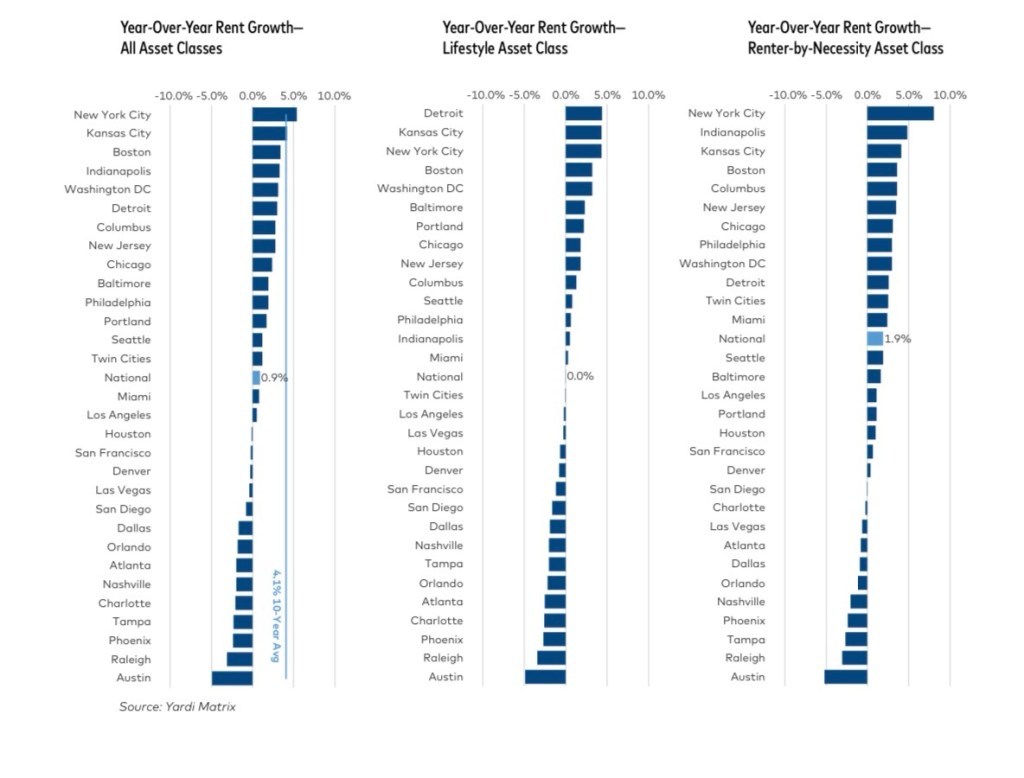

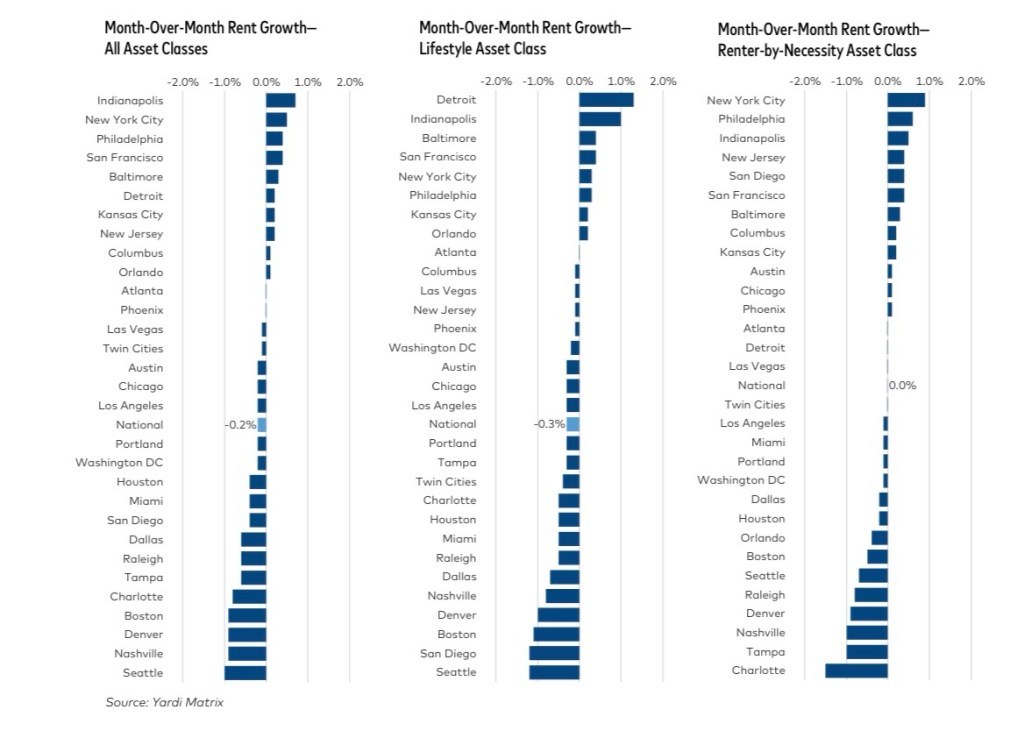

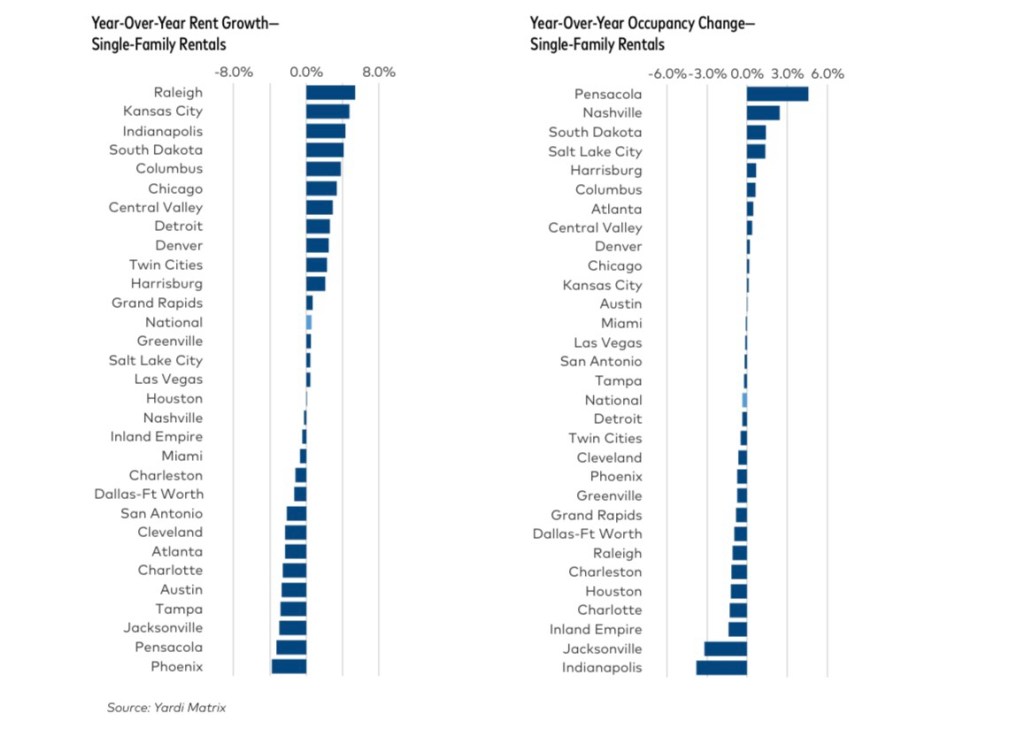

The report breaks down performance metrics by region, revealing variances in occupancy rates, rental growth, and construction activity. Key regions, such as the Southeast and Southwest, are experiencing significant demand driven by population growth and economic expansion. In contrast, some metropolitan areas are facing challenges due to oversupply and economic shifts.

Navigating the Real Estate Landscape

The housing market presents a complex yet promising landscape for real estate developers and investors. By staying attuned to market dynamics, understanding regional variations, and prioritizing sustainability and innovation, stakeholders can position themselves for success in this evolving sector.

As we move forward, continued analysis of economic indicators, rental trends, and consumer preferences will be crucial in shaping effective strategies for real estate investments.

Leave a comment